Here’s how investors could play the semiconductor microchips shortage on the ASX

Pic: Getty

The chips shortage we had to have

Although much of the news about the microchips shortage has centred on the auto industry, the problem is affecting pretty much every sector that uses semiconductors.

From home appliances to consumer electronics and medical devices, all are facing the chips crunch.

The bad news is, there doesn’t seem to be a quick fix as it takes billions of dollars and two to three years to set up a new semiconductor plant from scratch.

But how did we ever get to this situation ?

Looking back, it’s impossible to point to one reason (although the pandemic was a major one). It was more like a handful of problems coming together at the wrong time.

Firstly, Covid-induced lockdowns caused sales of home appliances and electronics to skyrocket as people worked from homes.

And there’s the supply chain side bottlenecks caused by pandemic restrictions, which hampered global shipping and resulted in runaway inflation all over the world.

Almost 90% of the world’s electronics go through China’s Yantian port, and its closure in June last year due to Covid left hundreds of container ships waiting to dock.

Bad decisions by the car industry also played a big part in the chip shortage.

When the pandemic first hit, many automotive companies cancelled their chip orders – shifting the chip factories’ production capacity to consumer products like smartphones.

With production being diverted to consumer electronics, a shortage of car chips soon ensued with companies like Nissan and GM suddenly having to halt some of their production lines.

What can we do to get ourselves out of this mess?

Not much according to experts, as the world relies on just one chipmaker – the Taiwan Semiconductor Manufacturing Company.

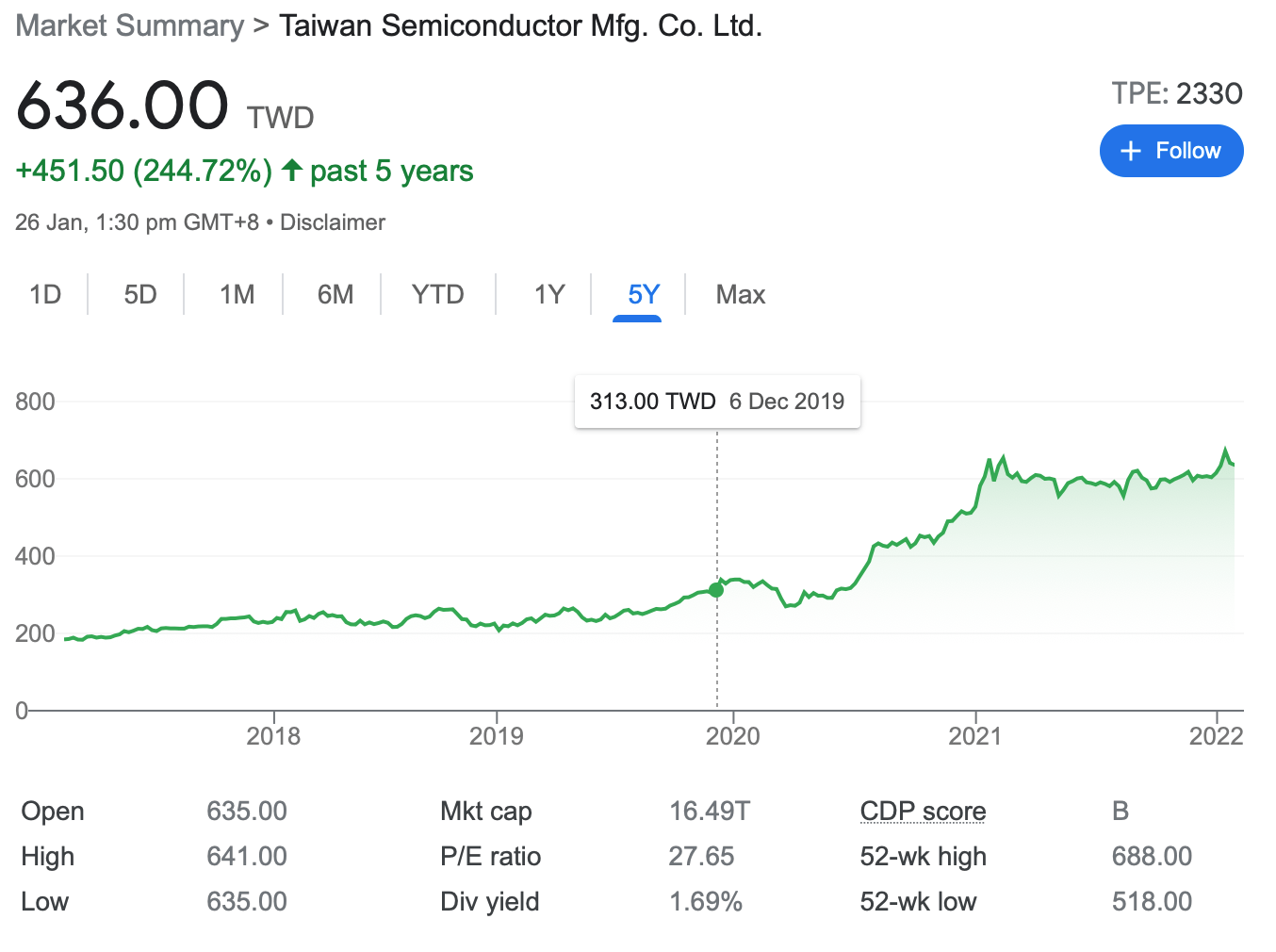

The TSMC’s stock price has more than doubled since the pandemic start of March 2020, but its dominance is now posing obvious risks to the global economy.

The most concerning bit: a possible war between Taiwan and China could in theory put all of the world’s access to chips immediately in jeopardy.

President Biden’s announced plans to invest US$52 billion in US semiconductor manufacturing will somewhat diversify chip production away from Asia, but experts argue it won’t ease any short term pain.

How can investors play the chip shortage?

ASX semiconductor stocks are well positioned for the market’s tight condition.

And there are a number of ways you could play the sector, depending on which part of the segment or value chain you’re after.

| Code | Name | Price | % year change | Market cap |

|---|---|---|---|---|

| BRN | Brainchip Holdings | 1.78 | 230% | $3.04bn |

| RVS | Revasum | 1.04 | 115% | $110m |

| AMO | Ambertech | 0.35 | 75% | $32m |

| WBT | Weebit Nano | 3.37 | 29% | $553m |

| AD8 | Audinate Group | 8.19 | 6.20% | $631m |

| BCT | Bluechiip | 0.04 | 2.50% | $25m |

| SLX | SILEX Systems | $1.16 | -7.60% | $235m |

| PVS | Pivotal Systems | 0.66 | -34% | $84m |

| BLG | Bluglass | 3.4 | -57.50% | $37m |

| 4DS | 4DS Memory | 0.09 | -58% | $125m |

| SE1 | Sensera | 0.02 | -65% | $10m |

In 5G technology for example, only 20 per cent of smartphones worldwide had 5G technology in 2020, but that is set to increase markedly in the years to come.

New inventions in IoT and AI devices have also led to more sophisticated electronics being made, and will only accelerate the demand for microchips and semiconductors.

And of course there’s the larger and longer structural demand taking shape in the emerging industry of electric vehicles (EV).

Silicon carbide chips to anchor the EV industry

Revasum (ASX:RVS) is the ‘shovel and pick’ play for the sector, providing the heavy grunt machines to actually produce the semiconductors.

It’s also one of the best semiconductor stocks on the ASX, with the share price almost doubling in the past 12 months.

The company designs and manufactures capital equipment with a strategic focus on the Silicon Carbide (SiC) market, and wafer sizes of ≤200mm.

SiC wafers have a few advantages over plain old silicon (Si) wafers; namely they operate faster, with less power loss and can handle higher power and withstand temperatures of > 200°C.

SiC-based power semis can also drive lower energy losses, reduce heat dissipation and operate at higher temperatures vs Si-based ones.

In other words, silicon carbide semis are perfect for the automotive industry.

Speaking with Stockhead recently, CEO Rebecca Shooter-Dodd said that traditionally, the industry has used silicon wafers but more recently, we’re seeing a shift to silicon carbide wafers.

“The automotive industry and specifically EVs and their charging stations are one of the real drivers for the silicon carbide industry at the moment,” Shooter-Dodd told Stockhead.

“It makes your car charge faster and go further, which is what everyone wants.”

Tesla is using silicon carbide, so it’s kind of a premium material right now.

“But what we’re seeing is as the costs fiscal down, more plants will move to silicon carbide,” she added.

Some other big guns like Cree and ST Microelectronics have also started to make the move to 8-inch SiC wafers – which is anticipated to triple in volume demand between now and 2025.

“What differentiates us from competitors is the process results we see off the tool. We’ve seen our results compared to other companies’ results, and they’re pretty damn good,” said Shooter-Dodd.

Revasum share price today:

Microchip stocks in AI and 5G

Brainchip has previously claimed that it’s the only publicly listed pure-play artificial intelligence (AI) company on the ASX, and it’s definitely been one of the most talked about companies in 2022.

Its stock price has doubled this year, following a couple of patent announcements for its AI microchips.

The company focuses on the development of its Akida Neuromorphic Processor, which powers smart homes, transportations, cities, as well as the health sector.

At face value, the latest Brainchip patent may be fairly difficult to decipher for investors with only a cursory knowledge of semiconductor chip technology based on the neural pathways of the human brain.

“Method and a System for Creating Dynamic Neural Function Libraries” is the name of BRN’s latest US patent success.

It follows another US patent approval for “Event-based Classification of Features in a Reconfigurable and Temporally Coded Convolutional Spiking Neural Network” on January 21.

Brainchip chief technical officer and founder, Peter van der Made, who holds a 9.351% stake in the business worth north of $2.5bn, said US patents act as validation of the technology BRN has built.

“We will continue to work towards increasing our patent awards globally as we continue to advance the field of neuromorphic artificial intelligence,” said van der Made.

Weebit is the inventor of ReRAM, a faster and lower-power memory chip that was built to power wearables, Internet of Things (ioT) devices, and a host of AI applications.

The ReRAM cell functions similarly to a synapse in the brain, making it an ideal solution for neuromorphic computing which drives AI.

The company has recently filed two new design-related patents, while progressing discussions with multiple potential production partners and customers.

ReRAM, unlike DRAM, is non-volatile meaning that it remembers the contents of its memory even when power is removed.

And unlike other ReRAM technologies, Weebit uses Silicon Oxide as their phase-changing material, with titanium used on either side of their phase-changing structure.

4DS is a pioneer of the Interface Switching ReRAM, a unique area-based ReRAM technology for storage in mobile devices and cloud data centres.

The company has 28 US patents for a bunch of its memory chip technology, which it developed entirely in-house.

Operating out of its facilities in Silicon Valley, the company says its unique Interface Switching ReRAM meets the essential requirements for Storage Class Memory, with speeds comparable to that of DRAM.

4DS is targeting the vast opportunity space between DRAM and NAND Flash.

Silex is an R&D company whose primary asset is a laser uranium enrichment technology.

But through a subsidiary called Translucent, its licensed a set of semiconductor materials known as crystalline rare earth oxides (cREO) to a UK company IQE to turn it into chips.

IQE is currently progressing the cREO technology towards commercial deployment for 5G mobile handset filter applications.

But Silex has said the outcome of this commercialisation program is uncertain, and remains subject to various technology and market risks.

A couple more microchips stocks on the ASX

Pivotal makes gas flow monitoring and control technology used while making semiconductors which require precise flows of gas to shape the underlying wafer on which the circuits are built.

The company recently announced that it’s considering undertaking an IPO in the US, and a subsequent dual listing on NASDAQ.

K2 bought the exclusive worldwide rights to the Mears Silicon Technology (MST), a patented, quantum-engineered material that enhances transistors to deliver significantly better performance in today’s electronics.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.