Here’s why you can ignore those headlines about any ‘tech-led recession’

Pic: via Getty Images.

- A tech-led recession is unlikely because it employs only 3% of the US labour force

- eToro’s Ben Laidler says tech isn’t a canary in a coal mine guys, calm down

- A softening US labour market will be key to bringing inflation down

High-profile tech sector layoffs, from Amazon to Twitter, have surged and investors are worried about a white-collar-led recession.

But eToro global markets strategist Ben Laidler says a tech-led recession is actually unlikely because the sector doesn’t really employ that many people in the scheme of things.

While tech layoffs have reached around 135,000 at 850 companies globally, the sector is still hiring and “the layoffs are their own idiosyncratic drivers,” Laidler said.

“The tech sector is seeing a double whammy of normalising post-pandemic growth and sharply lower bond-yield-driven valuations,” he said.

“‘Tech’ is over a third of the S&P 500 index but only 3% of the US labour force in another stark reminder that stock markets are not economies.”

Tech is not a canary in a coal mine

Laidler says don’t worry too much about the US jobs market slowing down, and that tech is really not a good ‘canary in the coalmine’, for several reasons.

“One: It doesn’t employ many people, at only 3% of the US workforce, though they are well-paid at over $100,000,” he said.

“Amazon’s much hyped 10,000 layoffs is only 1% of its total workforce.

“Two: Other tech firms are still hiring. The latest Challenger, Gray & Christmas job cuts reports shows tech neck-and-neck with autos this year at 28,000 layoffs, but with nearly twice as many announced hiring plans, at 50,000.

“And Three: Tech has not usually been a good lead economic indicator.”

The latest US payroll growth was 260,000 and Laidler says the problem is too strong – not too weak – labour market demand.

Unemployment is key to bringing inflation down

A softening US labour market is coming and its key to helping bring inflation back to the Fed’s 2% target, Laidler adds.

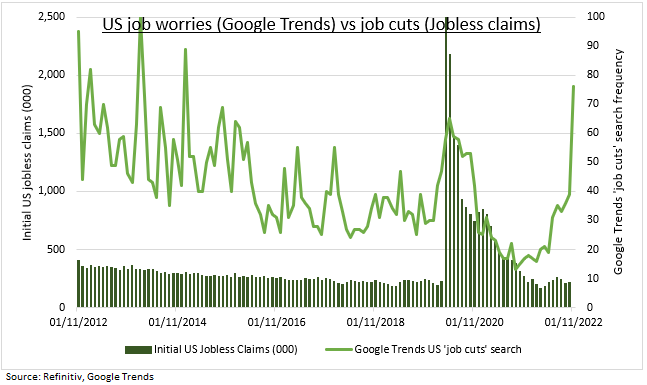

“Unemployment is up from its cycle low at 3.5%, payrolls growth is now clearly slowing, and US Google searches for ‘job cuts’ have surged to an eight-year high,” he said.

“This does not always translate to job losses but will dampen consumer spending.”

A typical ‘cyclical’ economic downturn sees a 2.3pp unemployment rate increase, whilst the Fed is forecasting a more benign 0.9pp rise.

“Either is painful in context of a workforce of 158 million,” Laidler said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.