MoneyMe has strong FY26 start with loan book growth and revenue gains

MoneyMe records strong start to FY26 with progress across key metrics. Pic: Getty Images.

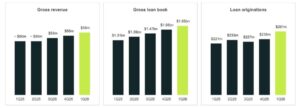

- MoneyMe’s loan book rises to $1.65 billion in Q1 FY26, up 26% on pcp

- Gross revenue reaches $58 million, up 15% on pcp as loan book expands

- Product and tech milestones in Q1 include launch of Autopay for private car sales

Special Report: Non-bank lender MoneyMe’s share price is up ~10% after recording a strong start to FY26, achieving growth across all key metrics as it scales its loan book, improves profitability and strengthens credit performance.

MoneyMe’s (ASX: MME) loan book rose to $1.65 billion in Q1 FY26, up 26% on the previous corresponding period (pcp), supported by loan originations of $261 million, up 18%.

Revenue and profitability metrics improved, with gross revenue reaching $58m, a 15% increase on the pcp, driven by higher returns from an expanded loan book.

The net interest margin (NIM) came in at 7%, reflecting a greater mix of secured assets – 62% of the loan book – while the risk-adjusted NIM (RNIM) improved to 1.9%, up from 1.5% in FY25.

Credit performance continued to strengthen, with net credit losses falling to 3.1%, down from 3.8% in the pcp.

Arrears above 90 days improved to 1% and the average credit score increased to 796, up 3% year-on-year.

“MoneyMe had a strong first quarter, progressing our strategic priorities and gaining momentum across key metrics,” CEO and managing director Clayton Howes said.

“The loan book increased by over $90 million in the quarter alongside strong revenue from high-quality, predominantly secured assets.

“We continue to invest in growth and our normalised NPAT is significantly improving with scale.”

Source: MME

On track to deliver on targets and growth ambitions

MME also continues to benefit from lower funding costs and improved warehouse terms, benefiting its risk-adjusted NIM going forward.

A recent Fitch ratings upgrade across five note classes in its MME 2024-1 APY Trust reflects strong asset performance and a positive outlook for continued outperformance.

“Our risk-adjusted net interest margin continues to trend upward, supported by improvements in our cost of funds and a further reduction in credit losses,” Howes said.

MME said it was on track to deliver its medium-term outlook with continued growth, improved profitability in line with better credit performance and a stronger risk-adjusted margin.

“We have a robust capital position and ample liquidity to deliver on our long-term growth ambitions, and we are excited about the trajectory we are on,” Howes said.

Technology and product expansion

The start of FY26 has seen MME achieve several product and technology milestones, including the launch of Autopay for private car sales.

Piloted in September and launched in October, MME is extending its secured car loan offering beyond dealerships into a segment that accounts for more than half of used car sales in Australia.

MME is also preparing for the launch of a new credit card offering in H2 FY26, supported by its Mastercard principal issuer status gained in the quarter, alongside the expansion of its personal loan limit to $70,000 to increase its market coverage.

“We are increasing our brand presence and expanding the reach of our products with the launch of Autopay into the private sales market and an enhanced personal loan offering targeting high value segments,” Howes said.

Driving operational efficiency and data integrity with AI

Enhanced risk-based pricing models, increased artificial intelligence deployment and website optimisations have also contributed to improved operational efficiency, faster service and stronger customer conversion.

The company continues to invest in AI across its business and has deployed specialised AI agents and multi-agent systems to enhance operational workflows and business decisioning.

In Q1 FY26, MME introduced AI-powered customer email routing to improve workflow efficiency and response accuracy across teams. AI agents were also deployed to strengthen data integrity and governance.

“Our development and deployment of AI is driving increased operating efficiency and better customer experiences as we prepare to reignite credit card growth with a new product in the second half,” Howes said.

This article was developed in collaboration with MoneyMe, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.