Reckon falls 10pc as consumer watchdog raises eyebrow on MYOB acquisition

Pic: Yuichiro Chino / Moment via Getty Images

Accounting software giant MYOB’s acquisition of rival Reckon’s assets has raised concerns from the competition watchdog, sending the junior down 10 per cent in trade on Thursday morning.

The Australian Competition and Consumer Commission today said it had competition concerns with MYOB’s (ASX:MYO) proposed acquisition of Reckon’s (ASX:RKN) accountants group.

“If MYOB acquired Reckon’s Accountants Group, it would likely be the only supplier of practice software suitable for medium-to-large accounting firms,” ACCC Commissioner Roger Featherston said.

“If MYOB has a monopoly on this software, it would substantially lessen competition. We think there’s a significant risk for customers that prices will increase and service levels will decrease.”

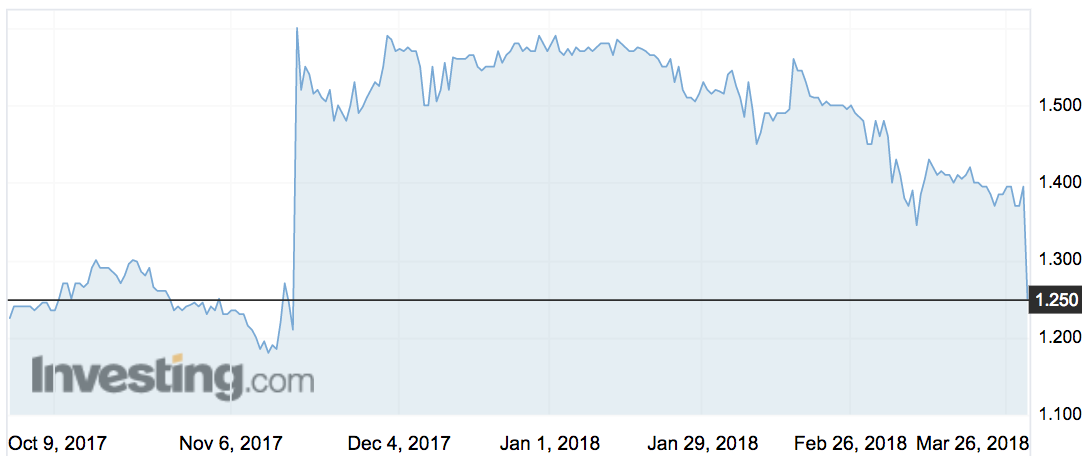

It was the $180 million deal that saw Reckon shares surge 32 per cent in November, but today its stock was trading down 10 percent at $1.25.

That’s down 30 per cent from its January highs of $1.60.

Reckon said any deal was contingent on ACCC rulings.

“Shareholders will recall that completion of the sale is conditional on and subject to regulatory approval from both the ACCC and NZCC, and other customary closing conditions,” it said.

Mean time Reckon is continuing to operate the business as usual until a final decision from the ACCC is released on May 30.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.