Sprintex in trading halt amid capital raise as it lays foundation for growth into eCompressors

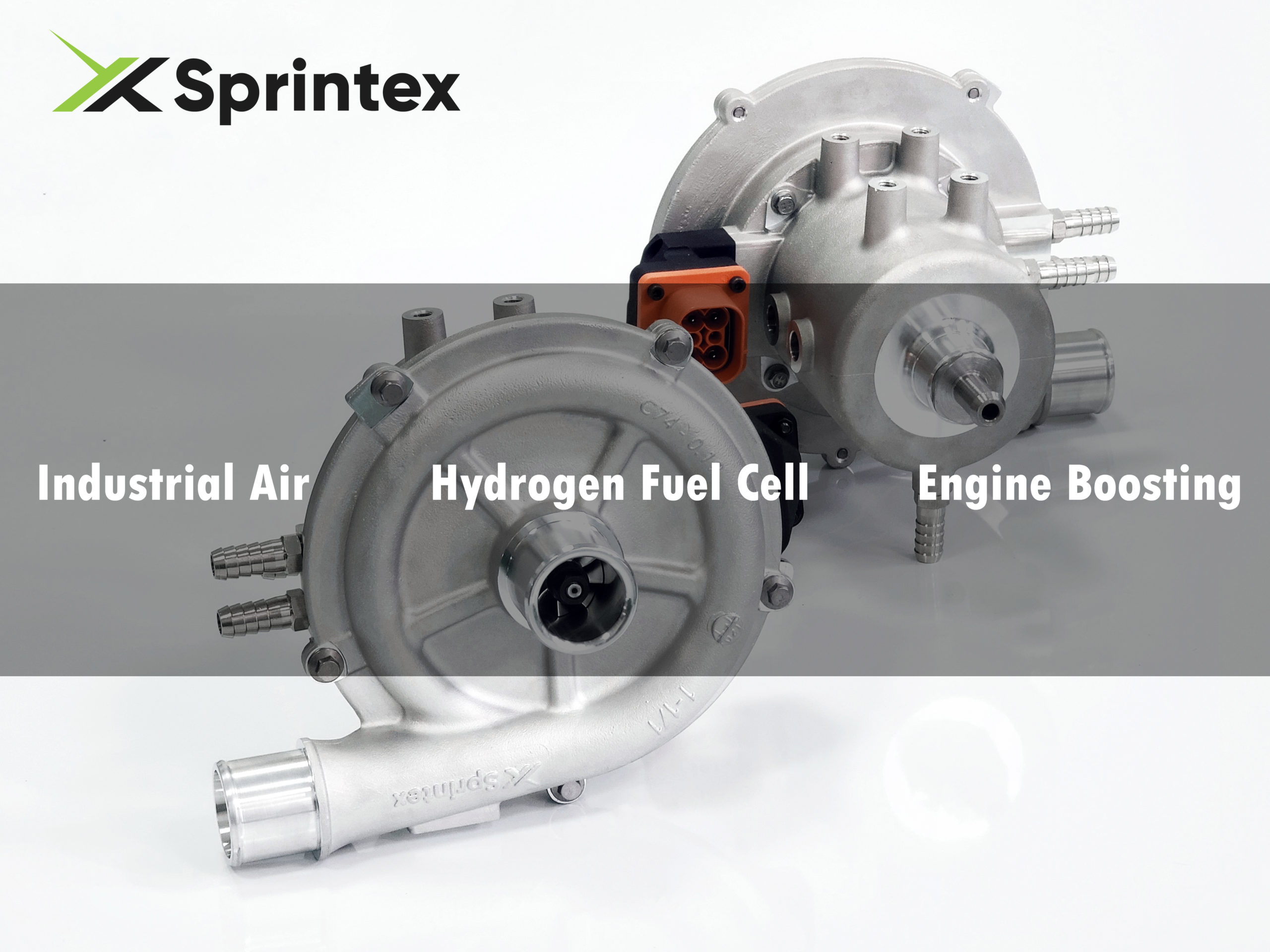

Pic: Supplied

Sprintex is focusing on adding lucrative electric compressors to its existing mechanical drive compressor business as it continues in a trading halt pending a capital raise announcement.

Supercharger specialist Sprintex Limited (ASX: SIX) today released its Q1FY22 results with a cash balance of more than $1m and plans to further expand into electric compressor (eCompressor) market.

As Sprintex enters two major deals to drive growth, it also entered a trading halt on October 29 pending release of a capital raise announcement to further fund development and production of products.

The company’s share trading is due to remain suspended until November 2 or when more details are released, whichever occurs first.

Sprintex designs and manufactures compressors and superchargers for use in a wide variety of combustion engines, industrial and hydrogen fuel cell applications.

The company has predominantly been focusing on leading the way in the green economy by reducing automotive carbon emissions whilst boosting engine performance.

However, a highlight of the quarter was Sprintex’s deal with Aeristech, a global leader in eCompressors.

The deal facilitates both Sprintex and Aeristech’s steps towards the industrialisation of high-speed eCompressors. It also accelerates Sprintex’s penetration into the high-growth and lucrative hydrogen energy and clean air markets, including hydrogen fuel cell, industrial turbo blowers and compressor sets.

First production samples are scheduled for Q4FY21.

Sprintex wins $6.3m supply deal with Chinese firm

The company announced last week it had entered into a three-year supply agreement with Nanjing RGE, a leading manufacturer of wastewater treatment equipment and systems in China.

Under the terms of the deal, Sprintex will customise and develop a series of standalone, high-speed centrifugal air compressors for use in the water treatment industry.

RGE and Sprintex will collaborate on the design of dedicated water treatment systems, ranging from 10-60kW.

The minimum contract value is worth RMB30m (~$6.3 million) over the first two years of the initial three-year term.

Sprintex’s new facility in China to drive growth

The company opened a R&D and manufacturing facility in the city of Suzhou in Jiangsu Province in June. The Sprintex Energy Technology 1,500 sq metre facility will become its engineering centre and production base in China with a production capacity of 50,000 units per annum of high-speed electric compressors.

As of September 30, Sprintex has $1.194m cash. Managing director Jay Upton described the agreements with RGE and Aeristech as major steps forward in the company’s expansion into the electric compressor market.

“Activities since our last quarterly report have significantly enhanced our company’s inroads in the eCompressor market,” Upton said.

“The strategic collaboration with Aeristech will stimulate exciting synergies between the two companies on product development, production and sales and the supply agreement with Nanjing RGE provides an entry and a foothold into more mature industrial markets.”

Sprintex’s work on development of a supercharger system for the Toyota Tacoma also remains ongoing.

Shares in Sprintex last traded at 8.1 cents on October 28. The company has a $17.33 million market cap.

This article was developed in collaboration with Sprintex, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.