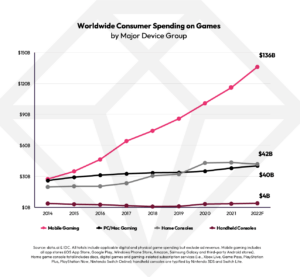

Streamplay capitalises as the mobile gaming sector more than doubles both console and PC

Tech

Tech

With mobile gaming on a global level reaching ~25% penetration this year, mobile tech player Streamplay Studio has been on a tear.

Recently, Streamplay Studio (ASX:SP8) has been shoring up deals with telcos in South Africa and across the Pacific to provide its suite of handheld gaming, video and music services.

The company owns and operates online competitive social gaming platform technology and bespoke cloud streaming technology for the burgeoning mobile gaming sector. Streamplay has also set up an internal game studio and are developing games in-house.

What makes the company unique, is that instead of users having to install the video games, they can stream —via mGames (mgames.com.au)—on their phones.

In addition to Streamplay’s gaming offering, the company also owns music platform technology. Its mJams (mjams.com.au) product allows users to create song playlists, share music and even attend virtual concerts.

Mobile gaming has been on a steady upward trajectory for a few years now and there are currently 6.92bn smartphone users in the world today – which is a game-watering 85.95% of the world’s population.

This is quite an impressive feat, as back in 2016 there were just 3.668 billion users and made up 49.40% of the population at the time.

There’s no surprise big corporates are buying out mobile game development studios at pace, with Sony, Microsoft and China’s Tencent investing heavily.

Originating out of South Africa in 2016, Streamplay saw a gap in the domestic market and started with a single domestic product where casual gamers can connect, play and compete for prizes.

Fast-forward to 2022, the company launched its first cloud gaming product. Navigating cloud gaming’s complexity, with its substantial operational costs, proved formidable, says Mondello.

“Yet, we believe our team has come out on top by delivering effective technology that has so far outperformed expectations and displayed immense scalable revenue potential.

“Simultaneously, we’re advancing our life cycle by venturing into new global markets.”

The company’s IP and its related services now enable cutting-edge online casual gaming and competition facilitation platforms where subscribers enter tournaments, play their favourite casual games, and earn rewards and prizes with underlying social interaction options.

It introduced leaderboards, rewards and incentivisation for users to revel in their gaming experience.

Continuous growth has culminated in a pivotal partnership with MTN, South Africa’s telecom giant. To date, its platform has been embraced by over 1.7 million subscribers.

With an addressable audience now exceeding 50 million, Streamplay’s presence spans multiple nations including South Africa, Papua New Guinea, Fiji, Solomon Islands, American Samoa, and Tonga.

It recently signed a strategic partnership with Digicel Fiji, the leading telecommunications provider in the country that has ~280,000 users connected out of a ~900,000 population.

Digicel Fiji is a core part of the Digicel Pacific business – owned by Telstra, and the partnership represents a strong endorsement for Streamplay’s reach into the region.

Further representable markets for Steamplay through Digicel Pacific include Nauru and Vanuatu.

Digicel Fiji CEO Farid Mohammed says that “both mGames and mJams Music will be strong and unique offerings in the Pacific mobile market and the prospect of rolling them out to our markets, of which Fiji is the first, is compelling.”

SP8 director Bert Mondello says the company is pleased with the overall performance of the company recently, with teams maintaining revenue whilst concurrently deploying multiple integrations across our telco partners.

“The telco integrations have been a crucial milestone that paves the way for continued future successful launches of our platform in new markets,” Mondello says.

“The successful rollout of mGames in Papua New Guinea has been met with resounding success, with a rapidly growing user base which will result in increasing revenue for the Group. These achievements reinforce our confidence in a promising FY24.”

SP8 said the quarter’s primary focus was on enhancing stability and scalability of its bespoke game engine and its upcoming original game Slime Crisis.

Streamplay aims to continue to invest in R&D of “game streaming technology capable of streaming premium games, real-time multiplayer features, new competition features (such as Head-to-Head competition), extended brand engagement features and new social engagement features”.

It’s dedicating efforts to enable both Xbox and PlayStation console owners to utilise the streaming platform even more by being able to pair existing bluetooth-enabled console controllers to users’ mobile phones.

During the last financial year, Streamplay posted receipts from customers of $804k of which $171k were banked in the current quarter.

Total cash equalled $15.4m at June 30, with cash on hand being $6.4m and $9m invested in long-dated term deposits.

It’s also continuing to implement its expansion strategy with MTN Group which has an addressable market of ~120 million. These activities saw a whopping 165% in subscriber growth during Q2 this year.

“MTN serves a staggering 285 million users throughout its 19-country portfolio, while Digicel Pacific commands a subscriber base exceeding 2.5 million across the Pacific region,” Mondello says.

“Our achievements are anchored in the strength of our partnerships,” Mondello says.

“These strategic alliances have unlocked substantial value, granting us access to extensive user networks which fuels the expansion of our marketing initiatives and plays a pivotal role in driving our impressive revenue milestones.

“We know we are heading in the right direction and we are ahead of the competition with our technology in cloud gaming.”

This article was developed in collaboration with Streamplay, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.