CLOSING BELL: ASX holds onto gains as Nickel Search, Everest Metals rise on drill results

Pic: Getty Images

- ASX gains 0.46% while the emerging companies index falls

- RBA board will meet eight times instead of 11 times annually to set interest rates

- Nickel Search again intersects massive sulphide mineralisation at the Sexton prospect

After ending a four-day losing streak to gain 1.5% yesterday, the S&P ASX 200 the benchmark opened 0.7% higher in morning trading, slipping back slightly throughout the day to close 0.46% higher.

However, the S&P ASX Emerging Companies index (XEC) – a benchmark for Australia’s micro-cap companies – was not so fortunate finishing down 0.45%.

On Wall Street the Dow was up 0.9%, while the S&P 500 and tech-heavy NASDAQ climbed by ~0.5% each overnight ahead of the country’s pivotal inflation report later today (US time).

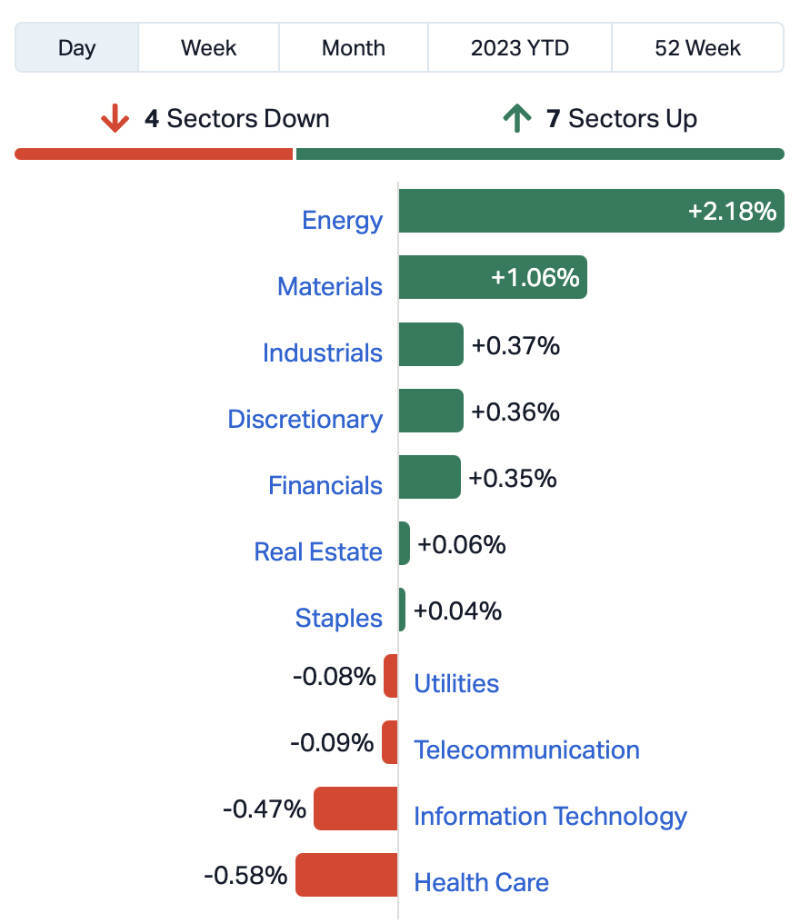

At the end of the day, the ASX’s 11 sectors looked like this:

Energy gained as oil prices showed an upward trend, with US crude surpassing US$74 per barrel and Brent crude approaching the US$80 mark.

The rising price of oil can be attributed to several factors including Saudi Arabia committing to maintaining a production cut of 1 million barrels per day into August along with Russia also announcing output cuts.

NOT THE ASX

The Reserve Bank of Australia (RBA) board will reduce the amount of times it meets in a year to set interest rates, but make the meetings longer.

During his speech at the Australian Conference of Economists in Brisbane today, Governor Philip Lowe, who could soon be updating his CV and looking for a new job, announced that starting from 2024, the board will meet on eight occasions annually instead of 11.

Lowe said the decision aligns with one of the 51 recommendations from the RBA review, which was published earlier this year.

Lowe said the reduced frequency of meetings will allow the board to dedicate additional time to analysing various matters, engage in more profound deliberations regarding monetary policy strategy, explore alternative policy options and associated risks, and enhance communication within the board.

Furthermore, Lowe said while it was appropriate to hold rates in July and monetary policy operates with a lag there may be more tightening needed to bring inflation back to the RBA’s 2-3% target.

Meanwhile, across the Tasman and the Reserve Bank of New Zealand has left interest rates unchanged at 5.5% but signalled the “need to remain at a restrictive level for the foreseeable future” to bring inflation back to its 1-3% annual target range.

NZ inflation is currently 6.7% with the economy already in recession.

And 2023 drama continues for troubled baby formula maker BUB, the subject of a bitter board split, which announced today it had launched legal proceedings against Chinese distributors Alice Trading and Willis Trading, subsidiaries of substantial shareholder, Hong Kong-listed Alpha Group.

“Legal proceedings to collect the debts and other outstanding amounts due from Alice and requisitioner Willis Trading Pty Limited will now be commenced to protect shareholders’ interests, ” BUB said in an announcement.

In a BUB update earlier this month new chair Katrina Rathie revealed details about the dispute concerning the agreement managed by former CEO Kristy Carr and former executive chairman Dennis Lin.

Despite the China distributor, Alpha Group, not achieving the expected sales targets, more than 9.5 million shares of the company were transferred to them.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.002 | 100% | 10,917,285 | $5,824,681 |

| NIS | Nickel Search | 0.0895 | 60% | 29,129,263 | $5,334,581 |

| GCR | Golden Cross | 0.003 | 50% | 400,000 | $2,194,512 |

| WCN | White Cliff Min Ltd | 0.01 | 43% | 16,639,335 | $8,100,530 |

| EMC | Everest Metals Corp | 0.355 | 42% | 5,343,217 | $32,358,277 |

| ENV | Enova Mining Limited | 0.007 | 40% | 260,940 | $1,954,647 |

| ADY | Admiralty Resources | 0.008 | 33% | 2,646,507 | $7,821,475 |

| KNM | Kneomedia Limited | 0.004 | 33% | 125,000 | $4,514,356 |

| PR1 | Pure Resources | 0.335 | 31% | 455,751 | $6,540,752 |

| ICG | Inca Minerals Ltd | 0.029 | 26% | 998,914 | $11,155,230 |

| SWP | Swoop Holdings Ltd | 0.3 | 25% | 168,108 | $49,702,241 |

| AUH | Austchina Holdings | 0.005 | 25% | 835,111 | $8,311,535 |

| IPB | IPB Petroleum Ltd | 0.01 | 25% | 1,000,000 | $4,520,980 |

| ABE | Australian Bond Exchange | 0.21 | 24% | 36,651 | $6,588,028 |

| FXG | Felix Gold Limited | 0.105 | 24% | 781,592 | $9,461,044 |

| DC2 | Dctwo | 0.024 | 20% | 100,000 | $2,614,322 |

| MKL | Mighty Kingdom Ltd | 0.024 | 20% | 105,715 | $6,524,392 |

| SIS | Simble Solutions | 0.006 | 20% | 369,519 | $3,014,754 |

| ICE | Icetana Limited | 0.051 | 19% | 428,002 | $8,571,122 |

| VN8 | Vonex Limited | 0.032 | 19% | 581,728 | $9,769,373 |

| MAY | Melbana Energy Ltd | 0.1175 | 18% | 23,255,755 | $337,020,410 |

| PV1 | Provaris Energy Ltd | 0.07 | 17% | 4,555,779 | $32,956,833 |

| ADS | Adslot Ltd | 0.0035 | 17% | 2,093,684 | $9,799,851 |

| AHN | Athena Resources | 0.007 | 17% | 1,000,000 | $6,422,805 |

| AL8 | Alderan Resource Ltd | 0.007 | 17% | 2,184,767 | $3,700,168 |

Topping the winners list today was NickelSearch (ASX:NIS) which has again intersected massive sulphide mineralisation at the Sexton prospect within the wider Carlingup project.

The company said the latest diamond drilling has hit visual sulphides in the Upper Mineralised Horizon (UMH) and Lower Mineralised Horizon (LMH), with both horizons intersected at shallower depths than expected.

Diamond drill hole 23NDD030 has intersected massive sulphides in the same horizon as previous results, which were reported over a 9.85m interval in diamond drill hole 23NRD028. The latest results confirm nickel mineralisation continues 60m along strike, extending the total strike length to 250m.

Also on the winners list today was Everest Metals Corporation (ASX:EMC) after announcing a targeted VTEM diamond drilling program identified Degrussa style mineralised system at the Revere Gold Project.

Three holes (1038m) of diamond drilling were completed over q 8.5km target area. EMC said Portable XRF results indicate up to 5.7% copper and up to 4.2% zinc at varying intersections.

“The similarities in geological sequences when compared to the Sandfire (ASX: SFR) DeGrussa VHMS deposit is geologically very significant,” COO Simon Philips said.

“We look forward to assays and downhole EM surveys to guide us on further testing the system.”

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AJQ | Armour Energy Ltd | 0.003 | -25% | 179,681 | $19,685,368 |

| MOB | Mobilicom Ltd | 0.016 | -24% | 20,125,650 | $27,860,211 |

| GTG | Genetic Technologies | 0.002 | -20% | 72,000 | $28,854,145 |

| MTB | Mount Burgess Mining | 0.004 | -20% | 38,509,764 | $4,415,856 |

| SFG | Seafarms Group Ltd | 0.004 | -20% | 551,600 | $24,182,996 |

| WFL | Wellfully Limited | 0.004 | -20% | 4,442 | $2,464,721 |

| SRJ | SRJ Technologies | 0.061 | -19% | 26,070 | $7,898,704 |

| DCL | Domacom Limited | 0.033 | -18% | 137,000 | $17,420,071 |

| AUZ | Australian Mines Ltd | 0.029 | -17% | 5,191,901 | $22,300,450 |

| WWI | West Wits Mining Ltd | 0.0175 | -17% | 41,032,747 | $47,103,362 |

| MPG | Many Peaks Gold | 0.175 | -17% | 59,300 | $7,638,540 |

| 1ST | 1St Group Ltd | 0.005 | -17% | 504,335 | $8,501,947 |

| AVE | Avecho Biotech Ltd | 0.005 | -17% | 40,000 | $12,972,982 |

| PNX | PNX Metals Limited | 0.0025 | -17% | 50,000 | $16,141,874 |

| RXL | Rox Resources | 0.245 | -16% | 2,735,716 | $96,962,735 |

| ODE | Odessa Minerals Ltd | 0.011 | -15% | 23,069,363 | $12,312,454 |

| IRX | Inhalerx Limited | 0.04 | -15% | 9,999 | $8,919,047 |

| OLL | Openlearning | 0.029 | -15% | 28,729 | $9,107,549 |

| BXN | Bioxyne Ltd | 0.018 | -14% | 152,619 | $39,934,553 |

| CXU | Cauldron Energy Ltd | 0.006 | -14% | 12,740,835 | $6,520,981 |

| TOY | Toys R Us | 0.012 | -14% | 1,233,420 | $12,083,213 |

| HAS | Hastings Tech Met | 1.335 | -14% | 921,183 | $200,378,811 |

| CI1 | Credit Intelligence | 0.125 | -14% | 17,000 | $12,107,378 |

| RBX | Resource B | 0.1525 | -13% | 703,698 | $12,962,220 |

| ADX | ADX Energy Ltd | 0.007 | -13% | 6,981,941 | $28,881,710 |

LAST ORDERS

Evion Group (ASX:EVG) MD Tom Revy and director David Round have been meeting with a number of funding and development parties in the US to advance development of the company’s flagship Maniry graphite project in Southern Madagascar.

EVG said discussions also included advancing agreements in relation to its proposed battery anode operations in Germany. A scoping study was recently completed relating to the plant by Wave International in Australia with ongoing assistance of Dorfner Anzaplan in Germany.

The study will be expanded to incorporate clean energy tech and production methods available to the company as part of its collaborative agreement with US-based battery anode material developer Urbix.

“Our strategy remains focused on becoming a leading vertically integrated graphite and battery anode material producer,” Revy said.

Defence tech company XTEK Limited (ASX:XTE) has announced its received an order from the Commonwealth of Australia’s Department of Defence for $3.4 million for spare parts in support of its existing Small Unmanned Aerial Systems (SUAS) fleet.

“XTEK is very pleased to provide high-end sustainment support services under the existing multi-year support contract we have with the Department of Defence for their in-service fleet of AeroVironment SUAS,” XTE Group CEO Scott Basham said.

“This latest spare parts order ensures that our team of engineers, technicians, and logistics support specialists, will have all of the specialist components at hand to be able to continue to support this important SUAS capability.”

TRADING HALTS

Lotus Resources (ASX:LOT) – Proposed Scheme of Arrangement

GreenX Metals (ASX:GRX) – Capital raise

Eroad (ASX:ERD) – Response to Brillian’s non-binding indicative offer

Optima Technology Group (ASX:OPA) – Update on company’s financial arrangements

At Stockhead, we tell it like it is. While Nickel Search is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.