MYOB backs out of $180m deal to buy part of Reckon; shares drop

Pic: Yuichiro Chino / Moment via Getty Images

MYOB, a key player in the cloud-based accountancy software market, has dropped a $180 million deal to buy a key part of competitor Reckon.

Instead it is looking at a share buy-back, greater investment in its platform and more sales and marketing resources.

MYOB in November announced the purchase of the assets of Reckon’s Accountant Group in Australia and New Zealand which provides software solutions to accounting practices.

The deal would have deepened the company’s relationship with more than 3000 accounting practices.

However, MYOB now says the regulatory process has taken considerably longer than expected and could continue for some time.

The competition regulator, the ACCC, has competition concerns with MYOB’s proposed acquisition of Reckon’s Accountants Group because it could mean MYOB becoming the only supplier of practice software suitable for medium to large accounting firms.

Shares sin both Reckon and MYOB fell.

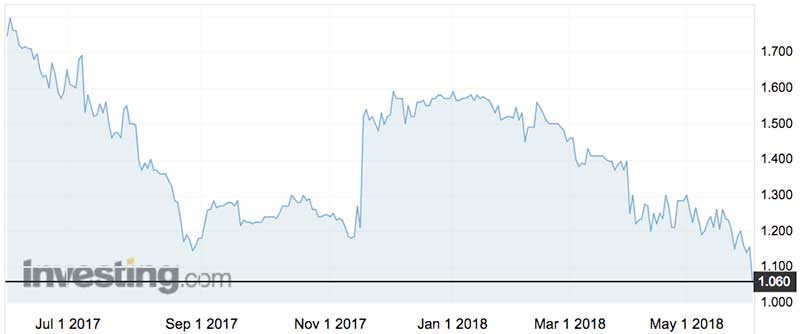

Reckon (ASX:RKN) dropped 8 per cent to $1.06:

MYOB (ASX:MYO) fell 8 per cent to $2.81:

MYOB now intends to invest more in the business rather than in acquisitions.

This includes $50 million of research and development spend over the next two years to bring forward the delivery of MYOB’s online platform.

This acceleration will increase research and development as a percentage of revenue above current levels. However, MYOB expects it to stay below 20 per cent from 2018 to 2020 and to drop back below 16 per cent of revenue by 2022.

The company will also tip $30 million into sales and marketing, increasing the size of MYOB’s adviser sales team to maximise the potential of the accelerated platform delivery, and to deliver an increased rate of referrals from the adviser base of accountants and bookkeepers.

Here are MYOB’s targets:

- Online subscribers: 1 million by 2020

- Organic revenue growth: high single-digit

- Total revenue growth: double digit

- Underlying EBITDA margins: >45% from 2022

- R&D investment: <16% from 2022

- Free cash flow: >$200 million from 2022

“While the acquisition will not complete as planned, we are excited about the opportunity to accelerate the organic growth in our business,” says MYOB CEO Tim Reed.

“With a proven track record of investing for growth, and a market ripe for expansion, we are confident that this is the right time to invest and set our business up for future success, whilst continuing to deliver value to our shareholders and our customers.

“With the Reckon deal no longer proceeding, we plan to accelerate the pace of our share buyback program, and thereby maximise the return to our shareholders.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

“We are confident that throughout this period of investment our business will remain highly profitable, with underlying EBITDA margins expected to be above 40%.”

Reed says MYOB’s financial goals, beyond reaching 1 million online subscribers by 2020, are to deliver underlying margins greater than 45% and generate $200 million of free cash flow by 2022.

MYOB updated its 2018 guidance, saying organic revenue growth is still expected to be in the 8% to 10% range with underlying earnings margins between 42% and 44%.

The company’s latest half year results showed revenue up 14% to $204 million and after tax profit rising 13% to $28.3 million.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.