ESG tech is in demand and Synertec has the technology to deliver

Pic: Getty Images

The global focus on sustainability and reducing carbon emissions is driving demand for ESG technologies, and for Syntertec this presents an historic opportunity for its innovative technology and engineering solutions.

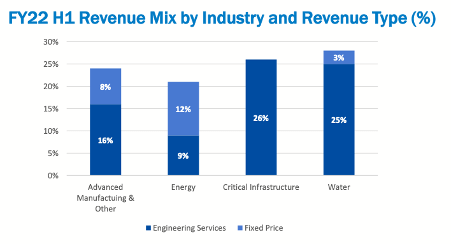

The company’s FY22 H1 results demonstrated the strength of Synertec’s Engineering business to generate cash flows, innovation and expertise to support emerging ESG technologies that are gaining traction with clients and real momentum towards commercialisation.

Total Revenue for the half was $5.8 million, up 65% on the prior comparable period (pcp) and revenue from high-margin engineering consultancy services increased by 93% to $4.3 million.

This shift toward high-margin revenues has resulted in Synertec doubling its gross margin percentage on pre-COVID levels, a trend the company sees continuing. Recent talent recruitment has enabled a near doubling of billable hours capacity, and includes the hiring of a new General Manager to lead the Engineering team.

The Engineering division added around $6 million in new contract wins, plus an agreement with Metro Trains Melbourne worth up to $3 million.

Adjusted group EBITDA was a loss of $0.8 million, which was a 28% improvement on the pcp, and included R&D costs of $0.4 million – which the company says reflects the investment in its Technology.

Technology business building momentum

All that Engineering know-how, and R&D is paying off. During the half year, Synertec (ASX:SOP) signed an MOU with Santos (ASX:STO) for the development of its Powerhouse AI-driven solar-battery power system.

“Some six months later, and with great credit to our team, we are now part way through the fabrication of our Powerhouse system,” MD Michael Carroll said.

There are a number of significant near-term milestones for Powerhouse, including the commencement of field trials in Q4 FY22, with commercial term and completion/sign off due in FY23.

Powerhouse technology has broad power applications across the energy, resources and other industries requiring remote continuous power solutions.

The company’s LNG Custody Transfer System was also certified for marine settings by the world’s leading classification body, DNV.

Carroll said it’s an important achievement that offers Synertec and its partner GasLog significant exposure to growing demand for LNG-fuelled shipping, with exposure to several local and international near-term opportunities, led by South Australia’s Outer Harbour LNG project.

“We also signed a perpetual, exclusive and royalty-free licence agreement with our partners, GreenTech, that provides us with the right to use Composite Dry Powder technology across a range of key global energy markets, including Australia, the Americas and Canada,” he said.

Commercialising the ESG-focused tech

With net cash as at 31 December 2021 of $7.1 million, the company’s balance sheet is well placed to support the dual strategy of commercialising large near-term ESG-focused technology opportunities in the energy sector and grow out the high-end engineering solutions business.

This article was developed in collaboration with Synertec Corporation, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.