Revenue up, losses down, shares flying as BidEnergy flexes muscles

Pic: Morsa Images / DigitalVision via Getty Images

Power bill manager BidEnergy has managed to get its full-year loss down even after paying out on a lost deal and undergoing a restructure.

BidEnergy sells an automated system that monitors a business’s energy spending. At its most sophisticated the software manages both invoices and meter data and offers an auction marketplace where energy retailers bid for companies’ energy spend.

BidEnergy (ASX:BID) improved its full year loss by 37 per cent to $4.5 million, and doubled revenue to $4.1 million.

It tried to buy US utility bill manager AXIS in July last year but after months of haggling cut the deal loose in December.

That deal, and a boardroom restructure at the end of 2017, cost the company some $1.1 million.

New managing director Guy Maine is refocusing now on organic growth opportunities at home and abroad, rather than acquisitions, and cut spending to end up with $5.3 million in the bank.

“We are very pleased with the energy spend management service we have been able to provide to multisite organisations via our market leading software platform, and are excited about the SME [small to medium enterprises] and residential market offering the development of new product Bid Billy presents,” he said.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

The company has a footprint in the US, securing deals with an American retailer and Berkshire Hathaway, and seeing current customers Toll and Cotton On begin to use the software in their American operations as well.

The US is where the company saw its largest jump in revenue growth, albeit off a low base from $2000 last year to $15,490 this year.

They’re now looking at the UK and Europe, where they have BP as a customer.

The company says the Australian market is ticking up slowly while a consumer watchdog inquiry has helped to raise awareness about energy prices and market complexity.

Mr Maine told Stockhead banks and utilities in particular are becoming more aware of the need for software to manage the data coming out of smart meters.

He said investors can expect faster subscriber growth, given the 41 per cent growth in annual subscriber revenue came in the last six months.

“The US is an exciting opportunity for us. We’ve made our first real in road in that market with that big US retailer,” he said, adding that it is a source of “significant” growth for BidEnergy.

The launch of the SME product BidBilly in South Australia a week ago is also proving itself, with savings of 10-20 per cent coming out of the competitive auction process.

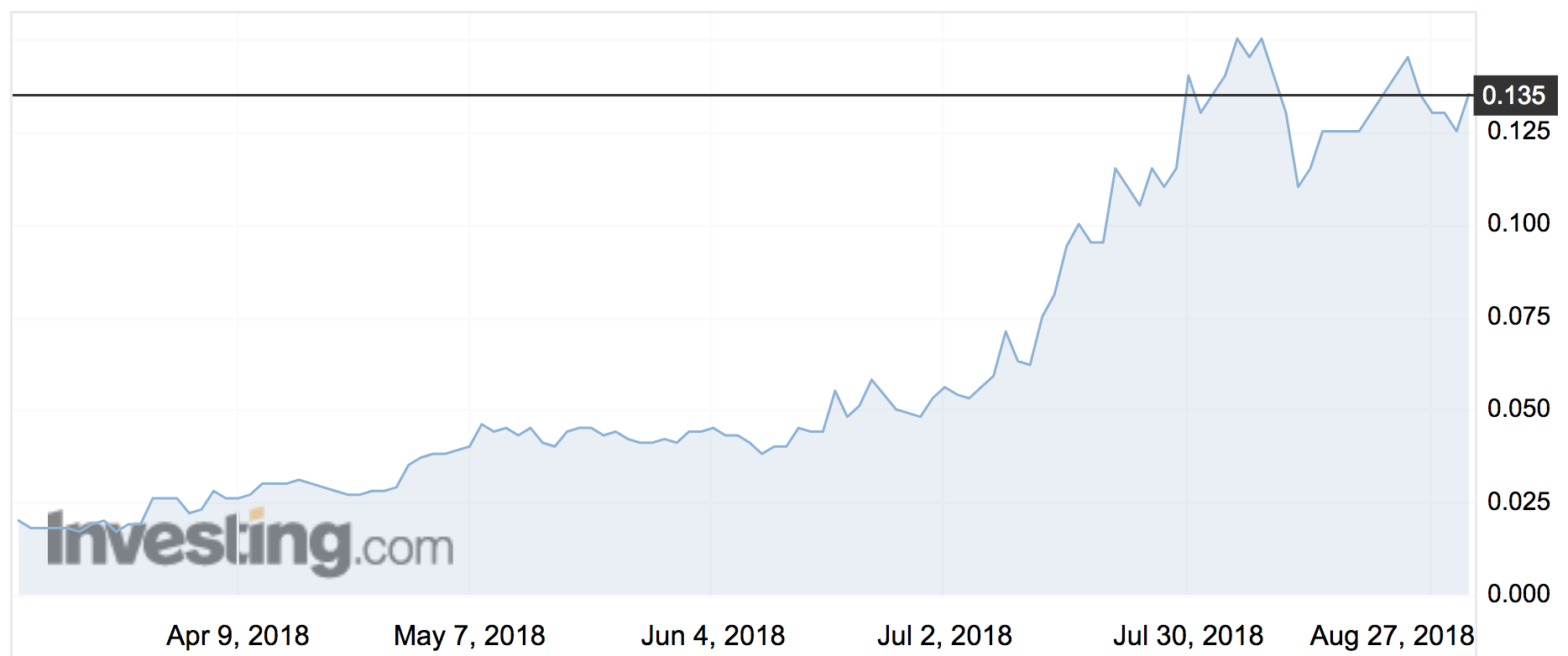

BidEnergy’s shares have been on a tear since July when it announced a new stripped-down product to help SMEs manage energy bills.

The shares rose another 8 per cent on Thursday after the annual report landed to hit 13.5c. They have risen 186 per cent since the start of July to a 52-week high in early August of 16c.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.