MoneyMe aims to scale up after delivering strong H1 cash profits

MoneyMe posts strong H1 profits, eyes growth. Image: Getty.

- MoneyMe grows loan book, boosts operating cash profit

- Shift to secured loans drives stability

- AI-powered platform supports future growth

Special Report: MoneyMe has posted solid results for the first half of FY25, thanks to impressive loan-book growth, a boost in loan originations and a more secure, high-quality portfolio.

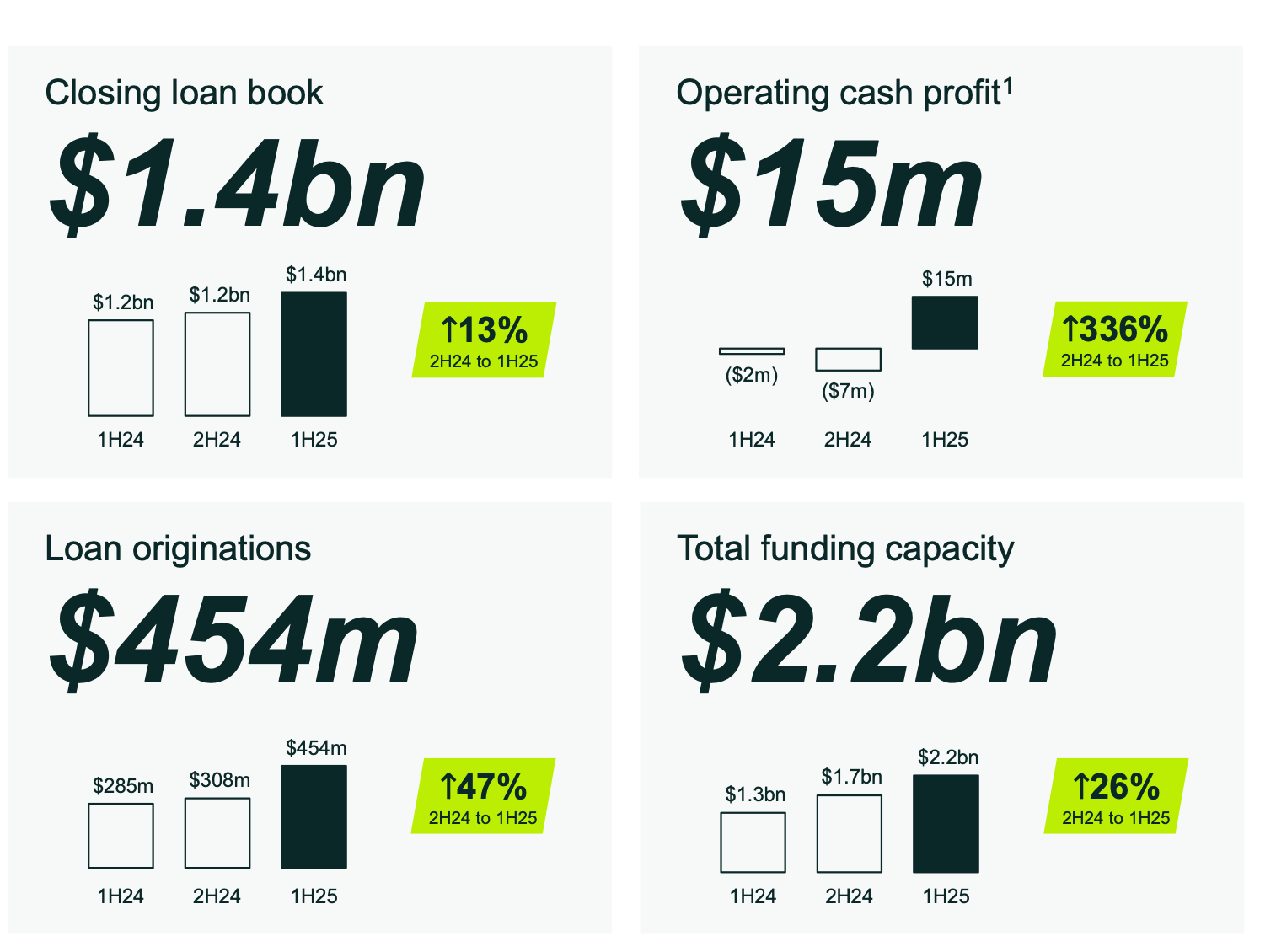

Non-bank lender MoneyMe (ASX:MME) has delivered a solid $15 million in operating cash profit for the first half of FY25, with strong growth and a bigger, higher-quality loan book.

The company’s loan book has reached $1.4 billion in the first half – up 20% from $1.2 billion in the same period last year.

Loan originations also saw a major boost in the half, jumping 59% to $454 million.

The 7% drop in revenue, from $108 million in 1H24 to $100 million in 1H25, is mainly tied to the company’s shift toward secured lending, which now makes up 60% of the loan book.

Higher-quality assets obviously come with lower risk, and this has resulted in a noticeable drop in credit losses – now sitting at 3.7%, down from 4.6% last year.

The quality of MME’s loan book is also improving, with the average Equifax score of customers rising by 5% to 778.

“MoneyMe delivered $15 million in operating cash profit while growing our loan book from $1.2 billion to $1.4 billion, driven by a 47% increase in new loan originations,” said CEO Clayton Howes.

Source: MoneyMe

Diversifying the portfolio

While there was a slight dip in revenue and net interest margin (NIM) from 10% to 8% due to a focus on secured loans, MME believes the shift to secured loans is a key strategic move that’s positioning it for a much more stable, long-term income profile.

“Our strategic shift toward secured lending and higher credit quality customers has a more stable long-term income profile and continues to deliver lower credit losses,” said Howes.

The growth in the half was primarily driven by MME’s secured car loan product, Autopay.

To grow this business further, MME has secured substantial funding, including a $517.5 million Autopay ABS (asset-backed securities) deal.

MoneyMe also secured a $125 million corporate facility with iPartners, refinancing its previous facility at a lower cost. Two warehouse renewals were executed during the half, as planned.

Howes said that over the medium term, MoneyMe plans to balance Autopay’s growth with the launch of a new credit card in 2025 and increased personal loan offerings.

This strategy aims to diversify the company’s portfolio, provide a fresh revenue stream and help to maintain a healthy net interest margin by boosting yield.“With our technology advantage and diversified product strategy, a robust loan book and an optimised funding platform, MoneyMe is positioned for continued growth and operating cash profitability in FY25.”

NPAT reflects growth and accounting adjustments

MoneyMe’s share price took a hit following the results, down 9% at close of trading, most probably due to the reported $39 million statutory net loss.

But before investors get too concerned, it might be wise to look beyond the statutory NPAT figure and focus on the underlying business operations.

MME said the $39 million net loss was largely a result of growing its loan book and a one-off accounting adjustment.

The net loss reflects upfront provisioning for expected credit losses – an accounting standard resulting in an immediate NPAT hit for a growing lender, while the interest income from new loans will accrue over time.

While expected credit losses increased due to the larger loan book, MME’s provisioning rate (expected credit losses as a percentage of the book) came down, in line with higher credit quality and lower credit losses.

The net loss also included a one-off, non-cash adjustment of $14 million, due to the consolidation of SocietyOne’s loan book onto MoneyMe’s Horizon platform.

Generative AI to improve customer experience

Despite these short-term impacts, there’s plenty of good news for MoneyMe when you go through today’s release.

The Certified B Corporation company said its cash generation and funding platform provide the runway to grow its loan book to over $3 billion in the medium term.

“Our strengthened funding and capital position, including the expansion of our ABS program and new corporate facility, provides the capacity to grow our loan book beyond $3 billion with increased capital-efficiency and reduced funding costs,” said Howes.

“Meanwhile, our proprietary technology and AI is driving operating leverage, allowing us to scale efficiently and quickly.”

Howes was referring to MME’s proprietary technology platform, which leverages high automation and AI to streamline its lending operations. MME said it had deployed in-house built generative AI to automate aspects of customer communication.

The company believes this addition to its technology stack will lead to faster response times and improved customer service, while driving further operating efficiencies.

This article was developed in collaboration with MoneyMe, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.