Trading Places: Sour milk as ousted Bubs CEO looks to spill board through substantial shareholder group

Pic: Getty Images

- Group of Bubs investors including ousted CEO Kristy Carr become substantial shareholder as board spill looms

- Data centre provide NextDC attracts new substantial shareholders as tech experiences an uptick on back of AI interest

- Youth casual attire company Universal Holdings sees two of its substantial shareholders sell out at end of May

Trading Places is Stockhead’s semi-regular, pretty damn fascinating recap of the latest red flag buying and selling of ASX stocks.

It is here that the rubber really hits the road for fund managers, stakeholders, distant (and not-so-distant) relatives and other famous or infamous investors.

Specifically, Trading Places tracks substantial shareholder movements – namely when a trade in a company’s stock crosses or falls below the 5% threshold.

Substantial shareholders are usually directors, individual investors, institutional investors or their relatives, which they refer to as listed related bodies corporate, or something similar. You can see in detail these listed bodies on the company’s ASX announcement.

Shareholders are required to publicly declare via the exchange when their personal stake goes below or above 5%, and from there, every movement in their holdings while owning above 5%.

Those becoming and those ceasing to be substantial shareholders are the ones we think are worth noting, where a trade takes an investor over the 5% threshold or has them drop back below.

Here’s the form to get you started, if reading this makes you twitchy.

Recent Buys

Swipe or scroll to reveal full table. Click headings to sort.

| Code | Company | Market cap | Date | Holder | Holding |

|---|---|---|---|---|---|

| BUB | Bubs Australia | $135.34 million | May-30 | The parties listed in section 1 of Annexure A | 5.18% |

| APX | Appen | $499.85 million | May-26 | Spheria Asset Management | 6.95% |

| AVR | Anteris Technologies | $357.59 million | May-25 | Morgan Stanley and its subsidiaries listed | 5.42% |

| VR8 | Vanadium Resources | $41.21 million | May-26 | Matrix Resources, Zhejiang Lygend Investment Co, other companies controlled by Lygend Investment and Cai Jianyong | 9.99% |

| SYA | Sayona Resources | $1.64 billion | May-25 | State Street Corporation and subsidiaries named | 5.04% |

| NXT | NextDC | $7 billion | May-25 | State Street Corporation and subsidiaries named | 5.10% |

| NXT | NextDC | $7 billion | May-24 | United Super | 5.08% |

Save our Bubs: New substantial shareholding as board spill looms

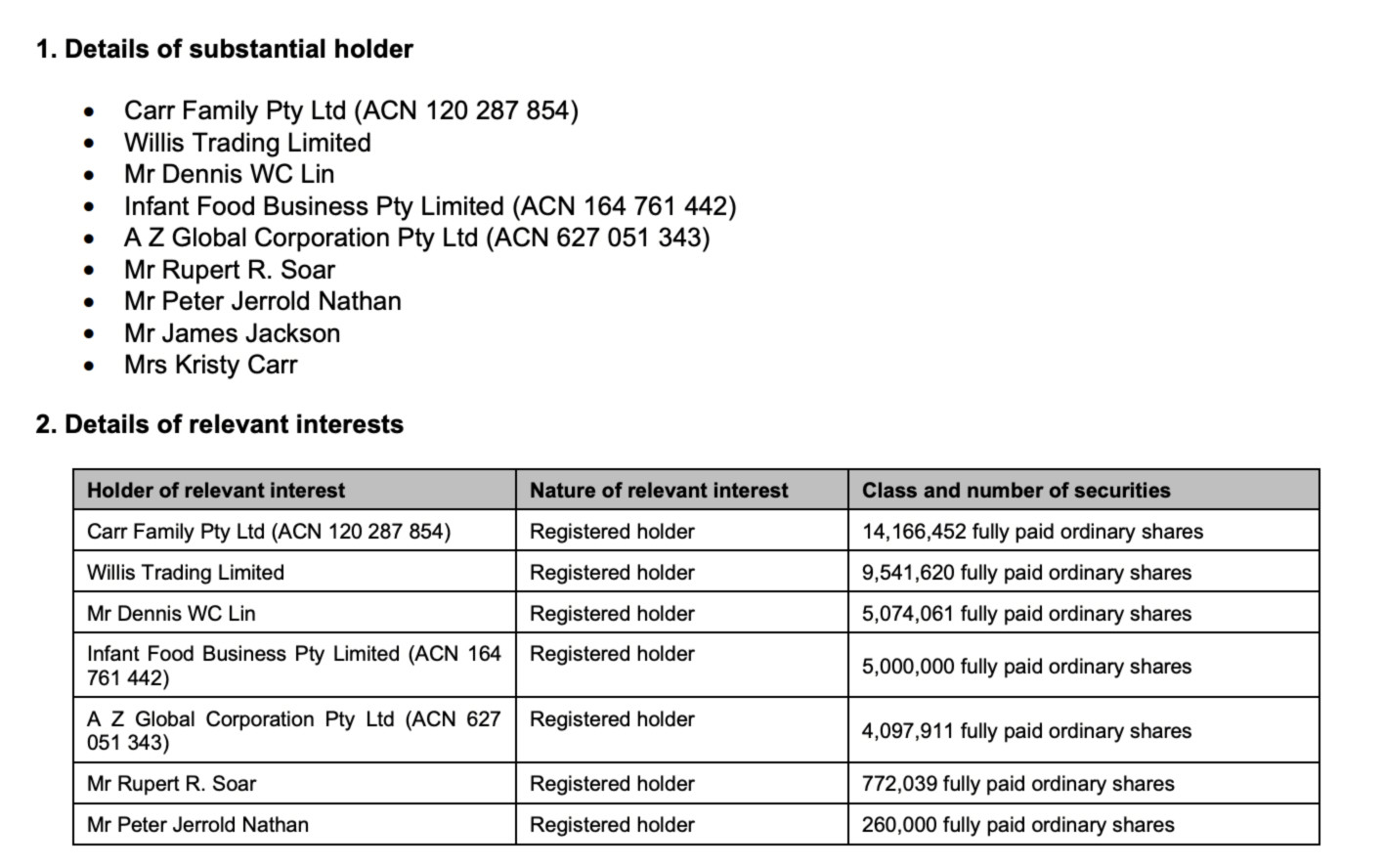

Weeks after being ousted from the company she founded, former Bubs Australia (ASX:BUB) CEO Kristy Carr has signed off on a becoming substantial shareholder form to announce the parties listed in “section 1 of Annexure A” had become a substantial shareholder.

With a 5.18% holding it gives the investors enough voting power to call an extraordinary general meeting and potential to roll the board.

Carr announced yesterday shareholders have launched a campaign called ‘Save our Bubs’ “to consider a board refresh to protect the interests of all shareholders”.

“As the founder and Bubs’ 4th largest shareholder, and an expert in the infant formula industry in Australia, USA and China, I have no confidence the current board has the relevant experience to oversee the management and strategic direction of this great company,” Carr said in a LinkedIn post.

Save our Bubs is calling for a new leadership team, including former A2 Milk Asia Pacific boss Peter Nathan to be appointed as CEO. They are also nominating former Elders deputy chair James Jackson along with dairy and infant formula supply chain and manufacturing expert Rupert Soar.

BUB announced the sacking of Carr from her executive role on May 10. Executive chair Dennis Lin’s employment with Bubs was terminated.

“Noting the recent deterioration in Bubs’ financial performance over the half year, the non-executive directors considered the time was right for a change in leadership and to change the governance framework of the company to ensure that it aligns with ASX Corporate Governance Principles and best practice,” the company said in an ASX announcement.

BUB announced on April 11, 2023 that independent non-executive director Katrina Rathie had been elected chair, replacing Lin and that Reg Weine had been appointed as an independent non-executive director.

In the May 10 announcement the company said Richard Paine will continue to act as interim CEO until a permanent CEO is confirmed.

On May 24 BUB announced CFO Iris Ren had “tendered her resignation for domestic reasons”.

So just who are these parties? Section 1 of Annexure A includes Lin, China customer, AZ Global/Willis Trading, Jackson and Soar. Together they have a combined holdings tally over 5%, sufficient to call an extraordinary general meeting and perhaps just roll the current board.

NextDC attracts interest as tech rises

Data centre provider NextDC (ASX:NXT) has attracted the interest of State Street Corporation and United Super as the tech rally continues in Australia and globally.

NXT is seeing booming demand for capacity in its data centres. This week eToro market analyst Josh Gilbert told Stockhead artificial intelligence (AI) exposed companies like NXT could see an uptick as investors get excited about the burgeoning technology.

The NXT share price is up ~42% YTD.

The BUB & NXT share price today:

Recent sells

Swipe or scroll to reveal full table. Click headings to sort.

| Code | Company | Market Cap | Date of change | Holder |

|---|---|---|---|---|

| DRR | Deterra Royalties | $2.33 billion | May-26 | Blackrock Group and subsidiaries named |

| UNI | Universal Store Holdings | $212.90 million | May-26 | First Sentier Investors Holdings and its related bodies |

| UNI | Universal Store Holdings | $212.90 million | May-26 | Comet Asia Holdings II Pte Ltd, Comet Asia Holdings I Pte. Ltd, KKR Asia III Fund Investments Pte. Ltd. and KKR Asian Fund III L.P (collectively the KKR Entities) |

| E33 | East 33 | $11.38 million | May-25 | Regal Funds Management Pty Ltd and its associates |

| HIO | Hawsons Iron | $29.75 million | May-26 | Regal Funds Management Pty Ltd and its associates |

| KAR | Karoon Energy | $1.12 billion | May-26 | First Sentier Investors Holdings and its related bodies |

Universal Holdings loses two substantial shareholders

Youth casual apparel retailer Universal Holdings (ASX:UNI) has seen two of its substantial shareholders sell out at the end of May.

Last week, UNI told the market that it was on track to deliver record sales in FY23, and material growth in EBIT compared to FY22.

However, UNI acknowledged there are increasing signs of pressure in the the youth market and its discretionary spending power.

Broker Wilsons Advisory has placed a 12-month target price of $4.22 on UNI and said the retailer has an attractive store pipeline, and clear momentum from its brands, Perfect Stranger and CTC (Thrills).

Wilsons also believes UNI has a strong, experienced management team. Valution wise, UNI is trading on a PE ratio of around 9x, versus its peers’ ratio of around 12.8x.

The UNI share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.