Tech makes a comeback with sector on pace for best week of 2021

Getty Images

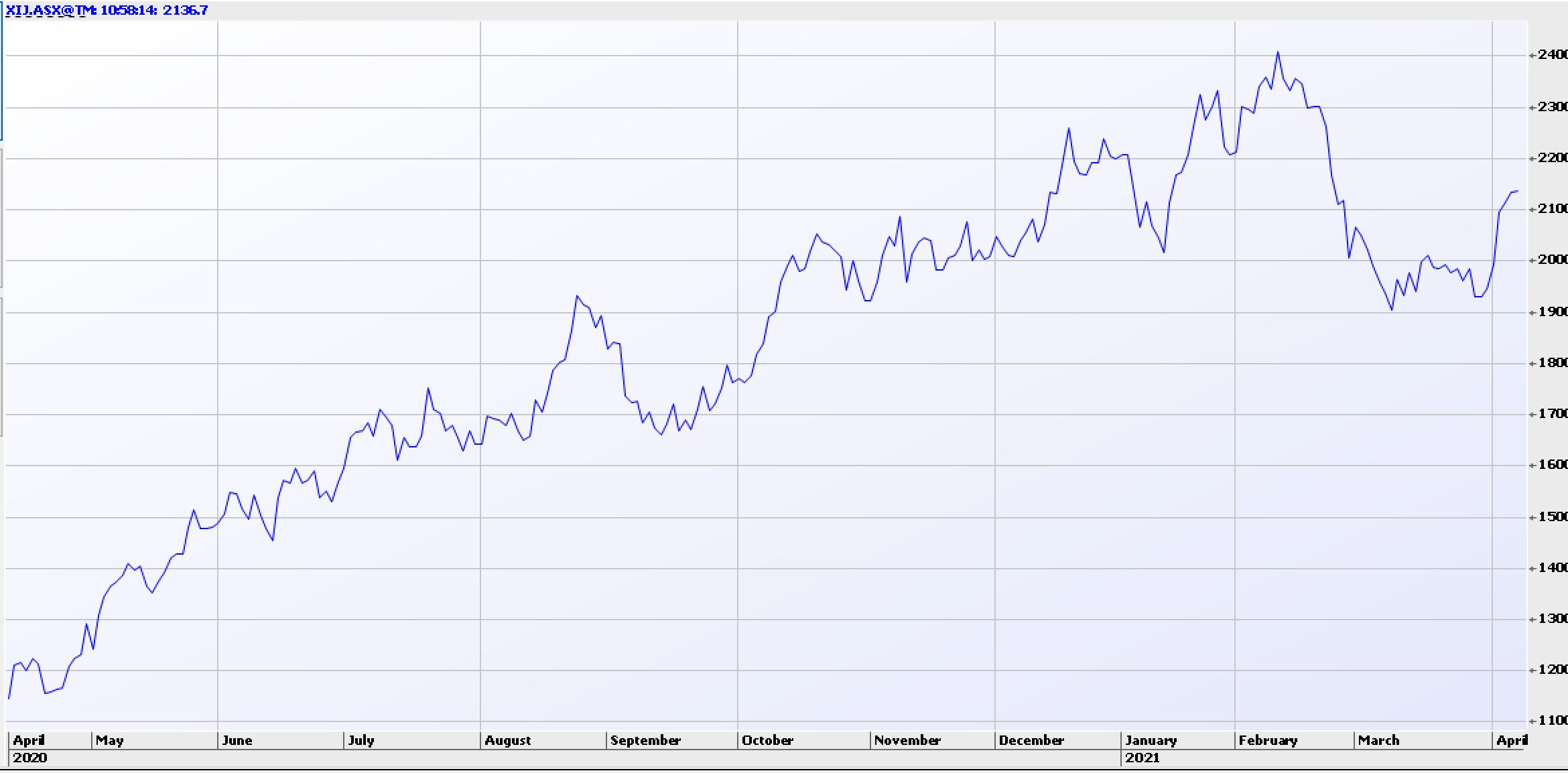

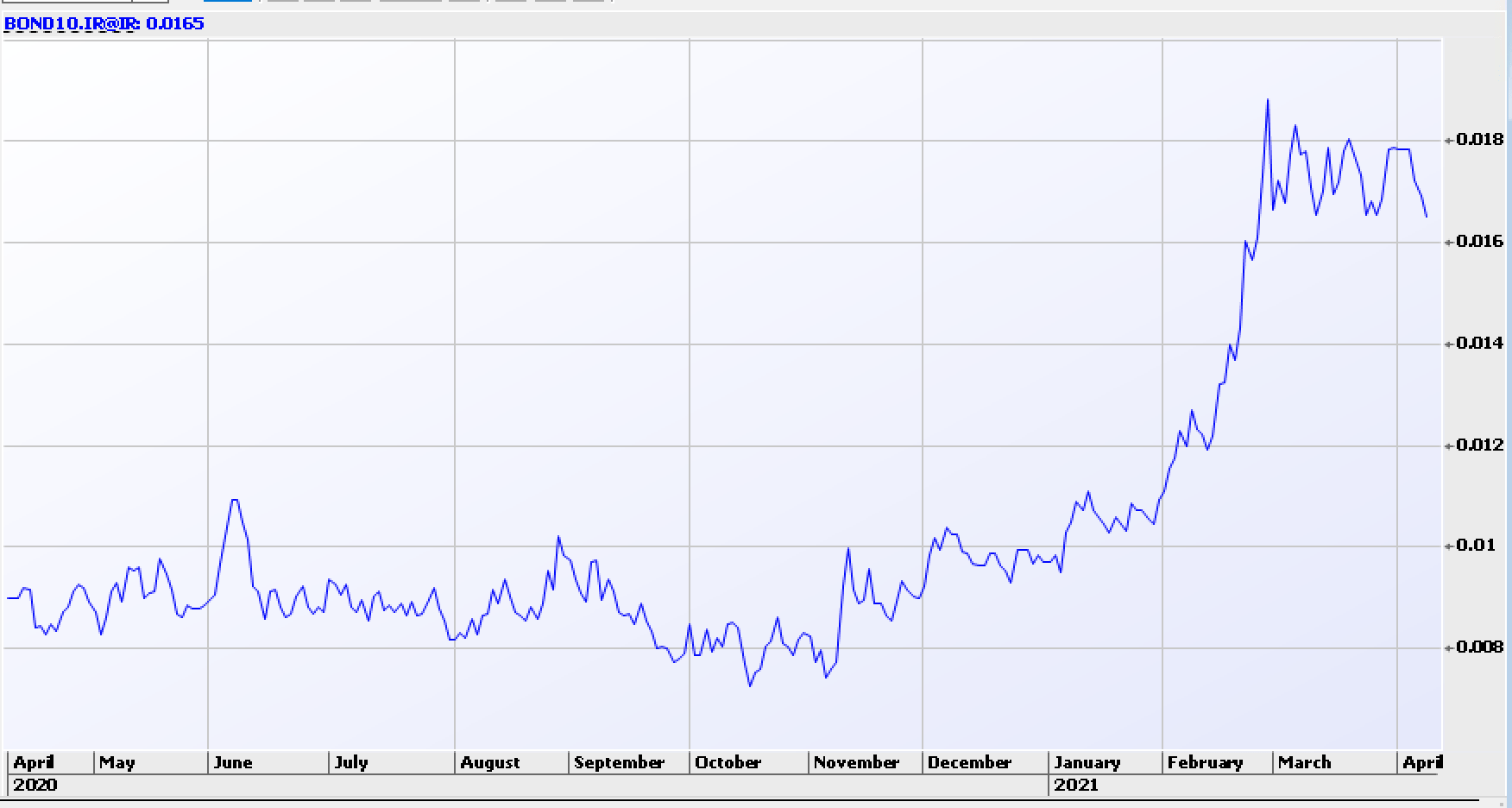

Australia’s tech sector has come roaring back this week after going through a month-long bear market driven by rising bond yields.

From February 10 through March 9, the sector declined 24.1 per cent as investors cycled out of high-growth companies like Afterpay (ASX:APT), Zip Co (ASX:Z1P) and Xero (ASX:XRO) and into pandemic-battered value stocks like Flight Centre (ASX:FLT), Qantas (ASX:QAN) and shopping mall owner Unibail-Rodamco-Westfield (ASX:URW).

But since the start of April, the Aussie tech sector has been on a teart. At 2pm on Friday it was one of only three sectors in the green, on pace to finish the week up 7.8 per cent for its best weekly gain since June 2020.

If it holds on through the rest of the afternoon, today will be the sector’s sixth straight day of gains, including a massive 5.1 per cent rally on Monday that was its best daily performance since July.

Afterpay

Australia’s biggest tech name, Afterpay, was trading this afternoon up 1.5 per cent at $121.80, well off its February 11 high of $160.05 but up from under $100 at the end of March.

“It’s a couple of things taking place,” said Bell Direct market analyst Jessica Amir.

“Treasury yields have stabilised; they’ve been consistently rising.”

Rising yields put pressure on risk assets like technology companies, but with yields easing “people think they’re going to get more capital growth now in tech,” Amir said.

A similar thematic has played out in the United States, where analysts credit moderating bond yields for the reason the tech-heavy NASDAQ composite has gained 4.4 per cent already in April after declining for five of the last six weeks before the month began.

“Rates going up was part of the reason why you had this broadening of the market and a bit of a rotation towards value stocks, especially financials and energy,” Ed Keon, chief investment officer at QMA, told The Wall Street Journal. “Now rates have eased off their highs, you’re seeing those sectors underperform and technology come back into the lead.”

Tech investors when they see the 10 year treasury yield drop pic.twitter.com/CvCKv3ZFj8

— litquidity (@litcapital) April 3, 2021

Better earnings

“We’ve also started to see consistent earnings upgrades, and we didn’t have that in February when the Aussie tech sector was in a bear market,” Amir said.

Morgan Stanley this week said that Afterpay’s US app downloads were triple the level of a year ago, and its total revenue was growing at a 57 per cent annual compound rate – far ahead of its global competitors.

“This is really a global leader,” Amir said of the BNPL giant.

With the first quarter over, some fund managers have also been forced to rebalance their portfolio to take into account the drop in their tech holdings, Amir said.

“Investment managers are in some cases being forced to buy back into technology,” she said.

With the 15-day moving average now above the 30-day moving average, Amir said the technology sector now has momentum and she expects its gains to continue.

April is historically the best-performing month for the ASX200, with the market rising 2.4 per cent on average since 1993, Amir said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.