Peppermint delivers key milestones in the last quarter, including the launch of micro-loan platform bizmoPay

Peppermint has had another significant quarter, delivering on all key metrics which was highlighted by the launching of bizmoPay.

Fintech company Peppermint Innovation (ASX:PIL) has had a very productive quarter, with the highlight being the delivery of its alternative non-bank micro-enterprise loan offering, bizmoPay.

In July, the company achieved a significant milestone after being awarded a financial lending licence for bizmoPay by the Philippines Securities Exchange Commission (SEC).

Following that approval, PIL immediately commenced a three-month pilot program for a select number of bizmoto agents to test out the bizmoPay platform.

The aim was to identify and optimise any friction points or blockages to ensure efficient system operations before it started offering the loan program to more than 56,000 registered bizmoto agents.

The pilot program has rapidly expanded in the last two weeks of September to more than 150 bizmoto agents.

“Having initiated a select 10-agent pilot program to identify friction points in our bizmoPay system, we rapidly expanded the size of the pilot due to the level of interest shown by other bizmoto agents,” commented Peppermint CEO, Chris Kain.

Kain said the pilot program was so in demand that by October 12, PIL had issued 359 loans across its three different loan products – Platinum Plus, Platinum and Silver.

During the quarter, PIL also recorded cash receipts of $472,000, which was an 83% increase on the previous quarter.

The company is well funded, with a strong cash position in the bank of $2.7m at quarter end.

BizmoPay

The granting of a financial lending licence by the Philippines SEC allows bizmoPay to offer alternative non-bank micro-enterprise loans to qualified bizmoto agents, registered bizmoto network members, and enterprise platform partners.

bizmoPay services fully complement the commercialisation of Peppermint’s proprietary technology platform which targets four key business sectors – mobile payments, ecommerce, delivery and logistics and mobile financial services.

Based on data analysis from the first 45 days of the bizmoPay pilot program, loan recipients on average increased their transactional volume by approximately eight times across the bizmoto ecosystem of services.

“We’re starting to get a picture of an overall positive impact on the agents’ ability to conduct transactions across the platform, which is exactly what we wanted to do,” Kain told Stockhead.

And of course, the more transactions across the platform, the greater revenue that the company earns.

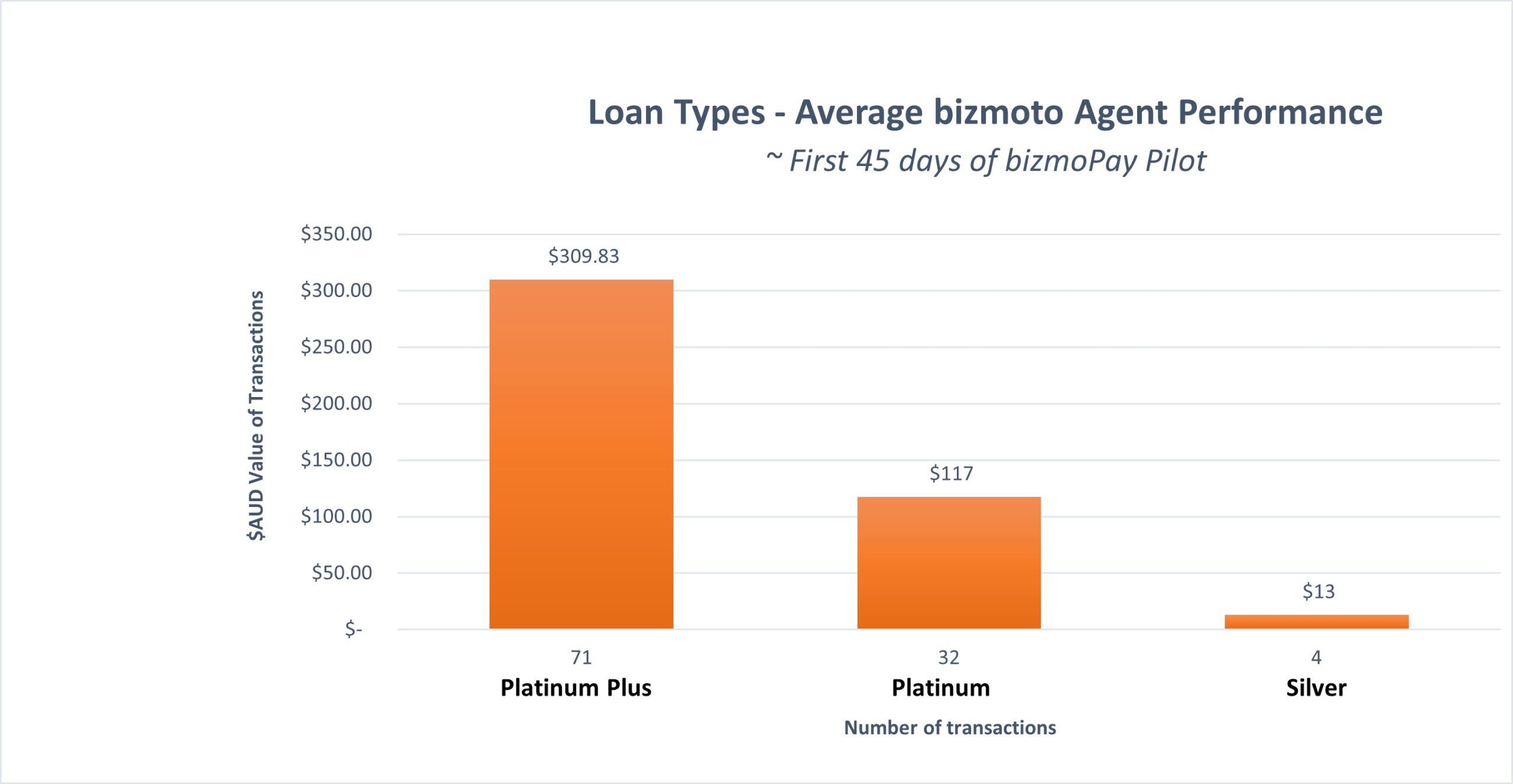

The bizmoPay pilot program started with only the Platinum Plus and Platinum loan products, with the shorter term and lower value Silver bizmoPay loan product commencing trials in the last week of September.

As such, no meaningful data were able to be collected for the Silver bizmoPay loan type.

The program yielded significantly different results in terms of transactional volumes and values across the first 45 days.

On average across the board, the total number of bizmoPay loan recipients completed 13 transactions during the first 45 days of the bizmoPay pilot program, and processed $1.05 per day in transactional value.

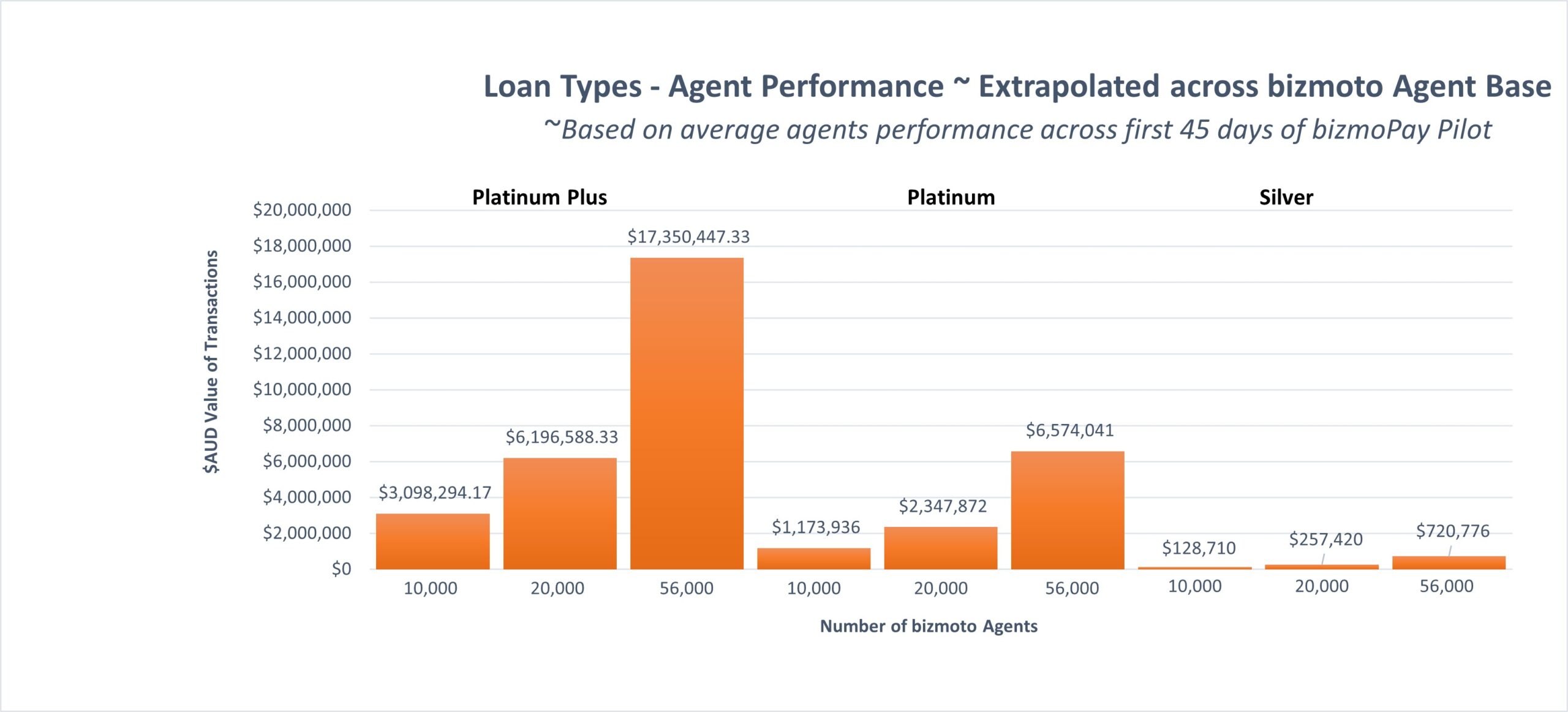

“That volume of transactions would represent an additional $22 million per annum in revenue if extrapolated across our 56,000 registered bizmoto agents,” said Kain.

“We’re also on schedule to deploy the next phase of our commercial roll-out for bizmoPay next month, whereby recipients will be able to apply for their micro-enterprise loans via their mobile app.”

Several agents significantly outperformed the average transactional volume during the first 45-day pilot period, including 20 agents who performed more than 50 transactions.

At the higher end, five agents completed more than 100 transactions, while one agent undertook more than 250 transactions.

Peppermint expects to expand bizmoPay’s agents to more than 56,000 users when the pilot is completed, with a target of $30m in micro loans over the next three years.

The graph below is an extrapolation of what the different average performance of each loan type would yield if applied across selected numbers of the registered bizmoto agent base over the same initial 45 day period of the bizmoPay pilot program:

Kain expects this simple and easy to use feature will be incredibly popular with many of its bizmoto agents.

The non-bank lending space in the Philippines is currently undergoing massive changes, especially in the mobile app space where users have exploded as more people access non-bank loan finance through their mobiles.

To capitalise on this momentum, Kain said the next level of regulatory licensing that Peppermint would be chasing is an Electronic Money Issuer (EMI) licence.

With an EMI licence in place, he believes that Peppermint could turbocharge its capabilities in the digital transaction space.

“An EMI licence will allow us to facilitate any e-money transaction and service open-loop e-wallet accounts, providing all Filipinos – not just bizmoto agents – with a convenient and secure way to receive digital money and access digital services,” Kain said.

“Every Filipino will have the chance to receive a bizmoPay loan, paid to their bizmoto e-wallet to access the bizmoto ecosystem and agent services. We believe this will stimulate significant transaction volumes over the bizmoto platform.”

In February, the company told the market that its phase 2 objective was the launch of bizmoPay.

“We’ve done that and ticked that box, so now we’re moving to phase 3, an EMI licence which is Peppermint’s next objective in delivering financial inclusion to the Filipino people.”

Other significant milestones

In March, PIL signed an API agreement with the Bank of the Philippine Islands, which saw PIL’s proprietary bizmoto platform integrated into the bank’s operating systems.

The integration will begin during Q4 2021, with the product expected to go live later in 2021 or early 2022.

PIL’s strategic Merchant Biller Agreement with Cebuana Lhuillier back in April allowed its bizmoto agents to cash in money and top up their mobile wallets at any of the 2,500 Cebuana shop fronts across the country.

The API that serves as the gateway for Cebuana Lhuillier to send funds has now been developed, with a projected go-live date later this year or early Q1 2022.

Integration of the bizmoto platform with GCash as a payments facilitator is also underway, and expected to be launched in December.

Once the GCash offer is live, bizmoto agents, riders and merchants will have exposure to approximately 46 million registered GCash users throughout the Philippines.

PIL’s bizmoTinda website meanwhile, has been improved to include multi-vendor customer and multi-vendor merchant functionality, allowing users to register as multiple vendors or multiple merchants.

The bizmoTinda allows users to sell their own items, with the convenience of having their own website.

Other milestones during the quarter include launching a blog newsroom with the aim of providing non-ASX sensitive information and news updates about the company’s activities to shareholders.

PIL also executed a direct marketing campaign around bizmoPay during the quarter, introducing the concept of a “Planet bizmoto” community among its agents.

The primary objectives of the “Planet bizmoto” community are to experience unique value, be loyal to the brand and transact frequently within the bizmoto ecosystem.

This article was developed in collaboration with Peppermint, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.