Credit Intelligence partners with UTS to deliver BNPL to SMEs

Pic: Justin Paget / DigitalVision via Getty Images

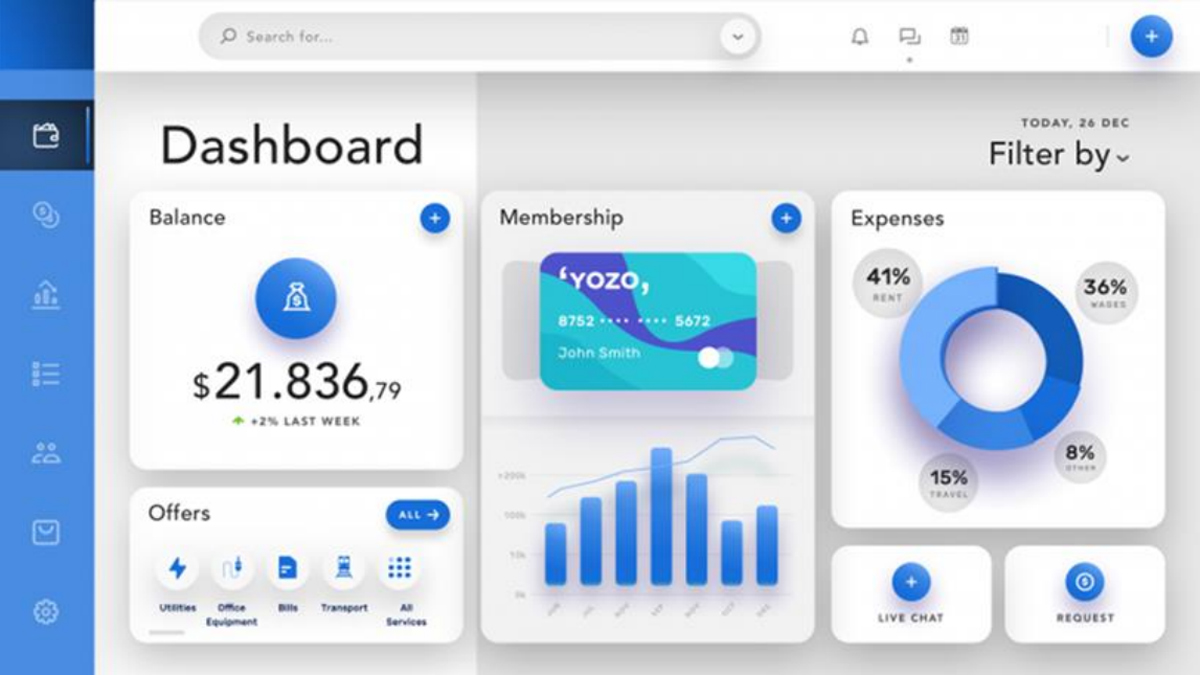

Special Report: Diversified fintech Credit Intelligence (ASX:CI1) has teamed up with the University of Technology, Sydney (UTS) to enhance its SME-focused BNPL platform YOZO.

YOZO, which Credit Intelligence acquired 60 per cent of last December for $1.38 million, was developed by a leading research team at the University of Technology, Sydney (UTS)in 2019.

The technology works as an AI-based platform for small business owners, to help them see their financial position and potential borrowing capacity.

Since the acquisition, CI1 has been developing YOZO into a broader platform for SMEs – offering lending and BNPL solutions in addition to its present financial management features.

Now the university and Credit Intelligence have unveiled a deal to continue to develop the platform.

The system will connect SMEs to BNPL solutions that are tailor-made and personalised for them. In determining the best BNPL solutions for individual SMEs, YOZO’s algorithm will take into account factors such as terms of the facility and repayment frequency.

YOZO’s clients will have 24/7 access to the platform and will be able to spend more time on their core operations rather than worrying about financing.

YOZO’s financial health check features will continue to be offered all one the one user-friendly, centralised dashboard.

It will alert SMEs of upcoming payments, late payments and dishonours as well as automatic advice if there are upcoming debits for which the business does not have sufficient funds.

Credit Intelligence-UTS deal to be one of a kind

Via its partnership with UTS, CI1 will establish a market-leading platform where YOZO Finance operates as a ‘one-stop shop’ for SME financing needs.

CI1 also said it will provide the ideal platform to promote ethical lending and responsible borrowing, as well as ethical debt collection and restructuring.

The company’s executive chairman Jimmy Wong hailed the deal, saying it was an ASX first.

“CI1 looks forward to continuing to increase our involvement with UTS in order to technologically revolutionise BNPL for SMEs, ethical debt collection and debt restructuring for SMEs and individuals,” he said.

“To the best of our knowledge, we are the only BNPL or debt collection/restructuring company on the ASX to be pursuing technical collaboration with a major university.”

The company told shareholders when announcing the acquisition, the global lending market would see a compound annual growth rate (CAGR) of 6% from 2021 and reach nearly $8 billion by 2023.

Since initial development in May 2019, YOZO’s beta testing has helped 300 clients access finance and it has reached a total loan book of $3 million.

Credit Intelligence is aiming for a rapid commercial rollout of YOZO this year.

This article was developed in collaboration with Credit Intelligence, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.