Smartwatch maker MGM Wireless is up five-fold as wearables outlook improves

Tech

Tech

The “wearable technology” market will return to double-digit growth in 2019 after going through some wobbles in recent years, says tech researcher IDC.

The next-generation of smart watches are expected to be the main market driver — which won’t come as any surprise to shareholders of ASX-listed MGM Wireless — up five-fold since launching its first kids smartwatches in September.

MGM originally forecast sales of 3000 to 10,000 of its Spacetalk smartwatches per year year. It now estimates the market at 120,000 to 180,000 units — or $30 million to $60 million.

A 2018 sector analysis by Statista pegs the wearable tech market at $US5.8 billion by the end of this year.

A shift in consumer preferences towards smartwatches “has been in full swing these past few quarters and we expect that to continue in the coming years,” IDC said in a new report last week.

“The smartwatches of 2022, even 2020, will make today’s smartwatches seem quaint,” said IDC’s wearables analyst Ramon Llamas.

“Health and fitness is a strong start, but when you include cellular connectivity, integration with other Internet of Things devices and systems, and how smartwatches can enable greater efficiencies, the smartwatch market is heading for steady growth in the years to come.”

>> Scroll down for a list of ASX stocks with exposure to the wearables market

Here’s how IDC sees wearables growth over the coming five years:

MGM’s watches let kids call and text a series of pre-filled numbers, as well as letting parents see their location via GPS tracking.

They retail for $349 and have a small monthly service fee to keep their systems secure. The company has almost sold out of its first run of 3000 watches and a second run of 7000 units is now in production — which boss Mark Fortunatow reckons could be sold out by Christmas.

“Like a lot of consumer electronics, the profit market is really healthy,” he told Stockhead.

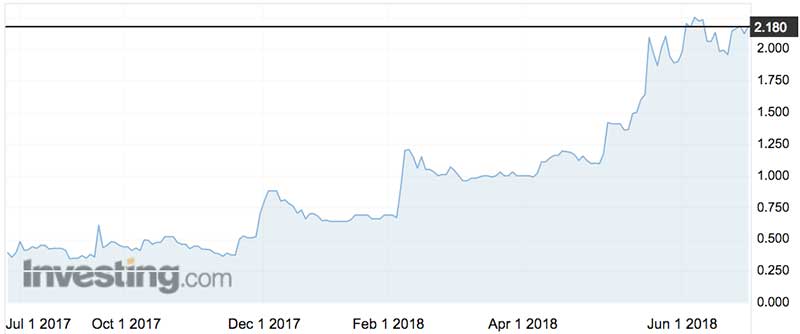

Over the past 12 months, MGM’s shares haveas rocketed from 39c to $2.18 — a jump of 454 per cent. The stock is at its highest point in ten years (it’s traditional business was SMS messages that tell parents when their kids skip school).

The break even point for the watch products is 7500 units, with the company on track to meet in the coming months.

Who’s the next MGM Wireless?

There are about ten or so ASX stocks that offer exposure to the wearable space. Here’s a quick round-up:

Nuheara (ASX:NUH) share price 9.7c

Intelligent earbud producer Nuheara (ASX:NUH) is ahead 32 per cent over the past 12 months now sitting at 98c.

Its headphone products include the Iqbud and the Iqbuds boost, designed to help those with mild hearing loss. In May, the company was commissioned to test whether its products help kids with auditory processing disorders.

In the March quarter the company received $1 million from customers for its products and burned through $1.1 million.

MGM Wireless (ASX:MWR) share price $2.18

MGM is shifting focus from a school text message business to its sale of Spacetalk kids smartwatch products. In April, the company launched a $1.5 million share placement to raise capital for Spacetalk production, an offer which was more than three times oversubscribed.

The company is working with retail distributors to sell Spacetalk units and has 7000 more watches now in production.

It’s one of the best performing small caps in recent months:

Dorsavi (ASX:DVL) share price 12.5c

DorsaVi takes a more athletic approach to wearables, producing wearable movement sensors for elite sportspeople as well as biotech trackers for patient management. On Monday, the company announced it was launching its injury rehabilitation trackers into the US market.

Its share price has dropped 55 per cent over the past year, sitting at 12.5c this week.

Catapult (ASX:CAT) share price $1.25

Athletic tracking producer Catapult has seen its share price drop 40 per cent over the past 12 months. In the third quarter of 2018, it received $13.1 million from customers, a figure up 23 per cent compared to a year ago.

Simavita (ASX:SVT) share price 1.4c

Simavita takes a different approach to the wearables market, working in the aged care space to produce disposable wearable trackers, including Alertplus, a sensor for nappies that shows when a product needs changing.

Elsight (ASX:ELS) share price 50c

Israeli startup Elsightis mainly focused on video communications but offers wearable body cameras that can transmit video and audio streams via mobile or Wi-Fi networks.

Elsight listed just over a year ago after raising $5 million at 20c. It touched $1.77 late last year and has since cooled to 54c — but it’s stil up 225 per cent over the past year.

AFT Corporation (ASX:AFT) share price 0.1c

It would be just plain rude to leave pets out of the wearables trend: at the end of last year, solar panels business AFT said it was lending its expertise to a variety of solar powered pet health and GPS trackers in a deal with Singapore business PetBacker.

Oventus Medical (ASX:OVN) share price 0.5c

Oventus is in the sleep apnoa treatment space and its device doesn’t require a sufferer to wear a strap around their head to keep their mouth closed. It’s designed to treat patients where other options have failed.

Medibio (ASX:MEB) share price 14c

Meanwhile, mental health play Medibio offers tracking tech which physically measures users’ stress levels.

Here’s list of ASX stocks with exposure to the wearables market:

| ASX code | Company | Price change one-year | Price Jun 26 (intraday) | Market Cap |

|---|---|---|---|---|

| MWR | MGM WIRELESS | 4.39440203562 | 2.12 | 25.1M |

| ELS | ELSIGHT | 2.25 | 0.52 | 51.8M |

| RMD | RESMED | 0.380929332043 | 14.265 | 20.7B |

| NUH | NUHEARA | 0.272727272727 | 0.098 | 88.3M |

| AFT | AFT CORP | 0 | 0.001 | 9.0M |

| OVN | OVENTUS MEDICAL | -0.0921052631579 | 0.345 | 36.5M |

| CAT | CATAPULT GROUP | -0.381188118812 | 1.25 | 245.3M |

| SVA | SIMAVITA | -0.548387096774 | 0.014 | 4.3M |

| DVL | DORSAVI | -0.586206896552 | 0.12 | 18.5M |

| MEB | MEDIBIO | -0.611111111111 | 0.14 | 28.4M |