There’s been a big, sudden jump in businesses adopting Artificial Intelligence

Pic: Morsa Images / DigitalVision via Getty Images

There’s been a remarkable turnaround in the number of everyday businesses adopting Artificial Intelligence technology — which could be good news for ASX stocks in the space.

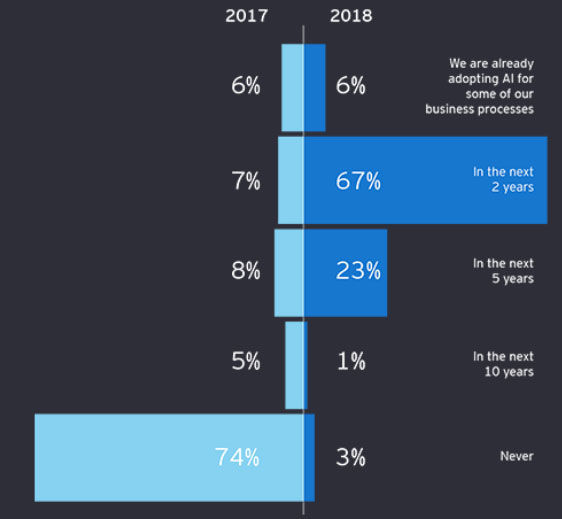

A year ago, consultancy Ernst & Young interviewed bosses of average-sized companies and found three-quarters said they would never adopt “robotic process automation”.

Robotic process automation refers to the computerisation of tedious tasks, freeing workers to focus on more important work. It’s often seen as a stepping stone to more sophisticated machine learning or artificial intelligence (AI) systems, says CIO magazine.

This year when EY conducted the same survey of 2,766 executives, they found a “massive shift in the number of companies that intend to embrace artificial intelligence”.

“Just 12 months later 73 per cent of respondents say they are already adopting or planning to adopt artificial intelligence (AI) within two years,” the consultancy said this week in its latest EY Growth Barometer report.

>> Scroll down for a list of ASX stocks that offer exposure to AI

“Attitudes toward new technology have evolved rapidly since last year.

“Intelligent automation and machine learning have moved centre stage as vital enablers to ambitious middle-market [average-sized company] growth.”

Here’s EY’s graph showing the one-year change in attitude to AI adoption among business leaders:

EY noted that businesses were so eager to “adopt revolutionary new technologies and incorporate AI into their businesses” most were under-investing in other technology areas such as cyber security.

Morgan Stanley believes fears of a labour shortfall will drive the AI market to $US1 trillion by 2050.

Just this week banking giant Citi revealed robots could replace as many as 10,000 of its human jobs within five years.

There are at least 25 ASX stocks that offer exposure to AI — although the number could be higher depending on your definition of Artificial Intelligence.

Morgan Stanley suggests there are three basic types of AI stocks to invest in:

1. Providers of core technology such as Weebit Nano (ASX:WBT), which is developing next-generation memory chips needed to power demanding AI applications. Weebit is up 258 per cent over the past year.

2. App makers such as FlamingoAI (ASX:FGO), which creates AI-based virtual customer service agents called Rosie and Maggie. Flamingo shares are up 11 per cent over 12 months despite significant falls since January.

3. Service providers such as BidEnergy (ASX:BID) which uses AI to to help companies manage their energy bill. BidEnergy is up 238 per cent over 12 months.

Here’s a selection of ASX stocks with exposure to Artificial Intelligence and machine learning:

| ASX code | Company | One-year price change | Price Jun 14 | Market Cap |

|---|---|---|---|---|

| WBT | WEEBIT NANO | 2.57894736842 | 0.068 | 98.1M |

| BID | BIDENERGY | 2.38461538462 | 0.044 | 29.6M |

| YOJ | YOJEE | 1.41666666667 | 0.145 | 103.6M |

| VHT | VOLPARA HEALTH T | 1.07792207792 | 0.8 | 142.2M |

| CMP | COMPUMEDICS | 0.852941176471 | 0.63 | 109.0M |

| M7T | MACH7 TECHNOLOGI | 0.739130434783 | 0.2 | 28.3M |

| CAJ | CAPITOL HEALTH | 0.625 | 0.325 | 261.9M |

| 4DS | 4DS MEMORY | 0.586206896552 | 0.046 | 44.3M |

| SP3 | SPECTUR *(listed Jul 2017) | 0.55 | 0.31 | 15.2M |

| MDR | MEDADVISOR | 0.4 | 0.042 | 52.7M |

| BTC | BTC HEALTH | 0.285714285714 | 0.18 | 23.5M |

| LNU | LINIUS TECHNOLOG | 0.25 | 0.07 | 66.4M |

| RHT | RESONANCE HEALTH | 0.222222222222 | 0.022 | 8.9M |

| FGO | FLAMINGO AI | 0.117647058824 | 0.038 | 43.4M |

| UTR | ULTRACHARGE | 0.05 | 0.021 | 20.1M |

| ALC | ALCIDION GROUP | -0.153846153846 | 0.055 | 34.6M |

| BRN | BRAINCHIP HOLDIN | -0.21875 | 0.125 | 118.1M |

| BRC | BRAIN RESOURCE | -0.22 | 0.039 | 20.7M |

| IPD | IMPEDIMED | -0.41935483871 | 0.36 | 149.7M |

| CM8 | CROWD MOBILE | -0.428571428571 | 0.08 | 15.8M |

| CGS | COGSTATE | -0.435344827586 | 0.655 | 78.9M |

| ONE | ONEVIEW HEAL-CDI | -0.52380952381 | 2 | 133.7M |

| MEB | MEDIBIO | -0.55223880597 | 0.15 | 30.4M |

| RAP | RESAPP HEALTH | -0.564516129032 | 0.135 | 92.3M |

| LBT | LBT INNOVATIONS | -0.608 | 0.098 | 19.3M |

| WHK | WHITEHAWK *(listed Jan 2018) | -0.675 | 0.065 | 4.7M |

| OPN | OPENDNA | -0.746153846154 | 0.033 | 3.5M |

The survey also showed strong confidence among average-sized companies with 87 per cent expecting revenue growth of at least 6 per cent this year.

The Asia Pacific region — including Australia — was expecting even greater growth.

“Four in 10 companies in China, Southeast Asia and Australia are targeting double-digit growth, significantly outpacing the global average of 6 per cent,” EY said.

View the full report: ey.com/growthbarometer

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.