Closing Bell: ASX plunges as broad based losses follow perfect storm of fears

Via Getty

- Benchmark ASX index closes back under 7000 pts

- All ASX Sectors in the red

- Small caps led by MKL, WBE

The ASX200 has closed sharply lower on souring sentiment, soaring bond yields and increasing Middle East military action.

The benchmark lost -1.4%, to be back under the 7000-point threshold for the second time this month.

It started overnight on Wall Street as the US 10-year Treasury yield found a new 16-year high, sucking the love out of the three major indices in New York as the US economy’s hard-bitten resilience encouraged fears of another Fed move to hold interest rates higher for longer.

WTI crude futures surged again overnight – almost up 1.8% to be looking poised for a higher run beyond US$90 per barrel – the highest in two weeks – following Iran’s call for a total Muslim nation embargo against Israel.

The situation in Hamas-controlled Gaza is quickly descending into a worst-case scenario – and a humanitarian nightmare.

US Futures are still down as The Fed gathers in New York, US President Joe Biden looks lonely in the Middle East and everyone is likely still a bit depressed about Elon’s miss overnight.

Kyle Rodda at Capital.com told Stockhead that overall, the results were a miss.

“Earnings per share fell to 66 cents, below the 74-cent consensus estimate. Revenue was also a fraction lower than expected, with margins falling slightly more than forecast to 17.9%. Free cash flow was also significantly weaker. Existing price cuts have hurt the business’s short-term performance, but the focus of investors appears to be future production, especially of the cyber truck. The vehicle will be rolled out on November 30, and Elon Musk has warned that the ramp-up will be ‘extremely difficult’.”

Tesla’s share price has copped a drubbing late in after-market trade.

At home the government’s 10-year bond yield has also done a runner – climbing above 4.7% to its highest levels in 12 years and mimicking the rally in US yields.

Local traders/investors have decided they’re not that chuffed about Aussie jobless rates unexpectedly falling to 3.6% in September – in the face of higher borrowing costs, with the data yielding little love out of the downtrodden ASX, where all sectors are in retreat.

If the S&P/ASX 200 ends down more than 1.69 per cent it will be the biggest fall since at least as far back as early March, when the US regional banking crisis gripped markets. It would also be the second-biggest fall this year.

We’re not all alone in the rain. Regional markets have also tracked Wall Street lower.

It’s been a mess in mainland China, where the Shanghai index is down near 2%, to its lowest levels in nearly a year, while the tech-laden Shenzhen index is wallowing at nearer to three-year lows.

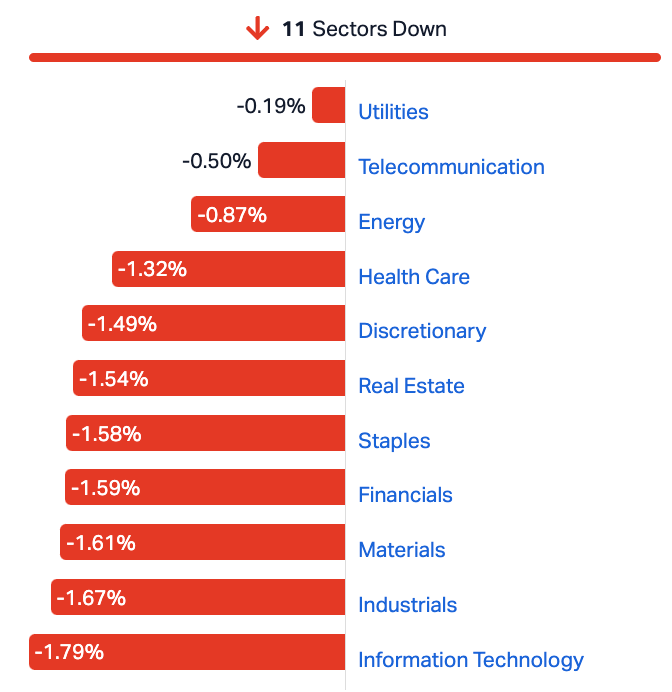

ASX Sectors

RANDOM SMALL CAP WRAP

Spacetalk (ASX:SPA) has dropped its new Loop 4G safety smartwatch, ‘which specifically targets parents wanting a safety smartwatch’ so they can monitor their tech-loving kids 24/7.

Key features according to SPA in bullies:

• 4G phone calling capability – the ability to make 4G phone calls keeps parents in the loop

• SMS messaging and instant messaging

• A parent-approved contacts list – No inbound and outbound calls or text messages with anyone outside a parent created contact list

• GPS location awareness, with location on demand – important for parents’ peace of mind

• Safe zones & alerts – allows the creation of safe zones for frequented locations and get alerts every time they enter or leave

• School mode – At the tap of a button, Loop converts to a regular watch during school time, lessening distractions when learning

• SOS alert with unlimited emergency contacts

• Health & fitness monitoring tools

• Reminders and Alerts set from the Spacetalk parent app

• 2MP Camera for happy snaps

• Calculator, Timer/Stopwatch, Calendar and Weather

• Additionally, Loop has no social media or internet browser, keeping curious eyes away from harmful content.

The company says Loop should ‘materially increase Spacetalk’s revenue base.’

The release of the Loop 4G smartwatch represents another deliverable in Spacetalk’s stated strategy of providing an ecosystem of products that materially enhances family safety (and peace of mind that comes with it) across every stage of life.

Loop meets a central part of this growth strategy, which is the creation of recurring software and Spacetalk Mobile (Mobile Virtual Network Operator (MVNO)) revenue stream. It comes with a pre-loaded SIM. Loop is additionally soft locked to the Spacetalk Mobile network, meaning it has a Spacetalk SIM pre-installed.

Taken together, these revenue gains will help Spacetalk move ever closer to its stated target of $20m-$25M of ARR within the next three years.

Spacetalk CEO Simon Crowther:

“We continue to execute on our strategy and The Loop 4G safety smartwatch is our second new hardware launch in calendar 2023. The timing is important for the upcoming holiday period and its comprehensive safety features will make it a great gift for kids. Loop is an important next step in the development of our ecosystem and will drive continued growth of Spacetalk Mobile subscriptions.”

We’re watching gold again this week…

Gold, not far off US$1,950 an ounce is at near three-month highs, signs of a bloodier-than-expected Israeli / Hamas conflict made the safe-haven a broader destination. Fears for oil and gas supplies as well as political uncertainty in the region – especially the possibility that other countries would be dragged in – have grown.

Meanwhile, everyone is anxiously awaiting the US Federal Reserve Chair Jerome Powell’s speech in New York later tonight to get a lookit his latest thoughts on the route of US monetary policy. Stronger-than-expected US economic data has so far reinforced the view that the Fed will keep rates elevated for an extended period. This pushed the benchmark 10-year US yield to 16-year highs above 4.9%, putting a lid on gold rallies.

J Powell will be in New York with his buds from the US central bank at the fancy Economic Club of New York, with war on the mind and a fast-changing global market outlook.

The Fed left its benchmark lending rate unchanged in a range of 5.25% to 5.50% at the last meeting in mid-September.

RIPPED FROM THE HEADLINES

Morgan Stanley shares plunged as much as 8%, the most since June 2020, after the bank’s dealmakers copped their biggest drop in fees on Wall Street and its wealth management suffered the lowest inflows in more than three years.

Tesla stock has now fallen -4.8% in after hours trade after the EV king saw profits reverse some 44% in the third quarter after it cut prices to maintain its royalty status in the EV world.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ROG | Red Sky Energy. | 0.006 | 50% | 8,359,736 | $21,208,909 |

| WBE | Whitebark Energy | 0.025 | 47% | 2,831,116 | $2,495,493 |

| EVG | Evion Group NL | 0.036 | 29% | 327,195 | $9,686,857 |

| DES | Desoto Resources | 0.14 | 27% | 56,497 | $6,591,915 |

| MKL | Mighty Kingdom Ltd | 0.014 | 27% | 247,946 | $3,588,416 |

| KGD | Kula Gold Limited | 0.015 | 25% | 1,434,850 | $4,478,543 |

| GTG | Genetic Technologies | 0.0025 | 25% | 90,014 | $23,083,316 |

| MTL | Mantle Minerals Ltd | 0.0025 | 25% | 90,108,663 | $12,294,892 |

| ANR | Anatara Ls Ltd | 0.031 | 24% | 239,271 | $2,998,100 |

| FGH | Foresta Group | 0.017 | 21% | 1,429,582 | $31,353,039 |

| IRX | Inhalerx Limited | 0.042 | 20% | 12,000 | $6,641,843 |

| TSO | Tesoro Gold Ltd | 0.018 | 20% | 3,183,715 | $15,804,189 |

| CT1 | Constellation Tech | 0.003 | 20% | 8,594,665 | $3,678,001 |

| GMN | Gold Mountain Ltd | 0.006 | 20% | 369,131 | $11,345,393 |

| AQN | Aquirianlimited | 0.205 | 19% | 325,870 | $13,896,907 |

| HCD | Hydrocarbon Dynamic | 0.007 | 17% | 730,000 | $3,897,995 |

| LRL | Labyrinth Resources | 0.007 | 17% | 565,075 | $7,125,262 |

| WIA | WIA Gold Limited | 0.036 | 16% | 805,579 | $28,541,234 |

| 5GG | Pentanet | 0.058 | 16% | 202,330 | $18,686,361 |

| HAL | Halo Technologies | 0.069 | 15% | 20,000 | $7,769,713 |

| RIM | Rimfire Pacific | 0.008 | 14% | 5,364,549 | $14,736,713 |

| LIN | Lindian Resources | 0.205 | 14% | 2,184,671 | $207,346,002 |

| ARX | Aroa Biosurgery | 0.75 | 14% | 2,889,072 | $226,671,325 |

| OLI | Oliver'S Real Food | 0.025 | 14% | 579,218 | $9,696,102 |

| NIM | Nimyresourceslimited | 0.17 | 13% | 223,881 | $11,620,148 |

Still on a bull run is Whitebark Energy (ASX:WBE). It’s now more than halved its morning gains of circa 100% but is still a happy-chappy compared to most stocks today. The company says its Wizard Lake oil and gas field has returned to production.

The company reports that workovers at Rex-4 and Rex-1 have been completed, and the field has returned to production effective October 18 with Rex-1, Rex-2 and Rex-4 collectively producing 50 bopd and 300 mcf/d (100 boe/d).

Making a sharp move in late trade has been the love for Mighty Kingdom (ASX:MKL), which earlier this week informed the market of ‘several unsolicited enquiries’ about getting taken out for lunch.

“In response to this interest, the board of Mighty Kingdom has decided to undertake a strategic review process of the company with the view of maximising shareholder value,’’ the game developer said.

“As part of this review process, MKL is considering all options with respect to its business including, but not limited to, a whole or partial divestment, joint venture arrangement or a strategic investment into the company to further growth and development.

“The company has not made a decision at this stage with respect to terms and deal structure that it is prepared to consider and therefore makes no assurances that a transaction will eventuate.

“Mighty Kingdom cautions shareholders not to make any investment decisions about the Company’s shares on the assumption that a transaction will proceed and further market updates will be provided following any material developments arising as a result of the review process.”

Mighty Kingdom also said it had conducted a share placement to raise $1m, with director and sophisticated investors taking up the shares at 1c a pop.

Shares are being snapped up for 1.2c right now, a 27% increase.

Also trimming gains from this morning is Tesoro Resources (ASX:TSO) up 20% after a near 30% burst, on news that the company has delineated a new large outcropping gold anomaly which has never been drilled at Drone Hill, with wide outcropping intersections of up to 47m.

The newly-discovered surface mineralisation is confirmed to extend at least 750m west and 380m south of the Ternera Gold Deposit in Chile, and assay results for initial eight scout holes at Kitsune returned prospective lithology and alteration with a similar geological setting to Ternera.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| TOR | Torque Met | 0.165 | -57% | 14,527,669 | $45,837,503 |

| INL | Innlanz Limited | 0.01 | -57% | 100,463 | $7,205,063 |

| WOA | Wide Open Agricultur | 0.17 | -48% | 2,411,948 | $46,566,576 |

| IS3 | I Synergy Group Ltd | 0.005 | -44% | 327,015 | $2,601,723 |

| TOY | Toys R Us | 0.01 | -41% | 12,714,212 | $15,689,607 |

| AHN | Athena Resources | 0.003 | -25% | 33,312,450 | $4,281,870 |

| VAL | Valor Resources Ltd | 0.003 | -25% | 1,588,428 | $15,493,339 |

| PIL | Peppermint Inv Ltd | 0.013 | -24% | 34,993,233 | $34,643,566 |

| CRS | Caprice Resources | 0.028 | -22% | 775,904 | $4,203,250 |

| M24 | Mamba Exploration | 0.035 | -22% | 100,000 | $2,744,250 |

| LEG | Legend Mining | 0.021 | -19% | 913,833 | $75,516,407 |

| PRS | Prospech Limited | 0.023 | -18% | 123,000 | $6,153,279 |

| LBT | LBT Innovations | 0.005 | -17% | 500,000 | $2,135,402 |

| RLC | Reedy Lagoon Corp. | 0.005 | -17% | 576,368 | $3,700,102 |

| YPB | YPB Group Ltd | 0.0025 | -17% | 621,934 | $2,230,384 |

| BRU | Buru Energy | 0.105 | -16% | 866,796 | $74,505,386 |

| HTA | Hutchison | 0.032 | -16% | 14,762 | $515,755,326 |

| BGE | Bridgesaaslimited | 0.027 | -16% | 100,000 | $1,261,952 |

| AKN | Auking Mining Ltd | 0.049 | -16% | 833,288 | $11,838,015 |

| BVR | Bellavistaresources | 0.11 | -15% | 75,000 | $6,257,998 |

| MTM | MTM Critical Metals | 0.022 | -15% | 2,750,017 | $2,582,764 |

| RLG | Roolife Group Ltd | 0.011 | -15% | 224,235 | $9,393,256 |

| HRZ | Horizon | 0.028 | -15% | 645,175 | $23,132,461 |

| AIV | Activex Limited | 0.017 | -15% | 147,560 | $4,310,052 |

| BDG | Black Dragon Gold | 0.029 | -15% | 25,000 | $6,822,782 |

TRADING HALTS

Microba Life Sciences Limited (ASX:MAP) – Proposed acquisition and an accelerated non-renounceable entitlement offer.

Imricor Medical Systems (ASX:IMR) – Pending the release of an announcement in respect of a capital raising.

Southern Cross Gold (ASX:SXG) – Pending an announcement in relation to material exploration results from the Sunday Creek project.

Volt Resources (ASX:VRC) – Pending the release of an announcement in respect of a capital raising.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.