Roolife doubles FY 22 growth, bringing global brands eye to eye into China

Roolife doubles FY 22 growth, bringing global brands eye to eye into China. Image: Getty

RooLife has delivered strong growth for FY22 as it continues to build on its reputation as a global leader in helping companies expand into China.

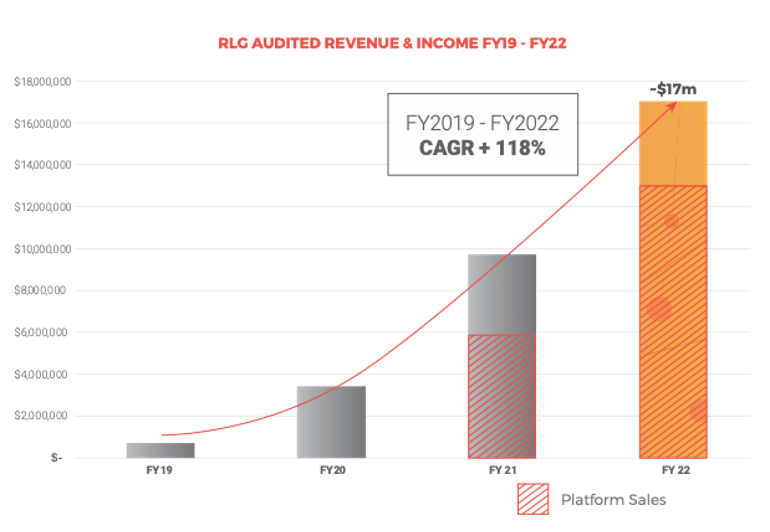

China-focused digital marketing and e-commerce company RooLife Group (ASX:RLG) has delivered growth of +118% in platform and product sales to ~$13m from ~$6m in FY2021.

Platform product sales represented over 76% of the company’s total revenue for FY2022 with RLG attributing the growth to strong continued investment in its proprietary technology and market development.

During the fiscal year, RLG significantly expanded its global business operations with customers and product sales from seven countries, which was supported by its tech platforms.

RLG said the company’s expanded global client base significantly boosted its revenue growth.

Source: Roolife

Delivering on ‘overarching vision’

RLG Managing Director Bryan Carr said during the last three years, RLG has strongly invested in the development of its technology and platforms connecting brands and suppliers with customers globally.

“In FY2022, the company’s management delivered on the overarching vision, growing platform product sales by 118% and delivering its services to 7 countries with marquee clients across 8 major industry segments,” he said.

Carr said accessing new markets continues as a strong focus with the recently announced appointment by Santander UK as its China entry provider for their clients.

“With Santander’s established global banking footprint and over 150 million customers, the Santander Navigator portal and technology nicely complements RLG’s Marketplace platform which is designed to match consumer demand with suppliers globally and is an integral component of driving the next phase of our growth strategy,” he said.

Reduction in loss for FY22

Revenue growth has consequently led to a 50% reduction in net comprehensive loss to $2.5m in FY2022, which was achieved despite COVID lockdowns in its key market of China and global supply chain delays with increased costs.

The sustainable revenue now positions the company to be self-sustaining from a cashflow perspective if the status quo remains.

However, RLG said the Board is of the view that further growth is achievable, and indeed necessary to achieve the economies of scale to be derived from the existing cost base.

Positive growth outlook for FY23

RLG has a strong net assets position of ~$6m to pursue further business expansion in FY23.

RooLife also continues to grow its reputation as a global leader in helping companies expand into China, one of the largest and fastest growing middle-class markets in the world.

In July RLG announced it had joined with AFT Pharmaceuticals (ASX:AFP) to launch China’s first New Zealand OTC online pharmacy, instantly accessing China’s burgeoning middle-class and ageing population both of which share a passion for online shopping and Kiwi-sourced product.

Following registration under China’s cross border e-commerce (CBEC) OTC pilot scheme, the store has become the first dedicated direct to consumer OTC online medicine marketplace for New Zealand registered medicines.

The RLG share price has risen 50% in the past six months to 1.5 cents.

This article was developed in collaboration with Roolife, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.