Revasum CEO Rebecca Shooter-Dodd reckons it’s the right time to be in the semiconductor biz in the US

Pic: Morsa Images / DigitalVision via Getty Images

The US is pouring money into its semiconductor supply chain and stocks like Revasum (ASX:RVS) who manufacture solely in the States are set to benefit.

Revasum designs and manufactures capital equipment for substrate conditioning and device manufacturing in the global semiconductor industry with a strategic focus on the Silicon Carbide (SiC) market and wafer sizes ≤200mm.

Speaking with Stockhead, CEO Rebecca Shooter-Dodd said the company has seen increased demand for its equipment to manufacture semiconductors due to the global chip shortage.

“There’s a global chip shortage of both silicon and silicon carbide chips – chips which are built onto wafers made of silicon and silicon carbide,” she said.

“Our machines process silicon and silicon carbide wafers, so as the demand increases, so does the demand for our equipment.

“The chip shortage is driving wafer demand, which therefore drives the need for more pieces of our equipment.”

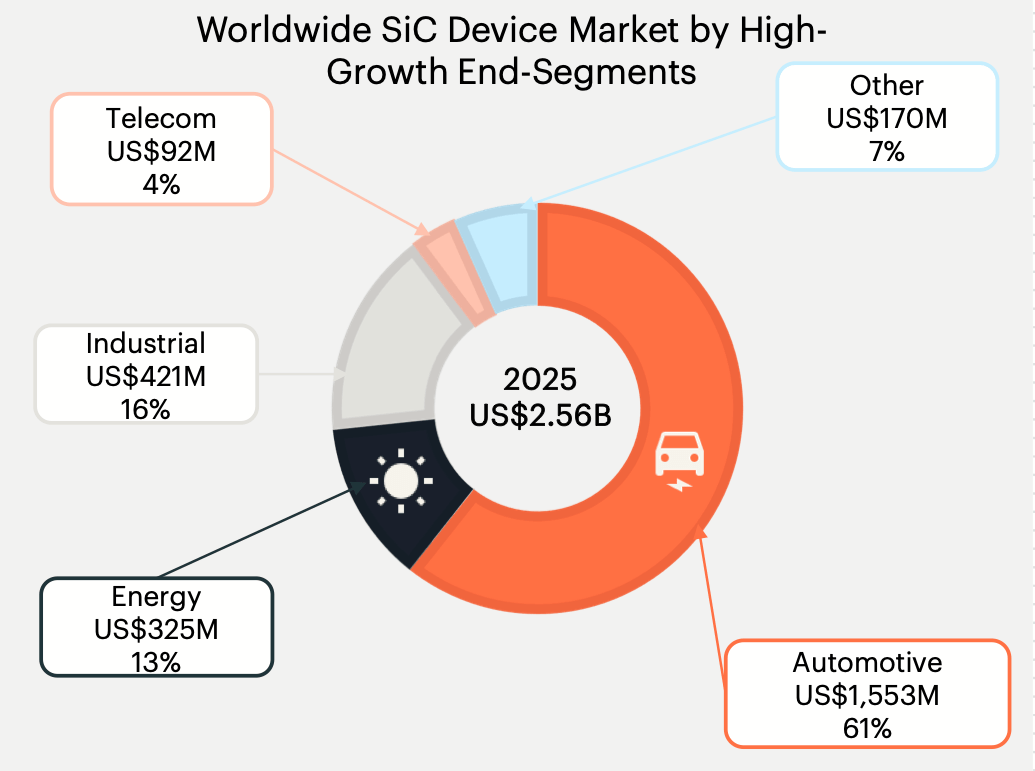

Why is demand rising for SiC wafers?

SiC wafers have a few advantages over plain old silicon (Si) wafers; namely they operate faster, with less power loss and can handle higher power and withstand temperatures of > 200°C.

Basically, this means when used in electric vehicles (EVs) they offer high temperature resistance and reduced power consumption compares to Si wafers.

And the increased demand for SiC wafer volume directly drives demand for SiC wafer fabrication equipment.

Most industry players have made the move to 6-inch SiC wafers with a CAGR of 33% in volume forecast between 2020 and forecast for 2025.

And some big guns like Cree and ST Microelectronics have started to make the move to 8-inch SiC wafers – which has a CAGR of 183% anticipated in 8-inch wafer volume between 2020 and forecast for 2025.

“What we actually build is these big white machines, what people pay for is the process inside of it,” Shooter-Dodd said.

“Silicon carbide is a very difficult substrate to process, it’s a very hard material, it gets very hot while you’re processing it.

“What differentiates us from competitors is the process results we see off the tool. We’ve seen our results compared to other people’s results – they’re pretty damn good.

“There’s a couple of other players in the space but there’s not a lot of people who can process the material, so it’s really driven by process results and that’s why people buy our equipment.”

Here’s what that process looks like:

Sales backlog as manufactures strive to meet demand

Given the demand, it’s no surprise that Revasum has a sales backlog.

At the start of 2020 the company had 79 active customers and have grown this to seven new customers in 1H20, three new customers in 2H20 and six new customers in 1H21.

And it shipped the first of two 6EZ SiC Polishers to the European facility of a NASDAQ listed customer in September.

And in 2H21, Revasum is fully booked for equipment manufacturing slots and entered the second half with over US$10 million sales order backlog.

Shooter-Dodd said historically the whole semiconductor industry has been just-in-time ordering.

“Now we’re seeing the move towards customers thinking longer term, getting their orders in early,” she said.

“That means we have a better look at the forecast, and an outlook on what revenue is going to look like for the next 12 months or so.”

“And we’ve also seen an increase in demand. Pretty much daily, people are announcing new fabs being built that will need to be filled with equipment – so we’re getting more inquiries.

“It’s a long sales cycle for us, you have to qualify the precision equipment, but once it’s qualified, we are seeing massively increased demand from our customers.”

US investing in domestic supply chain

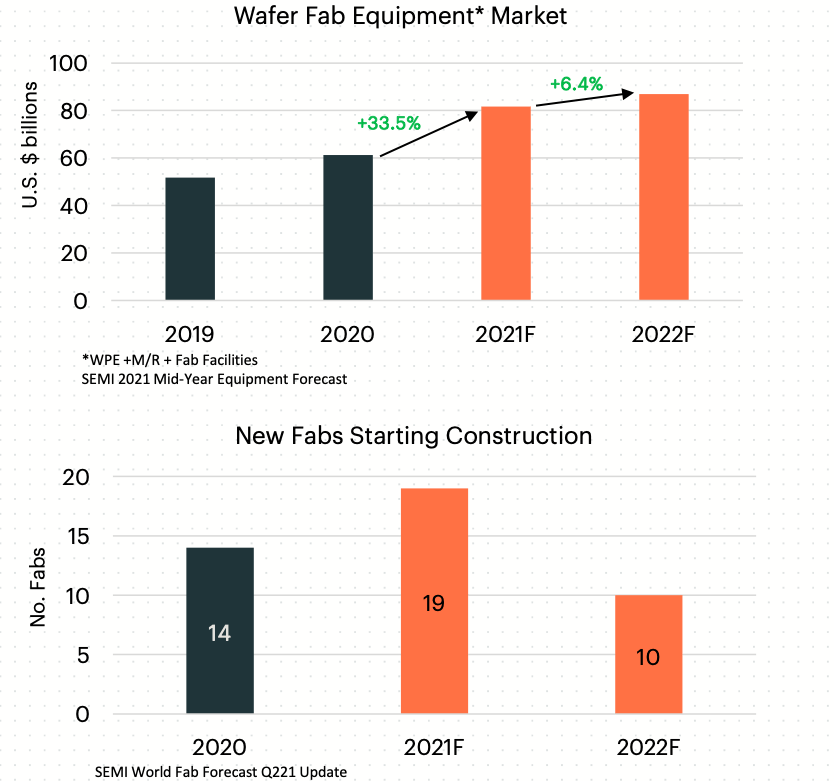

The wafer fab semiconductor manufacturing equipment market is projected to increase by 33.5% in 2021, which would result in a new record spending on semiconductor manufacturing equipment of US$81.7 billion.

And that growth momentum is expected to continue as data-driven digital transformation propels the industry investment to surpass US$85 billion in 2022.

Big semiconductor players around the US are scaling up their manufacturing capabilities – and they have Biden to thank.

The US Federal Government passed a bill in June for $52 billion to boost domestic manufacturing capabilities for semiconductors as part of his drive to rebuild US manufacturing under a US$2 trillion infrastructure plan.

“They are looking to secure the supply chain, and to onshore both research and development and manufacturing capabilities,” Shooter-Dodd said.

“We are seeing big announcements from people like Intel (NASDQ:INTC) about very large fabs being built, so they are increasing manufacturing capabilities, which is good for us.”

Scaling up means more equipment needed

In 2020 alone, 14 new fabs around the world commenced construction, with a further 19 planned in 2021 and 10 in 2022.

And they’ll need to be filled with new equipment.

“We sell all over the world, we have a global customer base, but it helps us that they’re in the US and all of our manufacturing is done in the United States,” Shooter-Dodd said.

“It makes us a good choice for people looking to onshore their supply chains.”

Shooter-Dodd said that she thinks there will be a lot more announcements over the next few months about companies building new facilities as the US Government gets the funding out and into the hands of manufacturers.

“Its an exciting space to be in,” she said.

“At the moment Tesla (NASDAQ:TSLA) that are using SiC chips in their EVs; once the cost of SiC substrates comes down it will become a more mainstream option.

“The electrification of vehicles will really drive our industry.

“And chips are in all electronic devices, whether it’s your iPhone, your Apple, watch – everything.

“As more devices come online, they’ll need more chips.

“So, I don’t think the chip shortage is going to go away anytime soon.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.