MONEYME makes strong start in FY25 as its growth momentum builds

MoneyMe’s momentum builds in Q1 FY25. Image: Getty.

- MONEYME made a significant surge in its return to growth in Q1 FY25 with increases in key metrics

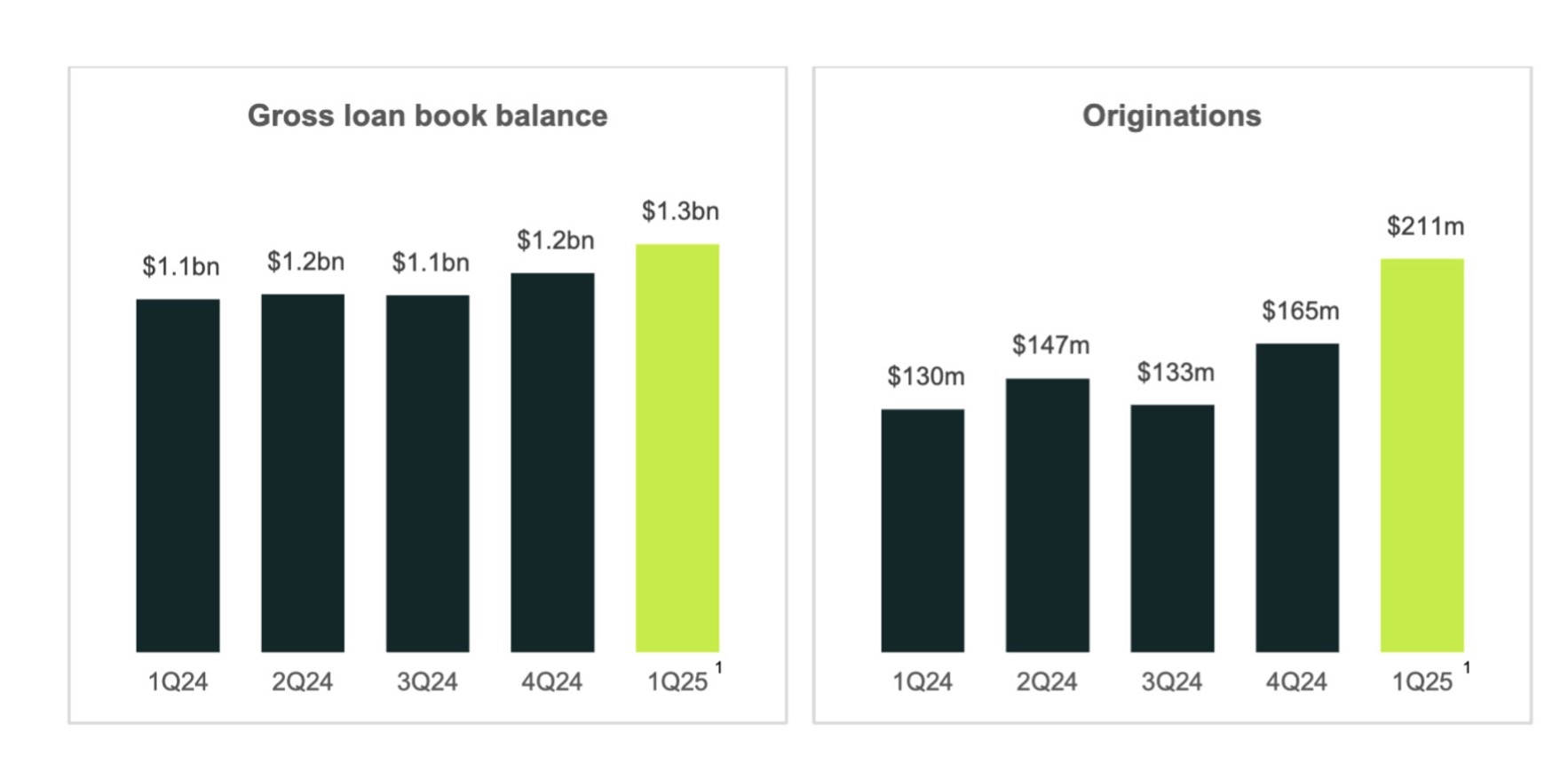

- Loan book balance increases to $1.3bn during quarter as principal originations rise

- Credit quality lifts along with ratio of secured assets reducing credit losses

Special Report: MONEYME has kicked off the new financial year in fine form with a boost to its loan book, lower credit losses and an increase in proportion of secured loans.

Non-bank lender MONEY ME (ASX:MME) has been hard at work growing its business, and that very much shows judging by its latest key financial results.

The company has reported that its gross loan book balance increased to $1.3bn in Q1 FY25, up 8% on both the prior quarter and prior corresponding period (PCP) as principal originations rose strongly.

MME said growth in strategic target segments saw principal originations increase to $211m for Q1 FY25, up 62% on PCP and 27% on Q4 FY24.

Continued growth in originations is forecast through FY25.

Source: MoneyMe

Increase in secured loans and higher credit quality reduce credit losses

MME’s strong revenue of >$50m for Q1 FY25, is a reflection of an increased ratio of secured loans and higher credit quality customers.

The company’s ratio of secured lending rose to 58% during the quarter, up from 55% in Q4 FY24 and 46% on PCP.

It’s on a trajectory of increasing its secured assets ration ad secured lending accounted for 68% of originations during the quarter.

Net credit losses decreased to 3.8% for Q1 FY25, 0.7% lower on Q4 FY24 and 0.6% lower on PCP.

MME said the decrease in credit losses was in line with management strategy and expectations as the higher quality loan book took effect.

A slight drop in net interest margin (NIM) to 9% at the end of Q1 FY25, from 10% in Q4 FY24, was attributed to a continued shift to secured lending.

The average credit score of MME customers rose to 774 for Q1 FY25, up 1% on the prior quarter and 6% on PCP.

Source: MME

Innovation is key as seven-year personal loan offering launches

During the quarter MME launched a new seven-year personal loan offering in broker channels.

MME said the seven-year personal loan segment is an important product offering in broker channels.

While personal loans are often five years, seven years have become increasingly popular with Australians concerned about cost of living due to their lower monthly repayments.

Founded in 2013 and listed on the ASX with a mission to change the way Australians access credit, the company said innovation remained a priority.

With this in mind, MME emphasised development was progressing on its revamped credit card offering, planned for a relaunch in FY25.

Optimising funding to support growth

During Q1 FY25 MME said it improved efficiencies in its funding. The company extended a major bank warehouse structured for improved capital efficiency and lower cost of funds.

What this has done is, in effect, released cash for growth, noted the company.

In July 2024, the company completed a $178m securitisation, pooling unsecured personal loans from MONEYME (MME) and its personal lending brand SocietyOne as collateral to raise capital and support ongoing lending.

After quarter end in October, MME also completed its debut $517m Autopay ABS transaction, releasing further capital for future growth and reducing funding costs.

MME said additional initiatives to enhance funding efficiency and capacity were expected in Q2 FY25, with more term deals anticipated for execution in FY25.

Growth in FY25 on the cards

Clearly pleased with the company’s FY25 so far, MoneyMe’s managing director and CEO Clayton Howes said: “We are navigating the challenging macroeconomic environment effectively, growing in targeted segments while increasing the mix of secured assets and delivering strong credit performance.”

Howes noted the company was seeing the benefits of credit quality in its loan book, with net credit losses reducing.

“It was great to see another quarter of high customer satisfaction, with a net promoter score of 69, as we continued to enhance customer experiences.”

“During the quarter, we launched our new mobile app and implemented several key technology updates, including enhancements to our credit decisioning through advanced analytics to optimise pricing and further support our returns as we resume growth.”

“Debt capital investors continue to have conviction in MoneyMe’s growth profile and the quality of the underlying assets.”

Howes added that MME’s $178m personal loan and $517m Autopay term securitisations completed year to date have provided a lower cost of funds and increased capacity for originations growth.

“Strong execution of our business strategy with a focus on sustainable growth continues to position the business for long-term success,” concluded MoneyMe’s boss.

This article was developed in collaboration with MoneyMe, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.