From market darling to outcast to darling again, Nuix emerges as top ASX tech stock in 2024

Nuix is top performing ASX tech stock this year. Pic: Getty Images

- Nuix’s share price skyrocketed after IPO, but fell sharply due to scandals

- But in 2024, Nuix has emerged as the top-performing ASX tech stock

- This came after successful launch of the powerful Nuix Neo product

Former market darling Nuix (ASX:NXL) has been on a roller coaster ride over the past few years.

After its high-profile debut on the ASX in late 2020, the tech company quickly captured strong market interest with its share price soaring and doubling within just a month of listing.

But the mood shifted dramatically in late 2021 when serious concerns emerged about its practices and governance.

The scandal broke out following revelations of internal disputes, allegations of financial mismanagement, and issues with the accuracy of the company’s reported earnings.

The turmoil led to a dramatic drop in the share price.

Throughout 2022, Nuix still struggled to regain investor confidence. Efforts to rebuild trust were ongoing, but the share price remained under pressure.

By late 2023, Nuix began to show signs of recovery, and in 2024, its shares made a remarkable comeback.

Nuix has now emerged as the top-performing tech stock this year after rising 150% and almost reclaiming its initial public offering price of $5.31 – thanks to significant turnarounds in its revenue and earnings.

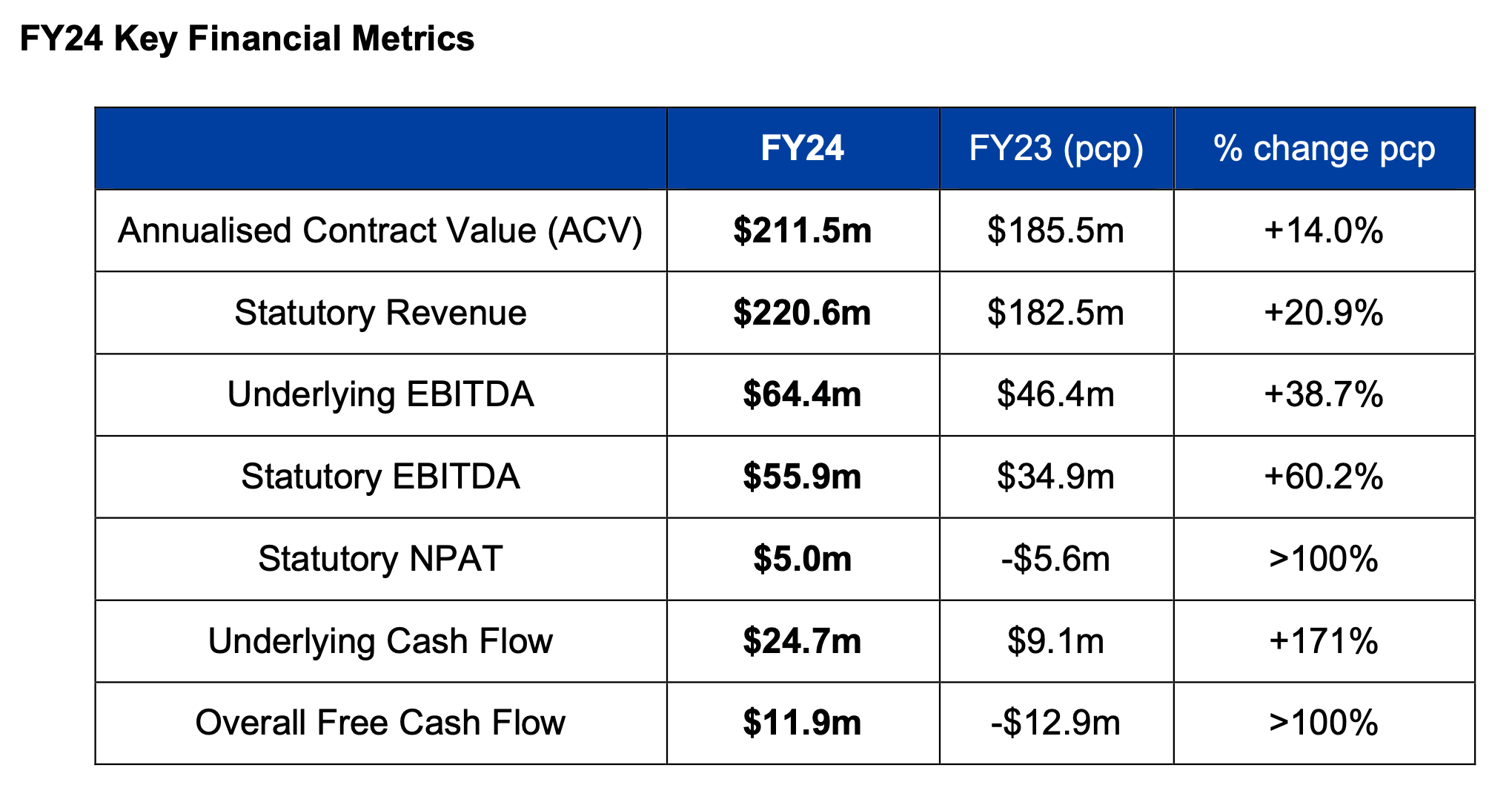

The company grew its top line revenue by 20% to $220m in FY24, while bottom line NPAT swung from a loss of $5.6m to a profit of $5m.

Crucially, Nuix generated free cash flow of $12 million during the year.

Nuix Neo is the answer

CEO Jonathan Rubinsztein attributed the strong performance to a solid finish to the financial year, driven by reduced R&D costs and the successful launch of Nuix Neo.

Nuix’s advanced software efficiently handles vast amounts of structured and unstructured data from sources like emails and social media. It’s great for legal, regulatory, and security tasks, offering powerful search along with visualisation features to simplify complex data.

The Nuix Neo is the company’s latest and most advanced platform, designed to tackle even more complex and massive data challenges with a lot more efficiency.

Launched in FY24, Neo is a big step up from the previous technology. What sets it apart is its ability to scale up easily, meaning it can process ever larger amounts of data without breaking a sweat.

In FY24, total ACV (annual contract value) from Nuix Neo amounted to $12.1 million, up 195% from the first half outcome of $4.1m.

Rubensztein sees Nuix Neo as the key to the company’s future success.

“FY24 represents a year of remarkable delivery by the Nuix team,” he said.

“The development and launch of Nuix Neo, along with three related use case solutions, is an outstanding achievement.

“Nuix Neo is an innovative step change in our customer offering and provides the foundation for an exciting growth trajectory for Nuix.

“Customer interest and take up has been particularly pleasing, as evidenced by the strong growth in Nuix Neo ACV over the year.”

How the Panama Papers made Nuix famous

In 2015, the tech world was rocked when Nuix discovered something pretty surprising about its website traffic. Early one April morning, the company noticed its visitor numbers had skyrocketed – tenfold, in fact.

At first, Nuix thought it might be a denial of service attack or some other tech mishap. But as it turned out, this spike in traffic was due to something much more exciting: the Panama Papers.

At the time, few realised the scale of the Panama Papers story or how crucial Nuix’s technology was to uncovering the global financial secrets hidden within those 11.5 million documents.

Nuix software’s ability to swiftly index and analyse such massive data sets allowed journalists to expose hidden tax havens and illicit financial schemes.

The International Consortium of Investigative Journalists (ICIJ) used Nuix software to sift through this vast trove of data in the Panama Papers, and the rest was history.

The power of Neo

In August, Nuix teamed up with fellow ASX-lister Atturra (ASX:ATA) and Hewlett Packard Enterprises to boost the speed of the Neo platform.

By running Neo on Hewlett Packard’s ProLiant servers equipped with Nvidia GPUs, the companies achieved a tenfold increase in processing speed for unstructured data, such as text, emails, and images.

Nuix and IT consultant Atturra are seeing increasing demand from governments and corporations of all sizes that are facing more regulatory pressures and tighter deadlines.

These organisations are being asked to analyse large amounts of unstructured data through information requests and various fraud investigations.

“Nuix has always led the industry globally in processing and analysing messy and unstructured data,” said Stephen Kowal, CEO of Atturra.

“Through our work with HPE, we are thrilled to be able to bring the infrastructure and services, supporting AI workloads and unlock faster analysis for more shared clients.”

What to expect in FY25

For FY25, Nuix has laid out its strategic targets and expectations.

The company is aiming for around a 15% increase in ACV, which reflects its commitment to steady growth.

Nuix also plans to continue the successful rollout of Nuix Neo and expects revenue growth from this product to outpace the increase in operating costs.

Also, the company anticipates maintaining positive underlying cash flow throughout the entire year.

“We are well positioned for the next stages of growth,” said Rubensztein.

“In the coming financial year we will continue to invest in our technology, further evolving our offering in line with our strategic vision.

“The technology and financial base established in FY24 provides a solid foundation for growth into FY25 and beyond.”

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.