The 10 tech stocks that impressed the market most with their half-yearlies

Pic: via Getty Images

- Spacetalk share price jumps 57% as it flags first positive quarterly cashflow since 3Q FY21

- Online tech retailer HT8 reduces low margin tech products, generates $7.1m revenue

- AI recruitment player Hiremii releases GPT-3 x Adwriter product, sees almost 30% share price bump

It’s the half yearly season again so we thought we’d go through all the tech stocks with reports out and come back to you with a list of who had the most impressive things to report. But it was too hard.

So we dropped that idea and instead, focused on what mattered most – investor opinions. Because at the end of the day, share price moves speak volumes, right?

So here are the 10 small to midcap tech companies who blew the socks off traders with their half-yearlies in January.

Spacetalk (ASX:SPA)

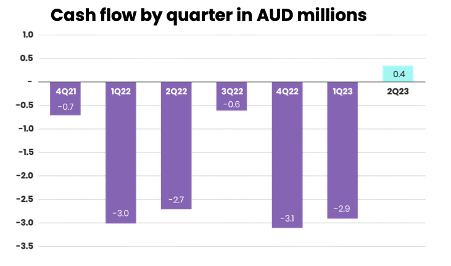

The child safety wearables developer has seen quite the turnaround, achieving a positive quarterly cashflow for the first time since 3Q FY21.

And the share price jumped 57% from $0.026 to $0.041, and was trading at $0.053 yesterday – which is a 103% jump since releasing its quarterly.

Compared to the previous corresponding period (pcp), the company’s $3.3m cash inflow was a fantastic transformation vs the outflow of $2.9m in Q1 FY21.

It can be partly attributed to strong Black Friday and Cyber Monday sales, along with a significant cost reduction program which slashed $2m over Q3.

During the quarter, Spacetalk also exited a lower profitable product line of a budget watch (Kids RRP $179) in favour of a more profitable alternative in a premium watch (Adventure RRP $349).

The company also introduced the Jumpy Sim card, which allows for the creation of deferred revenue as users often pay annually in advance – contributing to a working capital improvement.

Annual Recurring Revenue (ARR) grew to $7.4m, a 43% increase in wearables ARR and 10% for the schools business.

“This ARR for wearables shows the underlying growth rate of the business,” the company said.

The search for a CEO is still progressing but has reached the final stage, and the company says it’s hoping to announce something to the market shortly.

SPA had $4.2m cash in bank at the end of the quarter.

Harris Technology Group (ASX:HT8)

The online tech retailer enjoyed a solid Q2 FY23, generating $7.1m revenue, with $1.3m positive operating cashflow “despite difficult trading conditions.”

The share price rose 37.5% from $0.016 to $0.022 after the report’s release, before settling to $0.020 (+25%).

As of 31 December 2022, inventory on hand was $6.2m representing an 18% decrease on the September 2022 quarter ($7.6m), with the stock reduced primarily low margin technology products that are no longer in strong demand after the peak of the pandemic.

“Most of the overstocked products from the peak of the pandemic have now been cleared,” CEO Garrison Huang said.

“This will enable our team to focus on the higher-margin product categories that are less prone to excessive discounting across the wider retail sector.”

Household category sales continued to improve in the lead up to Christmas, recording revenue of $0.7m in the December quarter, delivering higher margins than tech products and contributing to the positive cash flow quarter.

“Although the reduction in underperforming tech products will impact Harris Technology’s FY23 revenue, it will position the company for long-term profitability,” Huang said.

The company finished the quarter with $3m cash on hand.

Hiremii (ASX:HMI)

The recruitment AI player was trading at $0.05 on the 27th of Jan and saw a 24.2% jump to $0.0621 on the following trading day and was up 20% at $0.06 per share yesterday.

During the quarter, the company reported revenue of $4.596m which was up 81% on the pcp and positive net cash from operating activities of $1.072m.

On the technology front, GPT-3 AI was integrated into Hiremii’s new Adwiter product which basically enables users in any location and any industry to “draft a job advert to 80-90% accuracy in under 2 minutes, reducing administration time by over 75% while improving the quality of ads,” the company said.

For context, GPT-3 is like OpenAI’s original language processing AI model – and Chat-GPT, the new fancy chatbot version that Stockhead’s Eddy Sunarto says won’t take over our jobs… yet.

Wife > ChatGPT

Always!! pic.twitter.com/lAImduQhes

— Florin Pop (@florinpop1705) January 25, 2023

“The new product forms part of the broader Hiremii platform and provides customers an on-ramp to the larger integrated hiring platform,” MD Andrew Hornby said.

“With first mover advantage, we are at the leading edge of specialist AI for the recruitment industry.”

Added to this, the company’s recruitment subsidiary Inverse Group, which targets new energy markets including lithium developers, rare earths, hydrogen, ammonia, saw a record $620k gross profit for the quarter.

“Our continued focus on delivering low risk, high value service to the future metals and sustainable energy sectors within global ASX listed and multi-national corporates provides ongoing confidence in our ability to grow a sustainable and disciplined business,” Hornby said.

“Our exposure to asset owners over the quarter increased further, particularly with lithium and Rare Earths.”

Hiremii’s cash balance on 31 December 2022 was $2.057m, up from $1.126m in Q1 FY23.

X2M Connect (ASX:X2M)

Utility data player X2M says revenue was $5.2m for the quarter, up 74% on the pcp, and it saw positive cash flows from operating activities of $0.39m.

X2M’s target market is the Enterprise and Government utility sector in the APAC region and its client base has continued to rise steadily, reaching 58 at 31 December 2022, up 38% on the pcp.

Growth in enterprise and government customers, together with deeper penetration into the addressable market within the existing customer base, drives growth in devices connected onto X2M’s proprietary platform, the company said.

“This is a key focus area for X2M and an important lever in establishing the base for future recurring SaaS and maintenance revenues.”

The company saw its share price jump 23.37% from $0.077 to $0.095 before settling at $0.08 at the time of writing.

Total cash at 31 December 2022 was $3.1 million.

DUG Technology (ASX:DUG)

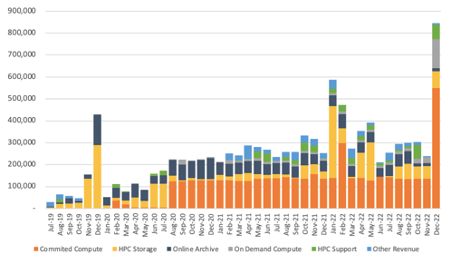

DUG saw total revenue in Q2 of US$14m, an increase of 25% on the pcp, and EBITDA was US$4.6 million, up from US$1.6 million.

The share price saw a 12.95% rise from $0.664 to $0.75 and was trading at $0.86 (up 29.5%) yesterday.

Business development initiatives secured US$13.9 million of new Services contracts during Q2 (up 29% on Q1 FY23 and tenfold increase on Q2 FY22), the signing of Monash University for the HPCaaS business as well as strong renewals in Software.

Software revenue increased 13% on the previous quarter and 6% on Q2 FY22; HPCaaS revenues grew by 10% on the previous quarter and 22% on Q2 FY22, supported by new contract wins from non-oil and gas customers.

“We’ve continued momentum from a good first quarter to produce our best half on record for EBITDA and importantly delivering positive operating cash flows,” MD Dr Matthew Lamont said.

“I’m delighted with our order book and opportunity pipeline with key strategic client wins over the last two months.

“Our Services business is performing exceptionally well. We see continued strength in the business moving forward.”

Total cash held at 31 December 2022 was US$2.5 million.

SPA, HT8, HMI, X2M and DUG share prices today:

Nuix (ASX:NXL)

Investigative analytics software company Nuix says its Annualised Contract Value (ACV) is in the range of $168–$171m vs pcp of $164.5m for the December quarter.

The company’s share price rose from $0.82 to $0.95 – an increase of 15.85% – and is trading at $0.91 (+10.9%) today.

Statutory revenue has risen to be in the range of $85–$88m vs pcp of $84m, driven by a stronger trading performance in December and currency tailwind, the company says.

Statutory EBITDA is expected to be materially higher in the first half than the pcp, in the range of $19–$21m and Net Profit After Tax (NPAT) is also expected to be materially higher.

Non-operational legal fees however may be higher in the second half compared to the first half, potentially impacting both EBITDA and NPAT in 2H23, Nuix says.

The company says that it has no further updates in relation to the previously disclosed legal proceedings in relation to a former CEO, Eddie Sheehy, but if a judgment is received prior to the publication of the full 1H results, adjustments may be required to the 1H results.

Nuix says it will advise the market if a judgment is handed down, along with any potential financial impacts.

The company ended the half with cash on hand of $37.1 million and no debt.

archTIS (ASX:AR9)

The company provides software solutions for the secure collaboration of sensitive information and saw a 15% share price bump after releasing its quarterly, from $0.1 to $0.115, and is currently trading up a further 5% (to total +20%) at $0.12 per share.

AR9 saw solid a 166% increase in Annual Recurring Revenue (ARR) in the quarter of $3.5m.

And for FY23 archTIS expects 60% revenue growth, which MD Daniel Lai eyeing becoming cash flow positive.

“The Australian Department of Defence remains a key strategic focus,” he said.

“One of the highlights has been the KPMG OneDefence initiative which has driven over $1.2m of contracts in the last 90 days (revenue yet to be realised) and will provide additional opportunities for further services and licensing revenue.

“This has placed us in the position that we are under contract to convert another $5.3m in revenue by 30 June 2023.”

The quarter was not without its challenges as the global technology and supply chain slowdown has deferred several licensing sales opportunities and delayed the start of some engagements.

The company ended the quarter with $6.8m of available cash.

De.Mem (ASX:DEM)

Wastewater technology player DEM saw a 25% bump in its share price from $0.12 to $0.15 off the back of its quarterly, and was trading at $0.14 (+16.6%) at the time of writing.

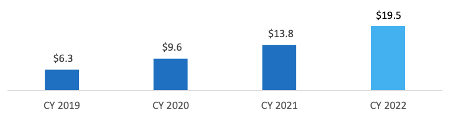

The company saw record cash receipts of $6.7m in the quarter, a 14% increase on the pcp and the 15th consecutive quarter of cash receipts growth vs. the pcp.

The company has generated approx. $19.5m in recurring cash receipts in CY 2022, reflecting of 41% vs the pcp in CY 2021 ($13.8m in recurring cash receipts recorded in CY 2021) which it says speaks to the quality and predictability of its recurring revenue base.

During the quarter, De.Mem also nabbed a $1.4 million contract award for the supply of a water treatment plant to South 32, and progressed the National Sanitation Foundation (NSF) – which is American regulator for drinking water related products – certification of its new Graphene-Oxide membrane filter technology.

The conclusion of the process is expected for the first half of CY 2023, and DEM aims to launch the product into the North American market, which is estimated to be a US$82.6bn global market by 2027.

Bigtincan (ASX:BTH)

The AI-powered software company’s share price rose 13.5% off the back of its quarterly, from $0.515 to $0.585, before settling at $0.555 (+7.7%).

Bigtincan achieved an ARR of $130m as at the end of December, driven by new customer wins including Pfizer, Align, Jabra, Equifax and Assurant, CEO and co-founder David Keane says.

These wins are in addition to expansions with Google, Cisco, Semrush, Seek, TMobile and Neogenomics, among more than 300 customers who expanded in excess of $30k per annum on average.

The company also picked up SalesDirector.AI during the quarter, adding the ability to link people, activity and engagement across the buyer’s journey to derive insights, including opportunity risk and relationship strength, and then make intelligent recommendations for users and management.

The tech will be integrated into the Bigtincan platform during 2023.

Bigtincan also completed a $30m placement to institutional investors, and has an ongoing non-underwritten Share Purchase Plan (SPP) scheduled to close on 18 January to raise up to an additional $5m.

Based on the 1H FY23 performance, the company says it remains on track for its guidance for FY23, with ARR expected to be in the range of $137m to $143m, and revenue in the range of $123m-128m.

Jaxta (ASX:JXT)

The world’s largest dedicated database of official music credits delivered “substantially improved” financial results, increasing quarter over quarter revenues by 140% and decreasing quarter over quarter operating costs by $85K (not including contractor fees paid to Icontech for the development of Vinyl.com which is set to launch this quarter).

“We have hit 2023 running with solid improvements made in the last quarter,” CEO Beth Appleton said.

“Monthly revenues have increased 232% from 12 months ago to AU$34K per month.

“We now have 26 Business Members, 8 Enterprise and 10 API deals.

“Monthly costs have decreased 43% in the same period with further savings coming this quarter from the office exit.”

The company’s share price went from $0.033 on the 30th of Jan to $0.034 the following trading day (a 13% bump) and was trading up 21.2% at $0.04 per share at the time of writing.

As at 31 December 2022, Jaxsta had $1,774 million in cash and cash equivalents.

SPA, HT8, DEM, NXL and BTH share prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.