Metaverse, AI and ESG among the seven tech trends to keep an eye on in 2023

Pic: via Getty Images.

- Info-Tech Research Group says the metaverse and generative AI are among the tech trends this year

- Data players and stocks involved in digitalisation are primed for the spotlight

- ESG reporting are expected to become more regulated globally

Info-Tech Research Group has flagged seven technology trends the Asia Pacific (APAC) region should be aware of heading into the new year – particularly if IT leaders want to be ready to capitalise on new opportunities for their respective organisations.

“Last year’s Tech Trends report focused on the capabilities organisations would need to compete in a digital economy,’ Info-Tech Research Director Brian Jackson said.

“The 2023 Tech Trends report considers how technology leaders can explore new technologies while protecting the organisation from the risks posed.

“Our research insights expand on the previous year’s trends, focusing on how IT can enhance existing capabilities and create new ones while simultaneously considering the volatility of a world dealing with several major crises.”

Here then, are the seven trends to keep an eye on in 2023 – with several stocks in each sector to check out:

-

The Metaverse

The metaverse gained notoriety after Facebook changed its name to Meta (and had a few quarters in a row of falling revenue and a falling market cap) but no one is really jumping on the bandwagon as yet.

The metaverse as a solution to hybrid work is still a far-off concept for most companies, with 63% of organisations having no plans to collaborate in virtual reality, such as using headsets that block out the real world.

“Only one quarter of firms are conducting a proof of concept or planning to do so,” the report says.

“Slightly more than one in 10 say they are either scaling up or already seeing widespread organisational adoption.”

Which ASX players have a hand in the metaverse?

There are a few stocks on the ASX who could be set to benefit if/when the metaverse kicks off, including $57m market cap company Vection Technologies (ASX:VR1).

In August, VR1 unveiled its FrameS Metaverse release, as part of its app integration with Webex by Cisco.

The new features will enable organisations to autonomously build an immersive metaverse – a dynamic 3D world where people can participate in meetings from anywhere across the globe.

The company had around ~$14 million cash at the end of the September quarter and said it expected to deliver full fiscal 2023 revenue guidance of $24 to $26 million.

Video game developer PlaySide Studios (ASX:PLY) signed a game-development agreement with Meta last month to create a mixed reality interactive software product to be playable on its Quest suite of virtual reality devices – with work on the title expected to commence in the current financial year.

“Meta is bringing virtual reality and mixed reality into the mainstream with its Quest suite of products, and we are excited about the opportunity to demonstrate our domain expertise with this game,” CEO Gerry Sakkas said.

The $256m market-cap company had $34.7m net cash at the end of 1Q FY23.

Aerometrex (ASX:AMX), which flies helicopters to take aerial photographs it then converts to 3D models, has contracts with giant Alphabet and Lunaverse – a realistic 3D world built on the Terra blockchain.

The $39m market-cap company has eyes on becoming the data provider for global metaverse companies.

“We’ve sold data sets to companies like Google, and we’re in constant discussions with Metaverse companies across the world,” CEO Steve Masters said back in August,

“And what we’re starting to see is the need for ultra-realistic sense of location. It’s fundamental to the Metaverse business models.

“Our 3D basically enriches the platforms that Metaverse companies are looking to build out, almost those social and economic pieces that go with with each particular Metaverse.”

The company can even make it snow in Las Vegas:

We’re so excited for the official release of @UnrealEngine 5 that we made it snow in Las Vegas. UE5 + @CesiumJS is going to substantially change spatial data work and the potential is enormous #aerometrex #metromap #unrealengine #ue5 #epicgames #lasvegas #3dmodel pic.twitter.com/O0FIrAzww6

— Aerometrex (@aerometrex) April 7, 2022

iCandy Interactive (ASX:ICI) launched itself into the Metaverse world by acquiring 100% of shares in Lemon Sky Studios in November.

Lemon Sky Studios has established itself as a leading studio in the Southeast Asia region, with a portfolio of AAA game titles verging on the Metaverse.

Then there’s $14m market cap company Remsense Technologies (ASX:REM) who provide imaging for mine sites and oil rigs in what James Whelan said would be called the ‘Engiverse’ if you’re the sort of person to give it a stupid name.

VR1, PLY, AMX, ICI and REM share prices today:

-

Generative AI

Generative AI is a type of semi-supervised machine learning that uses neural networks to create new content or interpret complex signal information.

Basically, by being trained with a large amount of content, models can be made to generate new works similar to what people would create.

“AI will receive the most net-new investment by organisations by the end of 2023, with 35% of organisations indicating they have already invested in it and 44% planning to invest next year,” Info-Tech said.

“With a 9% change between committed and planned investment, AI leads all technologies, followed by data lake at 5% and data mesh at 5%.”

AI stocks on the ASX

Pure play AI translations company Straker (ASX:STG) saw revenue rocket up in the first half of the financial year as it locked in a further three years with computer giant IBM, and reported a strong balance sheet with no debt and cash of $12.4 million as at September 30, 2022 – reaffirming its guidance for profitable growth in revenue in FY23 of 20 per cent with gross margins exceeding the 54 per cent achieved in FY22.

“We are building on our strengths with our new focus on delivering our services through workplace super apps such as Microsoft Teams and Slack, a move aligned with our strategy to ‘be where the customer works’,” founder and CEO Grant Straker said in November.

The company has a market cap of $73m and had cash of $12.5m at 30 September 2022.

Icetana (ASX:ICE) is another stock in the space, with its AI software solution popular among US state prison end users, with the company securing two new orders from reseller Rasilient valued at US$56,250 (A$87,800) in aggregate for five year licence terms.

“The prisons market has always offered a particularly strong use-case for icetana’s AI software,” CEO and MD Matt Macfarlane said.

The $6m market cap company finished the September quarter with $1.9m cash at bank.

BrainChip Holdings (ASX:BRN) is involved in neuromorphic computing, a type of AI that simulates the functionality of the human neuron and is working on commercialisation of its Akida chip.

Akida basically mimics the human brain to analyse only essential sensor inputs at the point of acquisition, processing data with efficiency, precision, and economy of energy.

BRN says keeping machine learning local to the chip, independent of the cloud, also dramatically reduces latency while improving privacy and data security.

This quarter the company is focusing on key sales targets and converting technical evaluations into paid licenses.

The company has a market cap of $1b and cash balance as of 30 September 2022 of US$24.6m.

Then there’s $286m market cap player Appen (ASX:APX) who provide data for developing AI products and machine learning, delivering AI products and services to many of the world’s largest tech companies and Fortune 500 customers globally.

STG, ICE, BRN and APX share prices today:

-

Industry-led data models

After AI, the two technologies gaining the most momentum in new investment this year are data lake (or lakehouse) and data fabric or mesh, with both seeing a 5% increase in the number of organisations planning to invest in 2023.

These platforms facilitate better access to enterprise data and enable real-time reporting.

According to the report, most organisations will look to develop their own data analysis, with 41% building their own data analysis with in-house staff and another 28% both building and buying tools to support analysis.

Stocks with a slice of the data pie

NextDC (ASX:NXT) is a $4b market-cap company which is seeing booming demand for capacity in its data centres.

In FY22 the company’s data centre services revenue increased by 18% (up $45.0 million), contracted utilisation was up by 10% (7.5MW) and interconnection revenues continued to climb (up 13%).

“We are living in extraordinary times – technology is pervasive and global data creation is about to explode,” CEO Craig Scroggie said last month.

“According to Forbes, 90% of the world’s data was generated in the last two years with more than 2.5 quintillion bytes of data being created each day.”

And NXT is ready to cater for this growth, and is keeping an eye on regional data opportunities in WA, QLD and the NT going forwards.

Another stock with data centres around the world is Megaport Ltd (ASX: MP1), whose Network as a Service (NaaS) platform offers an easy way for users to create and manage network connections in the cloud without the need for physical infrastructure.

The $982m market cap company says the massive growth in cloud adoption is fuelling an ever-increasing dependence on critical communications infrastructure as data traverses between end users and public and private cloud locations.

Plus, the platform was built for scalability – with global multi-terabit capacity that reaches 25 countries.

At the end of September 2022, the company’s cash position was $44.9m.

And DC Two (ASX:DC2) offers a number of managed and integrated cloud services delivered from data centres in Perth and Darwin and is currently rolling out DC Modular – a containerised “data centre in a box” innovation.

Notably, the $3m market cap company’s modular data centre in Victoria became fully operational and revenue generating during the September quarter, and they’re focused on supercharging recurring revenue in the Bibra Lake data centre – WA’s only Tier III design accredited data centre with its own ISO 27001 ISMS accredited cloud platform.

NXT, MP1 and DC2 share prices today:

-

Sustained digital processes

Digitalisation is another trend flagged by the report. That’s the use of digital technologies to change a business model and provide new revenue and value-producing opportunities – basically the process of moving to a digital business so there’s quite a few stocks in this space.

And while organisations are still investing in digitalising tasks and processes – they’re running out of steam.

Info-Tech says sustaining momentum will require effort, as well as new tools and ways of working.

Stocks involved in digitalisation

$539m market cap software player Nitro Software (ASX:NTO) operates in the digital document and signature sector and competes against the likes of Adobe and DocuSign.

The company recently announced it had entered into a binding agreement with Cascade Parent Limited, trading as Alludo, to acquire 100% of Nitro at $2/share.

North American-headquartered Alludo is a provider of virtualisation, productivity and professional-calibre graphic solutions for digital remote workforces.

The announcement comes after the company knocked back a bid by Potentia Capital Management recently in favour of exploring the Alludo offer.

Digital conveyancing platform PEXA (ASX:PXA) wants to be Australia’s leading digital property settlements platform, and is certainly zeroing in on that goal.

In FY22, the $2 billion market cap company grew its market penetration to 85% combined to drive a 22% increase in PEXA Exchange volumes to 4.05 million.

Plus, FY22 revenue was $279.8m – that’s a 27% increase on FY21.

PEXA announced plans to expand internationally in September, picking up UK-based remortgage processing firm Optima, which has an approximate 22% share of the remortgage market and direct relationships with six of the UK’s top eight lenders.

Consumers and professionals alike are a driving force behind digitisation we’re seeing within the property sector and beyond. But how has this played out within the legal industry? Read: https://t.co/ucOKG7RsBB pic.twitter.com/GzxFSStIAE

— PEXA (@PEXA_Group) November 30, 2022

Xero (ASX:XRO) is an accounting software company that saw demand boom in recent years.

Total revenue was up 30% (27% in CC) in H1 FY23 at $658.5 million, with subscribers growing 16% to 3.5 million.

Annualised monthly recurring revenue (AMRR) grew 31% to $1.5 billion (23% in CC) and total subscriber lifetime value (LTV) grew $3.1 billion or 30% to $13 billion (23% in CC).

“More small business customers around the world trust Xero to help them run their business and meet their compliance needs, while navigating a changing environment,” CEO Steve Vamos said.

“Our performance underscores how much our customers and partners benefit from Xero and the important role we are playing to help digitise the small business economy.”

The company has a market cap of $10 billion.

NTO, PXA and XRO share prices today:

-

ESG analytics and reporting

Info-Tech expects that in 2023, public companies will be required to report on their carbon emissions by financial regulators in places like the UK, EU, US, and Canada – however, many organisations are still behind on this issue.

“Less than one-quarter of IT professionals say their organisation can accurately report on the impact of its ESG initiatives, and 43% say their reporting on impacts is inaccurate,” the report said.

“Reporting accuracy was even worse for reporting on carbon footprint, with 46% saying their organisation could not accurately report its carbon footprint.”

Who’s got a share of the ESG market?

K2Fly (ASX:K2F) provides resource governance solutions for Environmental, Social and Governance (ESG) compliance, disclosure and technical assurance, and has contracts with Tier-1 and Tier-2 mining clients like Rio Tinto and FMG, operating in 54 countries.

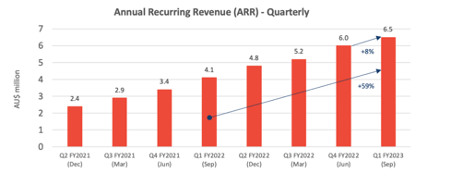

In the September Quarter, Annual Recurring Revenue (ARR)2 was $6.5m in Q1 FY2023, 8% higher than Q4 FY2022 and 59% higher than in Q1 FY2022.

And Total Contract Value (TCV)2 was $18.8m in Q1 FY2023, 6% higher than Q4 FY2022 and 34% higher than Q1 FY2022 (TCV is the remaining value of current contracts).

Recent deals include a 3-year $1.75m contract with Mineral Resources (ASX:MIN) for K2fly’s Mineral Resource Governance (Model Manager) and Technical Assurance (Ore Blocker) Solutions, a 5-year $1.9m contract with ArcelorMittal Mining UK Ltd for the Mineral Resource Governance solutions (Resource Disclosure and Model Manager, and 3-year $1.44m contract with Anglo America for the Mineral Resource Governance (Resource Disclosure) Solution across all Anglo American commodities and operating regions.

The company has a market cap of $30 million.

Then there’s $163 million market cap company Envirosuite (ASX:EVS) who provide ESG solutions across aviation, mining and industrial, waste and water.

EVS has three branches, and in its September quarterly saw continued growth with air-quality business Omnis, with $1.3m in new ARR and 13 new sites – plus they signed a global strategic alliance with SGS providing “clear validation of the platform’s technological advantage.”

The aviation branch saw strong performance in APAC, specifically Taiwan and Australia, and the Water business signed SA Water as a new customer with SeweX, and saw the first cross sell from Water to Omnis with Water Corporation in WA.

“The power of integrating EVS Water and EVS Omnis at customer sites is a significant opportunity for our customers as they address their ESG requirements by using Envirosuite technology,” the company said.

EVS also recently signed a global strategic alliance agreement with SGS, the world’s leading testing, inspection, and certification company – which it says will accelerate its penetration of the serviceable addressable market, and opens new industry verticals and geographies.

K2F and EVS share prices today:

-

Zero-trust security

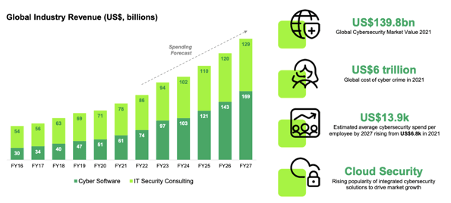

As cyber attacks increase in frequency and impact, organisations are turning to the concept of a zero-trust network to defend against threat vectors.

You only have to look at the Optus and Medibank (ASX:MPL) data breaches in recent months to understand how vulnerable software supply chains are.

Info-Tech says slightly more than half of the respondents to its survey said it is likely or very likely that a cybersecurity incident will disrupt their business in 2023.

Interestingly, disruption from new government-enacted security regulations was the next most common concern, with 40% saying it is likely or very likely to disrupt business.

Here’s a few cyber security stocks on the ASX:

Tesserent’s (ASX:TNT) Cyber 360 strategy offers identification, protection and 24/7 monitoring against cybersecurity threats, and they have more than 440 security engineers to support organisations to defend their digital assets against increasing risks and cyber attacks.

And in its September quarterly, the company said it saw a significant increase in client engagement and pipeline opportunities following the high-profile cybersecurity breaches mentioned above.

“The nature and scale of these breaches and the public reporting and media surrounding them has significantly increased awareness of both the risks and implications of a material cybersecurity breach, not only on businesses operations, but also and as importantly, implications for businesses reputations (where customers and suppliers may also be significantly impacted),” TNT said.

“Leaders across the cybersecurity market in both the government and private sectors all agree that the incidence and sophistication of cyber-attacks in Australia will only increase and that many organisations have a pressing requirement to step up their efforts in protecting their proprietary and customer data.

“The Australian cybersecurity minister has also foreshadowed new laws in the cybersecurity space that will increase both the responsibilities of organisations and their Boards, and the level of penalties for non-compliance.”

For the five months to November 2022 (FY23), the $169m market cap company recorded $70m of Turnover – up circa 35% compared to the prior year comparative period.

Another player in the space is Whitehawk (ASX:WHK), which offers an online tool that enables small and midsize businesses to take immediate action against cybercrime, fraud, and disruption.

Last month the $15m market cap company’s Cyber Risk Radar annual subscription was renewed in support of 3rd Party/Cyber – Supply Chain Risk Management (C-SCRM) for a global social media company.

The SaaS Solution includes automated Cyber and Business Risk monitoring, prioritisation and mitigation over the next 12 months, enabling comprehensive vetting, monitoring, identifying, prioritising and addressing a breadth of business and cyber risks, across a portfolio of 300 suppliers, vendors and partners.

And $40m market cap company Senetas’ (ASX:SEN) subsidiary Votiro owns the software tools that protect against malware and ransomware attacks.

According to Senetas, Votiro’s secure file gateway is the only SaaS-based file security solution that ensures all files coming into an enterprise are safe from malware threats and particularly ransomware.

And since they had the foresight to invest AU$20m in an emerging anti ransom ware technology three years ago, Senetas says they’re at the forefront of cyber security protection.

In FY22, group operating revenue was $25.1 million – up 9% on FY2021 – and Votiro revenue was up 82% to $5.8 million.

“Increased publicity and focus on cyber crime incidents are driving an increase in inbound customer enquiry and is expected to support business growth in the medium term,” the company said.

TNT, WHK and SEN share prices today:

-

Recession preparation

The final tech trend flagged for 2023, is recession preparation. In addition to the new technologies that could yield innovation and all the subsequent risks that IT must work to mitigate, a financial risk to the IT budget is looming this year.

“This risk reduces the degree to which IT can pursue growth opportunities and offer protection from regulatory burdens and bad actors,” Info-Tech said.

Budgets are expected to increase next year, and interestingly, IT professionals in the US are more optimistic than their international counterparts, as 70% expect a budget increase in 2023 compared to 55% for the global average.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.