As hot AI fuels a rebound in global tech stocks, which ASX plays could benefit?

Tech

Tech

Tech stocks in Australia and globally are having a much-needed resurgence in 2023 and for the most part it’s been fuelled by the rise in artificial intelligence (AI).

Released in November 2022, ChatGPT is latest technological breakthrough in what has been dubbed “generative AI”, with the chatbot becoming the fastest growing consumer application in history, according to a UBS study.

Since its launch, ChatGPT has gained immense popularity, with millions of individuals using its capabilities for activities like writing, app development, coding and even therapy sessions.

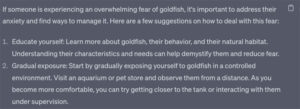

A colleague of mine asked ChatGPT how to deal with his crippling fear of goldfish, and received the following reply:

However, controversies have also arisen with the use of the new tech including issues of bias in responses, misinformation, ethical concerns such as academic integrity and whether it is the start of a new age of plagiarism and cheating.

Then there’s the story of a US law firm who used ChatGPT for researching precedents in support of a case they working on and ended up submitting to a court a whole lot of cases provided by the chatbot that didn’t exist. Stockhead’s Gregor Stronach gives a rundown of the case against ChatGPT here.

On the back of the release of ChatGPT has been the rise of US company Nvidia, which dominates the graphics processing units (GPUs) market and last year released the H100, one of the most powerful processors it has built, costing ~$US40k each.

Well known in the gaming sector, Nvidia is now reaping the rewards for investment in AI. Nvidia CEO Jensen Huang describes the H100 as “the world’s first computer [chip] designed for generative AI”, which can quickly create humanlike text and images.

The company also has the A100 chips, worth ~$10k each, and considered “the workhorse” for AI professionals. It also sells the DGX A100, which is eight A100 GPUs working together and costs ~$US$200k.

Nvidia has been making headlines throughout the year as tech companies worldwide scramble to get a foothold in the burgeoning AI sector. However, last week the company reached new heights when it add almost US$200bn to its market cap in a single after hours session.

Upon release of its Q1 FY24 results after market close, the Nvidia share price spiked 26%. It’s up ~172% YTD and now has a market cap of $963bn.

eToro market analyst Josh Gilbert told Stockhead AI is taking off, composing our emails, writing code, and in 2023 could even be giving our tech portfolios a lifeline.

“Nvidia shares have soared more than 150% this year-to-date, with the broader Nasdaq rising by 30% as the AI-fueled tech rally takes Wall Street by storm,” he said

“That resurgence is rubbing off locally as well – the ASX technology sector has significantly outperformed other sectors this year, up by 25% with AI-exposed stocks such as WiseTech Global (ASX:WTC) and NextDC (ASX:NXT).”

He said while the Microsoft-backed ChatGPT is the golden child in artificial intelligence right now, without companies like data managers NXT, AI wouldn’t exist at all.

“Investor opportunities lie with companies powering this AI boom worldwide – but also within industries that stand to benefit the most from embracing AI, such as marketing, finance and healthcare,” he said.

“Investor excitement around AI is understandable and given its potential, companies are racing to get ahead of this technology.”

“In their latest earnings call, Alphabet, Meta, Microsoft, Amazon and Apple collectively mentioned the term AI almost 200 times and are investing millions (potentially billions) into AI.

Gilbert said it’s important to remember, however, that AI is still an emerging field.

“AI is not a one-way investment – there will be ups and downs and it may take years to reach its full potential, much like we’ve seen with various other technologies over the years,” he said.

While there are several ASX tech companies using AI or set to benefit from AI such as data managers, there are actually only a few specifically working on developing the game-changing tech. Here are some which have caught our attention.

BRN is involved in neuromorphic computing, which is a type of AI that simulates the functionality of the human neuron and is working on commercialisation of its Akida chip.

Akida cleverly mimics the human brain to analyse only essential sensor inputs at the point of acquisition, processing data with efficiency, precision, and economy of energy.

BRN said keeping machine learning local to the chip, independent of the cloud, also dramatically reduces latency while improving privacy and data security.

With a market cap of $772 million, BRN is up ~8% in the past month but remains down more than 40% YTD.

AI translations company STG provides next generation language services supported by a technology stack and robust AI layers to clients globally.

By combining the latest available technologies with linguistic expertise, STG’s cloud-enabled translation services provider serves a range of sectors.

STR is due to release its full year financial result today on May 31. The company saw revenue rocket up in the first half of the FY23 as it locked in a further three-year deal with computer giant IBM.

The company said the latest deal would also make use of, and further enhance, the direct links the duo had established between Straker’s proprietary AI-powered RAY platform and IBM’s tech platforms.

STG’s RAY platform can also be used on apps such as Microsoft Teams and Slack.

The company has a market cap of $47 million and its share price is down ~36% YTD.

ICE’s Motion Intelligence is an AI-driven video analytics surveillance software designed to automatically identify unusual or unexpected events in real time.

Its software solution is particularly popular among US state prison end users.

“The prisons market has always offered a particularly strong use-case for icetana’s AI software,” CEO and MD Matt Macfarlane said.

The company announced last month it had received a 600-camera expansion order for its AI video analytics solution from a large shopping mall client in Kuwait.

With a market cap of just ~$10 million, ICE has seen its share price rise 51% YTD.

The global technology company specialises in providing high-quality, human-annotated data for machine learning and AI systems.

APX’s primary service is data annotation, where human workers review and label data according to specific guidelines and requirements.

The annotated data is used to train machine learning algorithms, enabling AI systems to understand and interpret different types of information.

APX has a large crowd of remote workers, referred to as the “Appen crowd”, who contribute to these data annotation projects.

The company’s expertise lies in handling complex and diverse data, including images, text, audio, and video. APX experience in various industries, such as healthcare, automotive, e-commerce, social media and more.

APX’s data solutions help organisations improve the accuracy and performance of their AI models, making them more reliable and effective in real-world applications.

In addition to data annotation, Appen also offers services like data collection, data processing, and linguistic consulting. The company last week announced the opening of its retail entitlement offer, part of a fully underwritten ~$60 million capital raise to support its effort to return to profitability.

APX has a market cap of $451 million with its share price rising ~18% YTD.

NXL is a software company that develops AI-enabled solutions for managing and analysing large volumes of data.

The company said its platform supports a range of use cases, including criminal investigations, financial crime, litigation support, employee and insider investigations, legal eDiscovery, data protection and privacy, and data governance and regulatory compliance.

Recently NXL announced it will acquire all the shares in Rampiva, a workflow automation and job scheduling software provider with the initial cost of ~US$2 million in cash and US$2 million in NXL newly issued shares.

Up to a further US$3 million in NXL shares will be issued if Rampiva achieves ACV growth and cost management milestones in the three years post acquisition.

Rampiva is a long-term NXL technology partner founded in 2016. NXL has a market cap of $320 million with its share price rising ~62% YTD.

Any stocks in this story missing you think should be included? email [email protected]

Now Read: Move over lithium as AI and Nvidia lead tech market rally boosting ASX ETFs