Phenomenal growth: MONEYME announces strong Full Year results and backs future growth plans with a $20m cap raise

MME’s FY22 was on the money. Pic: Getty Images

The Aussie-listed non-bank lender MONEYME delivered a strong earnings report on Wednesday, taking the opportunity of a “phenomenal year” to dip back into the market for a Barrenjoey-underwritten $20 million share placement to support further loan book growth and existing debt facilities.

With FY22 done and dusted, there’s some 40 million new shares at 50c a share to be issued and also a director participation (subject to shareholder approval) to take the total to $21.2 million. MONEYME intends to offer eligible retail investors a Share Purchase Plan at the same price, following ASX listing-rule resolutions being passed at the planned EGM.

Clayton Howes, MONEYME’s MD and CEO, says the money will go into bolstering the equity component of MONEYME’s warehouse facilities, giving the personal lender the capacity to keep on growing its loan book as well as supporting the company’s liquidity position.

The move comes as MONEYME (ASX:MME) reported a stellar year of financial returns.

FY22 MME Financial Highlights:

Cash NPAT of $20m, up 70% year on year

Gross revenue of $143m, up 148% year on year

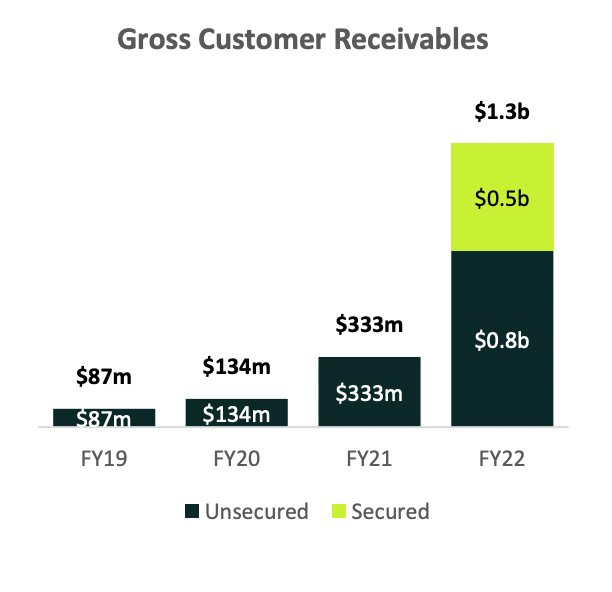

Gross customer receivables of $1.35b, up 305% year on year

Other MME FY22 winners:

- Contracted revenue of $398m, up 305% year on year

- Originations of $1.1b (42% secured asset finance), up 191% year on year

- 4x increase in external securitisation funding facilities to $1.7b

- Autopay secured asset finance book balance of $445m, up 70x year on year

‘Phenomenal’

“MONEYME has achieved a year of phenomenal growth, while also delivering growing cash profits, increasing our credit quality, and expanding our funding capacity to support continued momentum into the next financial year,” Howes said.

The year’s headline stealer was MME’s SocietyOne acquisition, with $7.5m of expense savings already realised and with ~$20m of expense savings expected to be realised (up 18% on ~$17m planned) by the final phase of the integration.

Howes says the tricky business of functional consolidation between the two businesses is expected to be completed by the end of calendar year 2022, ahead of plan.

Howes is also pleased as punch over the success of MME’s Autopay which came out of FY22 delivering exponential growth which Howes says is now the “best-in class product” for car finance in Australia.

“I am especially proud of the sensational demand for our Autopay product, the successful and ahead of plan integration of SocietyOne into the group, and our continued commitment to driving profit with purpose,” he added.

But wait there’s MME more:

- Improved loan book credit quality with 6% provisions, 23% lower year on year.

- Increased loan value to higher credit quality customers, increasing the average customer Equifax profile to 704.

- Increased cost efficiency by 41%, lowering office operating costs to receivables ratio to 6.8%.

- The syndicated facility agreement with Pacific Equity Partners, (initially drawn to $50m, and then upsized to $75m to support the SocietyOne acquisition)

- Some in-house customer service wins, MME reporting over 70% of customer calls answered within 8 seconds and a Net Promoter Score of 76, and average Google reviews of 4.7 out of 5 stars.

- An increase on ‘lifetime value on the portfolio’ by increasing the average receivable value and remaining receivable term by 211% and 38% respectively.

Outlook

Looking ahead, MME is not offering any specific guidance, but says it will look to leverage and build on its Autopay success. The priorities start at high credit quality and moderating book growth in the immediate term; (the company says it is on track to achieve revenue of >$200m in FY23)

MME will also look to expand its product offering into Bank Account and Credit Score products.

“Looking ahead, we have our sights set on profitable growth that leverages new additions to our product portfolio via both expanding and more cost-effective distribution channels,” Howes said.

“Our continued diversification of products and assets, scale advantages, and further synergies from the SocietyOne acquisition will increase our resilience as we close in on the major banks with a revamped brand identity that appeals to the mass market.

“Our agility through both culture and technology enables us to move fast as structural shifts in the market present new opportunities.

“MONEYME’s speed is a strength in any market environment, but especially in a changing one.”

This article was developed in collaboration with MONEYME, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.