Tech, BNPL shares are plunging… and bond yields rising

Getty Images

The ASX tech sector is suffering its second-worst day of the year as investors rotate out of hyper-growth companies like the BNPL players and into battered value companies in the energy and property sectors and the travel industry.

The overall market was up slightly at 3pm, with the All Ordinaries edging 0.4 per cent higher to 7,089.5, but the tech sector was down 4.4 per cent while the energy sector had soared 4.5 per cent.

Afterpay (ASX:APT) was down 7.9 per cent to $$137.45, Zip Co (ASX:Z1P) down 5.2 per cent to $11.74x and Xero (ASX:XRO) was down 3.4 per cent to $119.30.

Nearly every company in the sector was down, with Livetiles (ASX:LVT), Dubber (ASX:DUB), Technology One (ASX:TNE) and Link Admin Holdings (ASX:LNK) among the few edging higher.

Meanwhile, Oil Search (ASX:OSH) had risen 6.2 per cent, Santos (ASX:STO) was up 5.6 per cent and Woodside Petroleum (ASX:WPL) had gained 5.3 per cent.

Consumer discretionary and telecom shares were also taking a beating, with both collectively dropping over two per cent, while the real estate sector had gained 1.8 per cent and the material sector was up 1.7 per cent.

Travel companies were hitting their highest levels since late last year, with Qantas (ASX:QAN) up 4.6 per cent, Sydney Airport (ASX:SYD) climbing 6.1 per cent and Corporate Travel (ASX:CTD) gaining 10.2 per cent.

In the property sector, Lendlease (ASX:LLC) was up 6.9 per cent while Westfield owner Scentre Group (ASX:SCG) had risen 3.7 per cent and Dexus (ASX:DXS) was up 3.9 per cent.

Seek (ASX:SEK), officially classified as a communications company, had fallen 7.6 per cent.

The selloff came after a similar drop on Wall Street, where the tech-heavy Nasdaq Composite dropped 2.46 per cent while the Dow Jones Industrial Average rose 0.1 per cent.

Tesla (NASDAQ:TSLA) dropped 8.6 per cent to $US714.50, its lowest level since New Year’s Eve, while Apple, Amazon and Microsoft were all down more than two per cent.

Cryptocurrencies were also largely in the red, with Bitcoin down 7.4 per cent to $US51,724 and Ethereum falling 10.0 per cent to $US1,680.

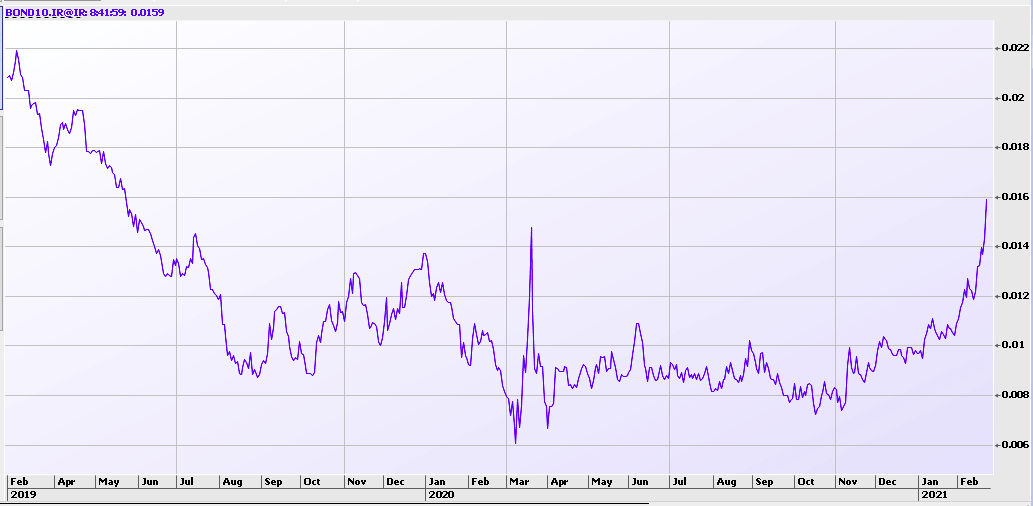

Meanwhile the yields on Australian 10-year bonds had jumped 5 per cent to 1.608 per cent – their highest level since May 2019.

(Taking a longer view, that yield is still much lower than it was from for many decades before mid-2019, when the Reserve Bank began a series of cuts to the cash rate).

Analysts said that the rising bond yields were taking their toll on hyper-growth assets such as tech companies.

Huge rotation out of growth stocks and tech today into value stocks, commodities and banks.

Rising interest rates, and treasury bond yields are good for value stocks and commodities but bad for growth and tech..— Will Meade (@realwillmeade) February 22, 2021

Higher yields can dim the attractiveness of tech and other growth stocks, and the threat of inflation also can make investors worried about potentially tighter monetary policy. #TreasuryNotes #Bonds #StockMarkets

— Καλημέρα ✝️ ✈️ (@StavrosZito) February 22, 2021

Bond yields rise when bond prices fall, and optimism about the US vaccine rollout has apparently made large investors less likely to invest in bonds and more likely to invest in shares.

But that rising yield in turn can make risk assets like speculative BNPL stocks less attractive to institutional investors.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.