You might be interested in

Tech

ASX Tech March Winners: Sector up 55% YTD as Aussie retail investors still love 'Magnificent 7'

Tech

ASX-listed BluGlass possesses potentially one of the most critical, enabling technologies on the planet

Tech

Tech

Semiconductors power pretty much everything electronic you can think of, from fridges and dryers to your smartphone or electric vehicle, and when the pandemic kicked in, the sector did too.

In 2020 and 2021, consumer and corporate investments in technology went off like a frog in a sock, but we kind of overcompensated, because 2022 brought a complete 180, with excess inventories, increasing geopolitical tensions (like US vs China tech/trade war and the actual real war in Ukraine) and shifting consumption patterns leading to an almost 50% peak-to-trough decline.

But investment bank J.P. Morgan thinks the sector looks prime for recovery this year.

“We think the worst is over for the USD 600 billion semiconductor industry, even as stocks have priced in the effects of a coming recession,” US head of investment strategy Jacob Manoukian and exectutive director US equity strategist Jonathan Linden said.

“We believe there are two reasons early 2023 presents an attractive entry point for investors: first, the growing power and scale of technology and other secular (structural) forces in the economy; and second, cyclical factors, such as the business cycle and market pricing.”

Basically, it comes down to the fact that semiconductors are vital in so many products, applications and services which are valuable assets whatever phase of the economic cycle we’re in.

“Chipmakers clearly benefited from the past decade’s rapid evolution in cell phones and consumers’ seemingly insatiable appetite for more memory, faster processing speeds and more functionality,” J.P. Morgan said.

“But some observers may still underappreciate the significance of the transition from hardware memory storage to cloud computing, the exponential growth in the gaming industry, and connectivity and technology’s penetration in consumer durable products, from automobiles to thermostats.

“All this likely translates into strong, sustained demand for semiconductors.”

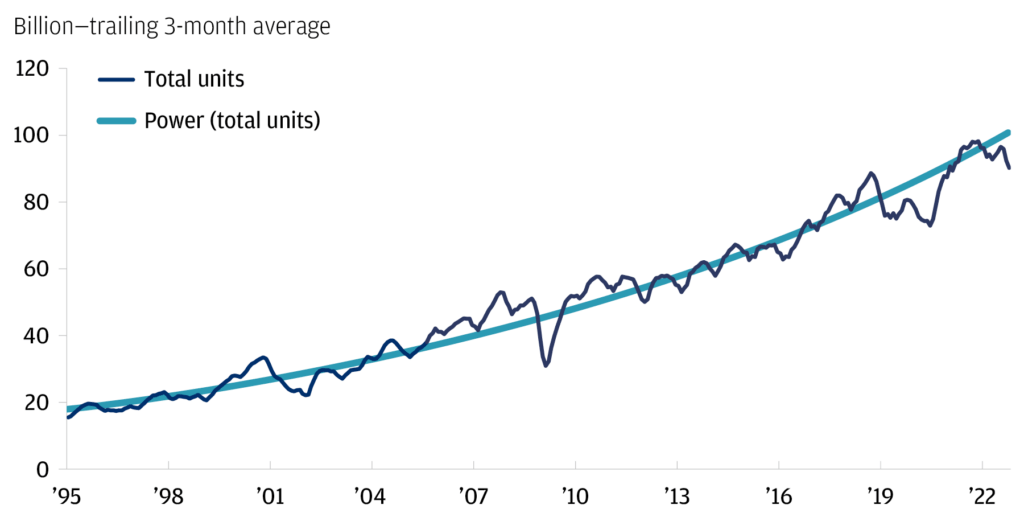

And look there’s a nice graph to boot:

While investors pummelled semiconductor stocks in 2022, J.P. Morgan thinks the entry point today looks attractive.

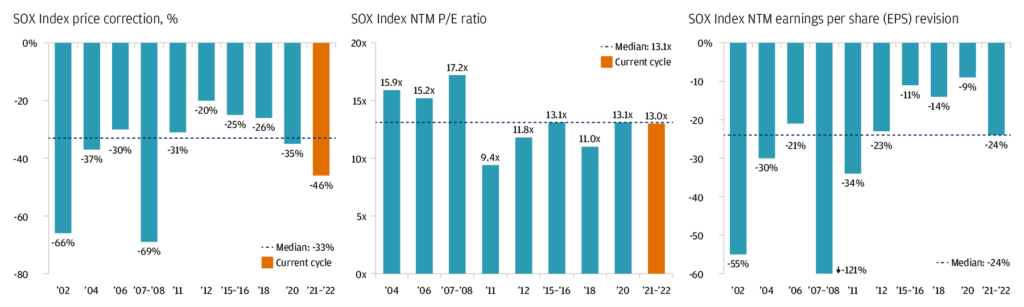

“We compared the recent downturn in semiconductor stocks to seven previous episodes,” they said.

“Looking at price moves, earnings expectations and P/E multiples, the industry now seems close to a cyclical bottom.

“Historically, after semiconductor stocks hit a bottom, they tend to perform strongly in recovery.

“In the one- and three-year periods following a cyclical bottom, semiconductor stocks have delivered median returns of 40% and 95%, respectively.

“That seems a signal worth heeding.”

According to the Semiconductor Industry Association (SIA), global semiconductor sales increased 3.2% in 2022, despite the second half slowdown.

“The global semiconductor market experienced significant ups and downs in 2022, with record-high sales early in the year followed by a cyclical downturn taking hold later in the year,” SIA president and CEO John Neuffer said.

“Despite short-term fluctuations in sales due to market cyclicality and macroeconomic conditions, the long-term outlook for the semiconductor market remains incredibly strong, due to the ever-increasing role of chips in making the world smarter, more efficient, and better connected.”

On a regional basis, sales into the Americas market saw the largest increase (16.0%) in 2022. China remained the largest individual market for semiconductors, with sales there totalling $180.3 billion – which sounds like a lot but was actually a decrease of 6.3% compared to 2021.

Annual sales also increased in 2022 in Europe (12.7%) and Japan (10.0%).

Analog, a type of semiconductor that is commonly used in vehicles, consumer goods, and computers, had the highest annual growth rate of 7.5%, reaching $89 billion in 2022 sales while logic ($176 billion in 2022 sales) and memory ($130 billion) were the largest semiconductor categories by sales.

Weebit Nano (ASX:WBT) CEO Coby Hanoch told Stockhead that while his company hasn’t been hurt by the downturn, he agrees with J.P. Morgan’s assessment.

“The market reacted to a series of events, including the rising inflation rates, the war in Ukraine, effects of Covid, etc., last year,” he said.

“One of the side effects has also been the large layoffs and pay cuts in the major companies. At this point I believe that the big companies have taken the hit and started implementing the plans to recover, so things should start turning around by mid-year.”

Archer Materials (ASX:AXE) CEO Dr Mohammad Choucair says semiconductor industry executives have a positive outlook for 2023; it’s not just JPM.

“What I can say is we are optimistic about the industry growing, and growing in strategic importance for global economies, over the next few years,” he said.

He points to KPMG and the Global Semiconductor Alliance’s (GSA) 18th annual global semiconductor industry survey in the fourth quarter of 2022 where more than half of the respondents (semiconductor executives) being from companies with more than $1 billion in annual revenue.

And 65% of those executives think the semiconductor supply shortage will ease in 2023.

J.P. Morgan says consumers still have high expectations for technological upgrades to their smartphones and computers, while companies are still investing heavily in digital transformation and cloud computing.

McKinsey & Company forecast an average annual growth of 6-8% through 2030, the result of which would be a A$1 trillion industry by the end of the decade.

In the US alone, the value of domestic semiconductor projects that are under way, announced, or under consideration total a whopping $223 billion to over $260 billion through 2030.

The US federal government also recently approved $54 billion in grants for domestic semiconductor manufacturing and research through the US CHIPS and Science Act.

It’s not all roses though. McKinsey notes that the current economic outlook is prompting several semiconductor companies to slow their capital deployment.

BluGlass (ASX:BLG) director James Walker said he’d like to see some of these initiatives from the Australian Government.

“COVID, ongoing tensions with China, and the war in Ukraine have highlighted the sovereign risk inherent in many supply chains, including the semiconductor sector,” he said.

“In recent years we’ve seen Western countries look to dramatically increase their ability to domestically manufacture high-value, high-use technology onshore.”

“We would certainly encourage government support for Australia’s semiconductor sector.”

Accenture recently released the report Pulse of the Semiconductor Industry: Balancing Resilience with Innovation, which surveyed 300 senior semiconductor execs who flagged several challenges including geopolitics (48%), cybersecurity threats (42%), the changing competitive landscape (39%) and talent shortages (35%) that could affect their ability to innovate even as the lingering effects of COVID-19 on the supply chain are expected to ease by 2024.

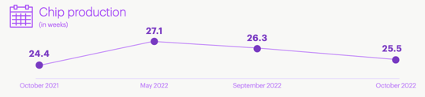

The shortage is already easing, with October 2022’s reported lead times at 25.5 weeks, compared with 26.3 weeks in September.

But where it gets interesting, is the four investment areas that could drive semiconductor growth – including the metaverse, digital health, mobility and sustainability.

Two-thirds (67%) of executives believe that semiconductors are the most critical technology to the development of the metaverse, and 44% of executives expect to allocate more than 20% of their semiconductor production budget to the metaverse by 2024.

Four in 10 respondents (42%) said the metaverse can create new business opportunities.

And 1 in 4 (25%) said the metaverse can play the largest role in the semiconductor value chain within the next five years or sooner.

“The projected growth over the next two years can be attributed to the scaling of the metaverse, enabled by semiconductors,” the report said.

Meeting that need will require technology innovation, which executives indicated is the biggest challenge for delivering custom semiconductors to metaverse companies—bigger than chip or talent shortages, or even the condition of the economy.

“Virtually all executives believe large-scale manufacturers that have the capacity to produce chips will benefit the most from the metaverse. There is, however, arguably less confidence in commercialisation,” Accenture said.

“We expect confidence will increase as we continue to understand what can be achieved technologically — so long as chip innovation continues.”

They point to US semiconductor giant AMD as an example, with the company “well-positioned as a metaverse enabler of products like data centers, near and edge computing and devices.

“It’s also the defacto standard for 3D content studios, gaming consoles, phones and PCs. Looking at what they accomplished in two years, the next two are likely to unlock even more innovation.”

Wearable devices, including fitness trackers, wearables and body sensors, could “represent the biggest growth opportunity for the industry, as these popular devices will benefit most from improved connectivity enabled by semiconductors,” according to Accenure.

“In the current landscape, patients are actively demanding — and receiving — healthcare and health experiences consistent with daily life.

“As a result, the digital health agenda has become a priority for the C-suite to continuously unlock insights and expand products and services throughout the patient continuum.

“89% of semiconductor executives agree that digital health innovations can increase the democratisation of healthcare.

“Semiconductor innovation is responsible for the consumers’ greater health education and literacy, accessed by digital health products.”

But the report flags that semiconductor players should focus on specific applications – not broad-based technology.

“Semiconductor companies should determine where and how they want to play — as a creator or an ecosystem provider.”

New vehicles can contain up to anywhere from 1,000 to 3,500 chips creating a downstream effect, and “as more and more digital technologies are integrated into autonomous vehicles, semiconductor companies need to be aware of trends in the space and the opportunities they create,” Accenture said.

“42% of executives believe some form of autonomous vehicles will become mainstream for personal use within just the next two years.”

And that innovation is powered by semiconductor-enabled technologies like AI, machine learning and natural language processing.

On the flip side, extended chip shortages and cost concerns are cited as the biggest roadblocks to mobility’s future, leading 93% of executives to believe that car manufacturers should partner with semiconductor and technology businesses to develop next-generation mobility technologies.

“One way to overcome current obstacles is by establishing cross-industry partnerships. 93% of executives believe motor vehicle manufacturing companies should partner with technology companies to develop and ultimately deploy next-generation digital mobility technologies,” the report said.

“The ideal partners for such a joint venture (JV), according to executives, are semiconductor design firms (31%) and integrated device manufacturers (25%).”

Notably, Accenture is not alone predicting growth in the sector.

KPMG US principal global semiconductor practice Scott Jones said automotive is gaining momentum as a revenue driver, “as evidenced by the increase in direct relationships between semiconductor companies and auto manfacturers.”

Already some car companies are forging ahead, like General Motors’ autonomous driving unit stating it will deploy its in-house designed chips by 2025, to decrease costs and increase volume.

Tesla also struck a JV with Swiss automotive semiconductor company, Annex, marking the first time an automotive company will be involved in the design and manufacturing of chips in China – and Intel recently completed the IPO for MobileyeTM, its autonomous driving business unit.

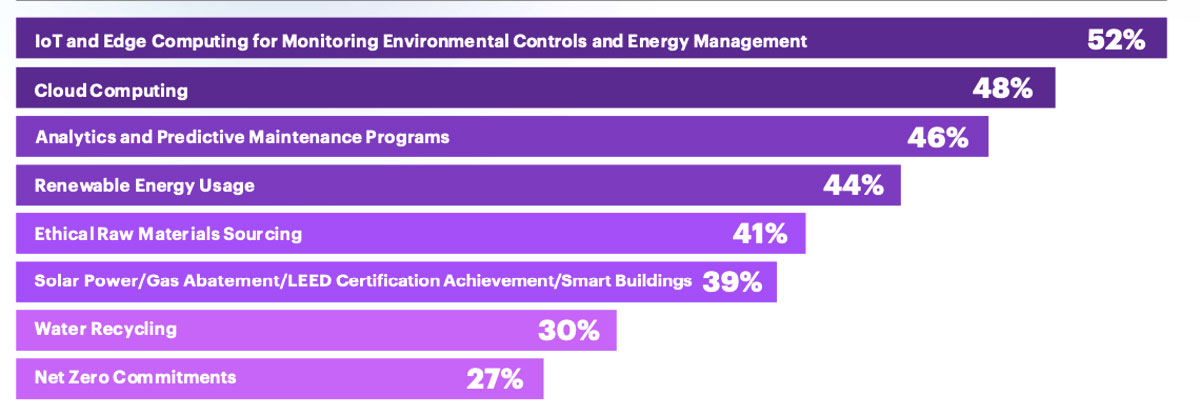

On the sustainability front, Accenture says more than nine in 10 executives (93%) believe that sustainability initiatives will have a positive impact on profitability and create more sustainable consumer products.

“Sustainability was also cited as the area most likely to play the largest role in the semiconductor value chain within the next five years.”

And it’s a probably a good thing, because, a large chip fab (fabrication) can use up to 10 million gallons (about 37.8 million litres) of water a day, which is equivalent to the water consumption of roughly 300,000 US households.

This is echoed by McKinsey, who suggest fab owners may also consider accessibility to renewable-energy resources more carefully as they decide where to build new main fabs, “since 45 percent of emissions of a typical fab are electricity related, excluding Scope 3 downstream emissions.”

Despite these challenges, Accenture says 64% of semiconductor execs are optimistic they can achieve carbon neutrality within two years.”

However, Dr Choucair reckons the need for competitiveness and productivity could impact how – and when – sustainability is embraced in the sector.

“The disruptions to supply chains over the last few years have had changing requirements for manufacturing skills, which may increase pressure on manufacturers to embrace ‘sustainability’,” he said.

“Proof of the role sustainability will play can be found amongst the communities forming at the World Economic Forum around this topic, and most recently at Davos.”

The company’s share price jumped almost 40% over January (from $3.48 to $4.84 per share) and was trading at $5.99 at the time of writing.

Not a surprising jump considering the company taped-out its first 22nm demo chip on the 3rd of Jan – which is essentially the final stage of the design process before the chips are sent for fabrication with the manufacturer.

The company designed a full IP memory module that integrates a multi-megabit ReRAM block targeting the 22nm FD-SOI process which is designed to deliver ‘outstanding’ performance for connected and ultra-low power applications such as IoT and edge AI.

As embedded flash is unable to scale below 28nm, new non-volatile memory (NVM) technology is needed for smaller process geometries.

Weebit says its ReRAM in 22nm FD-SOI offers a low-power, cost-effective embedded NVM solution that can withstand harsh environmental conditions.

Notably, the company also did a study in January its technology has a significantly lower environmental impact relative to the other emerging technologies.

The study found ReRAM was more eco-friendly than MRAM on all measured parameters, including:

Looking ahead in 2023, technology qualification with SkyWater, the final step before productisation and first orders on SkyWater’s 130nm process, and is expected to be completed in H1 CY23.

Hanoch said that over the past year, the industry has come to the realisation that ReRAM is no longer a “future technology”, but rather something that is proven and available today. “This triggered all the big fabs and customers to start looking for ReRAM solutions,” he said.

“During 2023 Weebit expects to announce agreements with at least one tier 1 fab and with product companies, generating initial revenues for the company.”

At the end of the quarter ending 31 December 2022, Weebit had a cash balance of $45.6 million.

Archer builds advanced semiconductor devices, including processor chips that are relevant to quantum computing.

Under development is the 12CQ quantum computing chip – a world-first qubit processor technology that would allow for mobile quantum computing powered devices.

The company kicked off the month of Jan at $0.62, jumping to $0.67 before settling back down at $0.62 again. It’s currently trading at $0.60 per share.

In its recent quarterly, the company made some solid advances with development, using one of Europe’s most powerful supercomputers, the Piz Daint, to accurately simulate the behaviour of its 12CQ qubit material.

The simulations will be used to support the design and development of the more complex quantum devices required for the future operation of the 12CQ chip technology.

Plus, a major milestone was achieved towards commercialisation of Archer’s biochip technology, with the development and custom-build of an operational, early stage end-to-end prototype system platform.

The company owns 100% of the biochip technology intellectual property and during the quarter, lodged two biochip-related provisional patents in Australia and proceeded to a full patent application for another, under the Patent Cooperation Treaty.

Dr Choucair told Stockhead the company’s theme for 2023 is ‘Scale’.

“We see 2023 as a year in which Archer Materials’ progress centres around this concept, particularly:

“As you would appreciate, this is complex work that requires significant innovation.”

The company finished the quarter with approximately $24.3 million cash and no debt.

The Victoria-based company makes smart chips based on MEMS technology for tracking very low temperature biological samples, down to -196 degrees Celsius.

The tech has applications in the healthcare industry, particularly those businesses which require cryogenic storage facilities (biobanks and biorepositories) as well as markets including cold chain logistics/supply chain, security/defence, industrial/manufacturing and aerospace/aviation.

MD Andrew McLellan told Stockhead the company’s plans for 2023 are to increase awareness within its target market around the importance of data.

“Chip technology will improve the capturing and processing of data, which in turn will improve productivity and confidence in every biological sample,” he said.

McLellan said ensuring supply chains can deliver is fundamental.

“If they are in place, there’s a lot of investment to ensure the security of the supply chain and alleviate disruption,” he said.

“It’s driven by the amount of data that can be collected, including, in our case, biological samples stored in liquid nitrogen.”

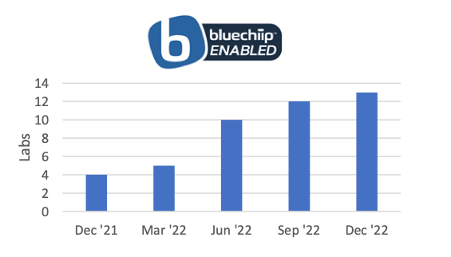

And the company is certainly seeing an uptake in end-customer use.

Since product launch in the December quarter 2021 BCT has seen orders from 11 customers in 13 operating laboratories, and in the December quarter recorded sales of $280k and cash receipts of $527k.

The company is progressing discussions and negotiations with potential OEMs in pursuit of OEM partner agreements including the delivery of concepts and prototypes to OEMs in the pharmaceutical, cell therapy and biobanking markets.

“OrganaBio is rolling out Bluechiip’s solution across their business, so we expect to see further growth from them,” McLellan said.

“They are not the only customer where this is occurring. As a general comment, once we get a foothold in a customer lab, say one or two of their labs, and they see the efficiency gains from our product and systems, we then see strong potential to expand with that customer.”

Bluechiip is also to actively execute its development activities with FujiFilm Irvine Scientific under the licence and development agreement executed in the December quarter FY22, and is actively pursuing a supply agreement as product development moves towards product launch.

“The intention from both parties has always been to work towards a long-term supplier agreement,” McLellan said.

“In the not-too-distant future we envisage executing a long-term partnership and progressing to having Bluechiip-enabled product in the IVF marketplace through Fujifilm.”

In January, the share price has remained steady around the $0.031 mark and the company wrapped up the December quarter with $575k cash.

Revasum sells equipment used in making semiconductors, a selection of very expensive automatic machines involved in grinding and polishing.

At the start of January the company was trading at $0.131 per share, and saw a wee 3% bump to $0.157 by the end of the month.

It says FY22 preliminary unaudited revenue was US$14.7m, a 7.6% increase year on year (YOY) from US$13.7m in FY21 – and there’s a total backlog (confirmed orders not yet shipped) of US$8m as of January 26.

“We completed 2022 on a strong note with multiple tool shipments in the quarter and a healthy backlog going into 2023,” president and CEO Scott Jewler said.

“While the supply chain for some critical components has improved, other parts remain at extended lead times.

“In the second half of the year, we significantly increased our customer facing activity and based on this interaction we have fine-tuned our design and process engineering priorities for the coming year.

“Growth in the compound semiconductor industry remains robust particularly for silicon carbide (SiC) wafers where our 7AF-HMG grinders and 6EZ polishers are operating at full capacity at multiple market leaders.”

In 2022, multiple leading silicon carbide wafer manufacturers announced investments in large new facilities which will begin to come online in 2024.

Revasum expects them to drive a significant increase in demand for wafer manufacturing equipment – including its grinders and polishers.

“The industry is in the early stages of the EV replacement cycle of the internal combustion engine and growth rates for SiC devices of 35%-40% per year are projected for the next five years by most analysts,” the company said.

“Silicon carbide wafers, which contribute as much as 35% of the cost of goods sold for a SiC device is expected to remain an area of intense technology focus and investment.”

Revasum said its Q422 unaudited cash balance was US$0.9m.

This company specialises in non-volatile memory technology and is pioneering an interface switching ReRAM for next generation gigabyte storage in mobile and cloud.

In early Jan, they were trading at $0.033, and saw a 33% jump to $0.044 before settling at +15% at $0.038 per share by the end of the month.

During the December quarter, the company finalised terms of its 2023 collaboration agreement with semiconductor R&D hub imec, whereby the manufacturing of the fourth platform lot (essentially the fourth batch of wafers processed together) will commence during Q1 2023 with the delivery to 4DS expected at the end of Q2 2023.

They’ve hit a few hurdles with platform lots so far, with an etch residue problem in 2023 resulting in the partial failure of the second platform lot and in trying to fix this the company inadvertently caused another issue with the third platform lot.

The goal of this next platform lot remains the demonstration of the cell operation in a megabit memory array environment and to explore optimized programming conditions to improve both the endurance and retention of 4DS Interface Switching ReRAM cells.

“Alternatives to the etch process will be explored in parallel, as the probability of a successful optimization of the etch process is unknown,” 4DS said.

“Additional improvements to the memory cell that were demonstrated on wafers processed at the Stanford Nanofabrication Facility will be incorporated in this next Platform Lot, as well.”

As of 31 December 2022, the company held cash of $3.359 million, compared to $4.322 million as of 30 September 2022.

Brainchip has basically developed an ultra-low power, AI neural processor that is capable of continuous learning – which allows customers to create ultra-low power chips and systems with the ability to incrementally learn on-chip without the need to retrain in the cloud.

So, it can think with ultra-low power consumption because it eliminates the power usage caused by interaction and communication between separate elements, and avoids dependency on network connections to powerful remote computer infrastructures.

The company saw an 11% share price spike from $0.746 to $0.83 at the start of January, and was trading at $0.628 by the end of the month.

CEO Sean Hehir said the focus in the December quarter was on executing commercialisation of the Akida chip by adding critical talent across North America and Korean, with plans to hire sales talent in Germany and Japan.

In January, BrainChip completed a design with the latest Akida IP technology on a more power- efficient and advanced technology node as part of its validation strategy to offer IP across different processes and foundries which enables partners to have various global manufacturing options.

“This reference design, which has been released to GlobalFoundries, will enable current and prospective partners to design MCU modules or add-on cards for always-on sensors as well as broader IoT, industrial and automotive applications,” Hehire said.

“We expect our next reference chips to be delivered in Q2 of this year.

“We remain positive on future market penetration and broad adoption of BrainChip’s technology.”

They also announced the tape out of the AKD1500 reference design on GlobalFoundries’ 22nm fully depleted silicon-on-insulator (FD-SOI) technology.

“This is an important validation milestone in the continuing innovation of our event-based, neuromorphic Akida IP, even if it is fully digital and portable across foundries,” co-founder and chief development officer Anil Mankar said.

“The AKD1500 reference chip using GlobalFoundries’ very low-leakage FD SOI platform, showcases the possibilities for intelligent sensors in edge AI.”

The company ended the December quarter with US$23.1m in cash compared to US$24.6m in the prior quarter.

BrainChip Tapes Out AKD1500 Chip in GlobalFoundries 22nm FD SOI Process – Read more here: https://t.co/kDi42qZhwb

— BrainChip (@BrainChip_inc) January 29, 2023

BluGlass is one of just a handful of gallium nitride laser manufacturers globally, operating in a high-value, high-margin semiconductor sector – which it says is worth around US$2.5 billion.

The company says there is significant unmet market demand for GaN lasers with its value proposition designed to solve key customer challenges by offering the industry’s easiest-to-use laser light.

“GaN lasers have inherent advantages over traditional infrared laser diodes and are used in everything from industrial cutting and welding of consumer products to medical diagnostics, 3D printing and quantum computing,” Walker said.

And the company already kicked off the year with a bang, launching its first suite of six gallium nitride (GaN) laser products products across 405nm, 420nm, and 450nm wavelengths in both single-mode and multi-mode devices at the industry event, Photonics West, in the USA.

Looking at this news in a share price context; at the start of January, the share price was $0,025 –it jumped 112% by the end of the month to $0.053 per share.

“These products are in in-demand and underserved wavelengths and we expect to secure first orders and revenues in the near future,” Walker said.

“We are continuing to develop and optimise our product offering to include new wavelengths, form factors and novel architectures.

“We’re also focused on bringing more of our core manufacturing processes in-house, and expect to be vertically integrated by mid-year. Vertical integration will improve the quality and consistency of our lasers while significantly reducing our production costs.”

On the sustainability front, the company’s proprietary Remote Plasma Chemical Vapour Deposition technology is more energy efficient than the existing MOCVD manufacturing process.

“In addition to its environmental benefits, the low temperature and low hydrogen manufacturing process enables new structures to be developed, creating brighter and better performing laser diodes,” Walker said.

Cash at end of the Q2 FY23 was $3.01 million

Pivotal makes gas flow monitoring and control technology used while making semiconductors which require precise flows of gas to shape the underlying wafer on which the circuits are built.

The company saw a 3% share price rise in January from $0.052 to $0.054, and Q4 2022 revenue of US$5.2m which was up 28% over the last quarter (Q3 2022: US$4m) yet down 34% on the prior corresponding period (pcp) (Q4 2021: US$7.9m) as customers rebalanced their inventory.

Backlog at 31 December 2022 was US$1.1m (versus US$4.6m in Q3 2022) and the company finished the quarter with cash balance of US$3.2m.

Heading into 2023, PVS says standard Gas Flow Controls (GFC) are growing market share in deposition applications following successful silane qualification for a major North American Logic IDM, and qualification into critical deposition application with a major North American WFE OEM.

“These segments are part of a company initiative to expand beyond etch applications serving memory, into foundry/logic and deposition segments,” they said.

While production capacity remains at approximately 4,000 units per month, PVS is still feeling the impacts of industry wide volatility, which it says is “amplified at upstream component suppliers like Pivotal, who are not only affected by semi-component supply into the Pivotal GFC, but also face fluctuating demand as the entire Wafer Fabrication Equipment (WFE) supply chain continues to adjust to the end user demand.”

PVS pointed to a SEMI report on 12 December 2022, which flagged a three year forecast of new semiconductor facilities starting construction (front end equipment – includes GFCs on Original Equipment Manufacturer (OEM) tools)) in the World Fab Forecast, driven by robust government spending initiatives to bolster domestic manufacturing capability.

Growth is expected at 35% in 2021, 43% in 2022, with a total of US$500 billion is forecast to be invested across 84 facilities starting construction in 2021-2023.

“Front end equipment typically comprises in the range of 45-55% of the total capital investment into a new production facility,” PVS said.