NAB takes 15pc option in ASX fintech Plenti… and a piece of the hottest auto market since 2017

NAB’s deal with Plenti could propel the fintech’s loan book. Picture Getty

- Data suggests Australian car market is booming

- NAB wants a piece of the action, with option to acquire up to 15pc stake in ASX fintech, Plenti Group

- Stockhead reached out to Plenti’s CEO, Daniel Foggo

The Australian new-car market has posted record sales for the fifth month running, with a yearly record now in sight.

Total new vehicle sales for October came in at 106,809 units, 22% higher compared to the same time a year ago.

According to data from the Australasian Fleet Management Association (AFMA), this was the highest October sales result since 2017. It was also the first time the annual one-million milestone has been achieved in the month October, with two months to spare for the year.

As the market booms, the battle to win customers has now spilled out to the lending sector with big banks fighting each other to get a slice of the action.

In September, Commonwealth Bank (ASX:CBA) signed a deal to become a preferred finance provider for Tesla Australia. As part of the agreement, CBA’s customers will now be able to access the bank’s financing directly from the Tesla website.

Westpac (ASX:WBC), after exiting the auto loans business in 2021, has relaunched a new product for customers buying a new or used hybrid or electric vehicle.

National Australia Bank (ASX:NAB) also got into the action last week, taking an option to acquire up to 15% of the rapidly growing fintech company, Plenti Group (ASX:PLT).

The strategic partnership will see the launch of a “NAB powered by Plenti” car and electric vehicle (EV) loan product, bringing together one of Australia’s largest and most trusted financial institutions and Plenti’s award-winning tech platform.

Under the deal, Plenti’s household renewable energy finance solutions will also be made available to NAB’s customers, which aims to help Australian households save on energy bills and reduce carbon emissions.

“This is a recognition that fintechs like Plenti have a lot of capabilities that can be really appealing to a bank like NAB,” said Plenti’s CEO, Daniel Foggo.

“This strategic partnership is expected to have a meaningfully positive impact on Plenti’s growth and profitability in future years.”

NAB deal to propel Plenti’s loan book

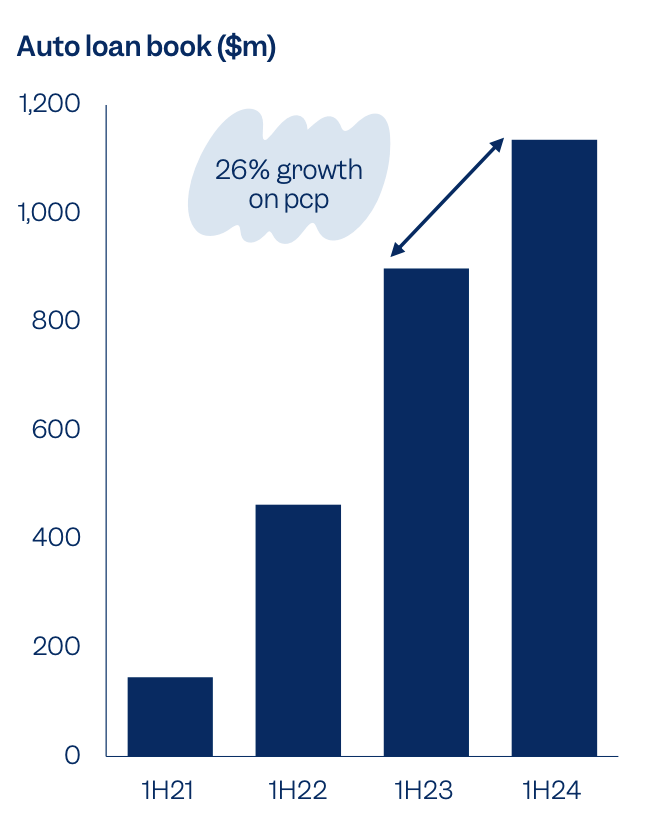

Over the past three years, Plenti has significantly grown its auto loan book from pretty much a standing start to over $1 billion.

Foggo said the company’s success is down its superior technology platform, which allows it to integrate with partners really effectively.

“Tesla is a good example where we’ve got a deep technology integration, where we can really help customers get finance through a seamless, fast experience, and I think that’s our key differentiation,” he told Stockhead.

“That also means that we can operate really efficiently, which in turn allows us to grow revenue fast.”

Despite the rapid growth, Plenti estimates that it currently only has a 4% penetration in the massive $35 billion auto loans market.

Foggo however believes that could soon change when the “NAB powered by Plenti” product is launched in the first half of 2024.

“I think the partnership with NAB will certainly help open doors for additional opportunities to help our business grow.

“We expect it to be cash generative from from the day we launch the product. So yes, it will be material in terms of both scale and profitability for us over time,” said Foggo.

Under the agreement, the loans will be funded by NAB as product issuer and held on NAB’s balance sheet, with credit risk borne by NAB.

“This means that we don’t have to fund the loan ourselves, which is quite good. And, as it’s on NAB’s balance sheet, they’re also responsible for the credit losses,” Foggo said.

Plenti’s overall loan book now sits at just over $2 billion, and Foggo says the NAB partnership could just be the deal it needs to propel it to $3 billion.

“The NAB partnership will certainly help us grow our loans under management.

“And we operate in really big markets, so we do see a really long runway in terms of us continuing to build market share,” Foggo said.

Other non-bank automotive lenders on the ASX

MoneyMe offers car loans up to $100,000.

The company’s Autopay platform allows car dealerships and brokers to approve and settle vehicle finance within 60 minutes, 7 days a week.

MoneyMe achieved B Corp certification in the last quarter, marking a significant milestone in its commitment to ESG values.

In FY23, MoneyMe recorded a statutory profit of $12 million, despite rising interest rates, heightened inflation, and geopolitical uncertainties.

In terms of the outlook for FY24, MoneyMe said it expects to deliver positive statutory and cash NPAT results for the first half and full year FY24.

Harmoney provides both secured and unsecured car loan finance.

FY23 was another impressive year for Harmoney, with the company reaching the important milestone of Cash NPAT profitability.

The company has set further targets to generate an ROE of 20% in the medium term, a target the company says is unique among its peer group.

Looking ahead to FY24, the focus in the half so far has been on the Stellare 2.0 rollout, and closure of the company’s retail peer-to-peer platform.

The first half is expected to deliver a Cash NPAT of approximately $0.5million.

Share prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.