Tesla, Apple trade higher on day one of share splits

Tech

Tech

Shares in Tesla and Apple both traded higher on the US Nasdaq stock exchange Monday after both companies completed share splits.

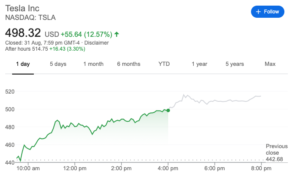

Elon Musk’s Tesla electric car company accelerated 12.5 per cent higher to $US498.32 ($672.68) per share at the Nasdaq market’s close Monday, US time.

Before splitting its shares on a five-for-one basis, giving Tesla shareholders five shares for each existing one they own, the stock was trading at $US2,213 per share.

This represented a mouth-watering gain for Tesla investors of 439 per cent for the year to date, with the company’s share price sitting at $US430/share at the start of 2020.

The reason for Tesla splitting its shares was to “make stock ownership more accessible to employees and investors”, the company said in an August 11 statement.

Friday’s market close share price for Tesla indicated a market value then for each share on a diluted basis of $US442.60/share.

Tesla’s market cap is now $US464bn, and its price-to-earnings ratio is still quite high at 1,290, meaning its dividend payout is 1,290 times smaller than its share price.

Apple’s share price jumped 3.3 per cent Monday and closed at $US129.04 per share.

This was after Apple split its shares on a four-for-one basis, giving Apple shareholders four shares for each one share they held in the company.

On Friday, the iPad, iPhone and MacBook maker was trading at $US499.23 per share.

Dividing Friday’s Apple share price by four indicates a market value of $US124.80 for the company before its share split.

For Apple its share price gain this year to date has been a more modest 70 per cent.

The tech company has a market value of $US2.2 trillion, according to Yahoo Finance.

“While the split will make shares seem more affordable for small investors, we note the market cap and our overall valuation of the firm remain unchanged,” Morningstar strategist Abhinav Davuluri said about Apple’s share split.

Morningstar has put a fair value estimate on Apple of $US71 per share, and for Tesla the analytical firm has pegged the fair value at $US173 per share.

“We expect the company to remain a leader in autonomous technology and range,” Morningstar strategist David Whiston said.

“Tesla is also gaining scale, and its ability to make desirable vehicles while generating free cash flow and net profit is far better than it has ever been, in our opinion.”

The affordability argument for share splitting appears to have less relevance, with the rise of share trading platforms that allow investors to trade fractions of individual company shares.

“Recent high-profile splits seem superfluous given that brokerage platforms like Stake, Interactive Brokers and eToro now enable trading in fractional shares for US stocks,” Morningstar said.

According to trading platform eToro, the share prices of Apple and Tesla could advance by a third in the coming 12 months following their share splits.

eToro based its conclusion on an analysis of 60 years’ worth of historical data that found on average share prices climb by around 33 per cent in the 12 months after a share split.