Swept away: Thred gives up on augmented reality a year after pivoting from social media

Pol Espargaro of Spain crashes out during the 2014 Malaysia MotoGP. Pic: Getty

Exactly a year after moving from social media into augmented reality Thred (ASX:THD) is disposing of the business due to “significant uncertainties associated with its future profitability”.

Thred lost $3.2 million last year on revenue of $249,000. It banked only $50,000 in customer receipts but had $3.2 million in the kitty at the end of June.

The social-media-cum-augmented-reality company told investors this morning it would sell its augmented reality “Sweep” app to a wholly-owned subsidiary, ARtech, for $550,000 plus expenses of about $160,000.

It was a year ago this week that Thred jumped 70 per cent after announcing it would rebuild its social media app — then called “Thred” — into a new app called Sweep.

Thred hoped to build an app where users could could view augmented reality content such as restaurant reviews, historical information or sales discounts integrated into real-world scenes via a smart phone screen.

Thred has also given up on its digital agency Agent Reality which hoped to build augmented reality products for agencies and brands.

As reported by Stockhead earlier this month the company asked ASIC to de-register Sweep on June 29, alongside Agent Reality, which provided an augmented reality app for for Vivid Sydney.

Sweep had earlier provided an O-Week app for UNSW.

“It is standard practice for organisations to constantly consider and adjust the various structures, activities, brands, costs etc within its business. Agent Reality and Sweep still exist, just not in incorporated form,” company secretary Damon Sweeny told Stockhead at the time.

The terms of the sale announced today will see Thred pick up around $670,000 for Sweep, which includes expenses between now and finalisation of the sale.

ARtech will fund the future development of Sweep through the offer of shares to third-party investors.

“This strategy will have the consequence of removing the significant financial burden of supporting the development and commercialisation of Sweep whilst retaining an equity interest in any future success,” the company said in a statement.

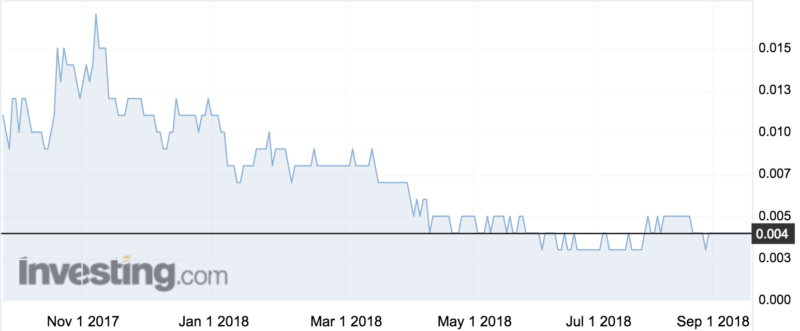

Thred’s shares were flat at 0.4c. It’s the latest hit for the company, which switched from mining to social media in 2016.

Thred has been approached for comment.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.