MoneyMe gains momentum as loan book hits $1.5bn, originations jump 65pc

MoneyMe loan book hits $1.5b. Image: Getty.

- MoneyMe’s loan book hits $1.5bn with originations up 65% from last year

- Continued operating cash profits while AI kicks into gear

- Autopay and tech-led growth lead the way

Special Report: MoneyMe has delivered another solid quarter, with strong loan book growth, operating cash profits and a clear strategy focused on tech, credit quality and new product expansion.

MoneyMe (ASX:MME) has wrapped up a strong March quarter (3Q25), delivering solid results across the board and proving once again that its tech-driven, customer-focused lending model is gaining real traction.

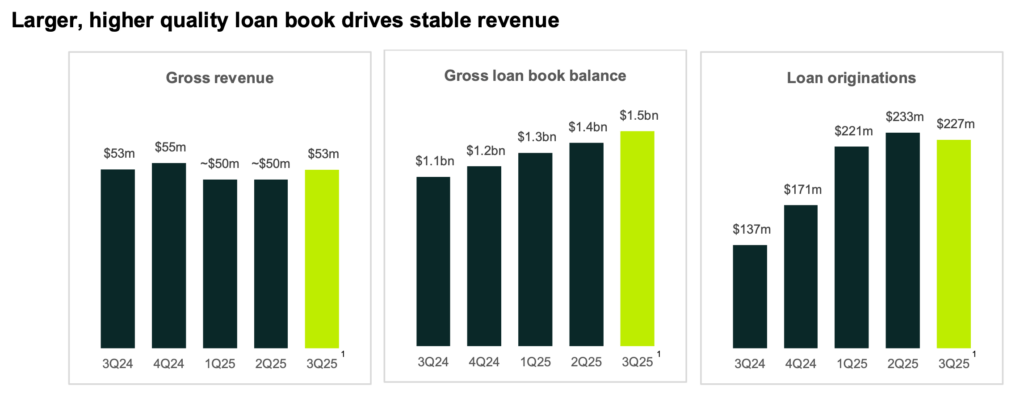

MME’s loan book hit $1.5 billion, up 27% on the same time last year and 6% on the prior quarter.

MME also reported $227 million in loan originations for the quarter, a 65% increase on the same period last year (3Q24), despite a 3% dip from the previous quarter (2Q25).

The slight quarter-on-quarter dip was expected, given the usual seasonality of the summer holiday period.

Autopay, the company’s secured vehicle finance product, played a key role in the result, contributing strongly to originations and helping lift secured loans to 61% of the total loan book.

Profitability maintained

Importantly, the business delivered continued operating cash profit (OCP) in 3Q25, and provided profit guidance for the full year.

“MoneyMe continued to grow in 3Q25, with operating cash profit tracking toward circa $20m for the full year,” said MME CEO, Clayton Howes.

Revenue held strong at $53 million in the quarter, consistent with the same period last year, and up from about $50 million in 2Q25.

MoneyMe’s net interest margin (NIM) for the quarter was 8%, flat compared to 2Q25 but down from 10% in 3Q24.

This year-on-year decline in NIM reflects a deliberate shift in the company’s lending mix toward secured loans and higher credit quality customers.

While these types of loans typically attract lower interest rates, they also come with larger average loan sizes and significantly lower risk, improving the overall stability and performance of the loan book.

“Our NIM was 8% for the quarter, down on the prior year in line with our strategic focus on secured and higher credit quality assets, which have a larger average loan size and a lower risk profile,” said Howes

Source: MoneyMe

Strong credit performance

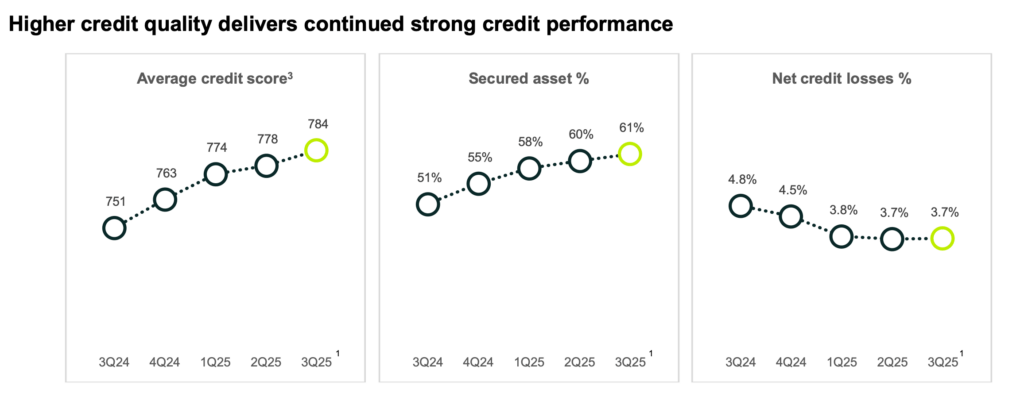

Secured loans now make up 61% of the portfolio, up from 60% in 2Q25 and 51% in 3Q24.

This secured loan strategy is clearly working.

MoneyMe’s average customer credit score has continued to climb, and the credit performance has followed suit with lower loss rates.

Net credit losses came in steady at 3.7%, which is unchanged from 2Q25 and a solid improvement from 4.8% in the prior year.

The credit quality of the loan book also improved: the average customer credit score rose to 784 from 778 in the last quarter, and 751 in the same quarter last year.

Source: MoneyMe

Funding expansion for more growth

While MoneyMe’s Autopay product continues to be a key growth driver, the lender also increased lending capacity for personal loans and credit cards with the expansion of its MME Horizon 2018 Warehouse Trust in March, taking it from $85 million to $130 million.

The deal received strong investor demand across all tranches.

Not only does this increase capacity for personal loans and credit cards, but it also improved funding margins and lowered the cost of funds.

“During the quarter, we refinanced and upsized one of our funding warehouses to support growth in personal loans and credit cards,” Howes said.

“We continue to represent well in the debt capital markets, achieving high demand and more favourable terms, reflecting the strong credit performance of our portfolio.”

The cost benefits from recent funding optimisations and the RBA’s March 0.25% cash rate cut are expected to fully play out in the second half of FY25, with more upside likely if further RBA rate cuts materialise.

MoneyMe acted fast to pass on the March rate cut to customers.

“We moved quickly to deliver savings to existing customers and adjust new customer pricing, supporting customer loyalty,” said Howes.

The company says this pricing shift supports customer retention and acquisition, while still protecting its NIM.

Generative AI driving operational improvements

Meanwhile, MME is leaning heavily into tech to sharpen its edge.

The company plans to extend its technology advantage by continuing to invest in automation and artificial intelligence (AI).

Generative AI is already implemented in its operations, being used for customer communications and staff training.

“Our investment in proprietary generative AI is delivering tangible operational improvements,” Howes noted, “streamlining customer communications and enhancing performance of customer service teams.”

Alongside the AI push, MoneyMe is working on developing a new credit card product, expanding its suite of offerings as part of its long-term strategy.

Strategy and outlook

Heading into the second half of FY25, MoneyMe is feeling confident about where things are headed.

The business expects to continue delivering operating cash profit, with full-year OCP tracking towards around $20 million – a strong indicator of steady, profitable growth.

The focus now is on pushing into new areas with the help of smart technology.

MoneyMe plans to keep building on its tech edge, continuing to invest in automation and AI to improve decision-making and customer experience.

The company will stick to its core strength in secured and high-credit-quality lending, while also looking to broaden the mix by growing its personal loan and credit card offerings, creating more balance across the portfolio over the medium to long term.

On the funding side, MoneyMe said it was aiming to bring costs down further by tapping into asset-backed securities (ABS) and scaling up its funding programs to support future lending growth.

Product innovation is also on the cards.

As mentioned further above, the team is developing a new credit card product but is also exploring ways to take Autopay – its secured vehicle finance offering – directly to consumers.

“Looking ahead, we remain focused on reducing our cost of funds through further funding optimisations, leveraging the latest technology to drive better customer outcomes, and expanding our product offering with a new credit card product.”

The company is also pushing forward on its sustainability agenda.

It notes it’s committed to modelling strong ESG practices that not only reflect responsible business, but also connect with customers and investors who care about doing things the right way.

This article was developed in collaboration with MoneyMe, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.