ChapterTwo launches first of its kind debt management mobile app in Australia

Credit Intelligence’s subsidiary ChapterTwo has made great strides in the debt management space in Australia, helping people to avoid bankruptcy. Image: Getty

Credit Intelligence’s subsidiary ChapterTwo has made great strides in the debt management space in Australia, helping people to avoid bankruptcy.

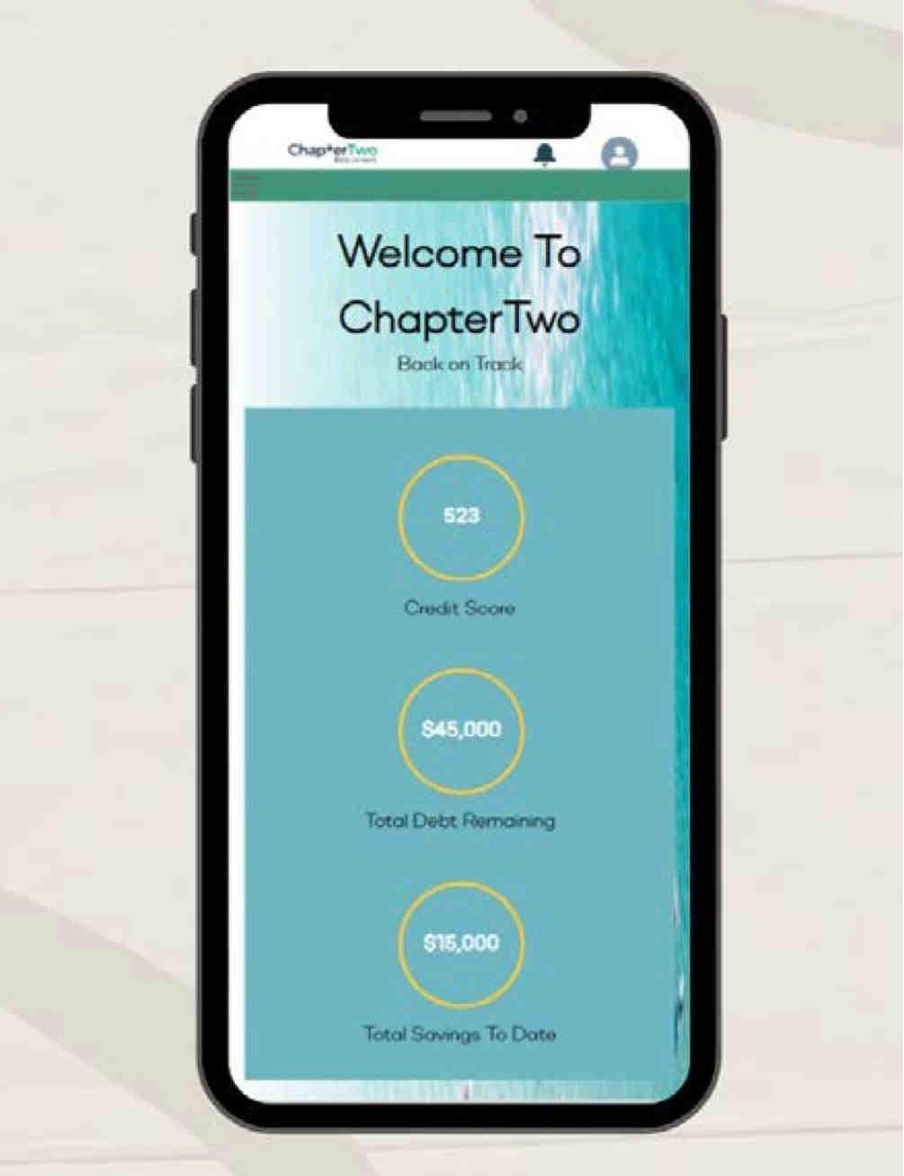

Credit Intelligence (ASX:CI1) subsidiary ChapterTwo Australia is set to launch its new Debt Management app, and has already begun a pilot rollout ahead of a full launch expected in the last week of September.

The app is powered through the Salesforce portal and launched through a Salesforce mobile publisher on the IOS and Android stores.

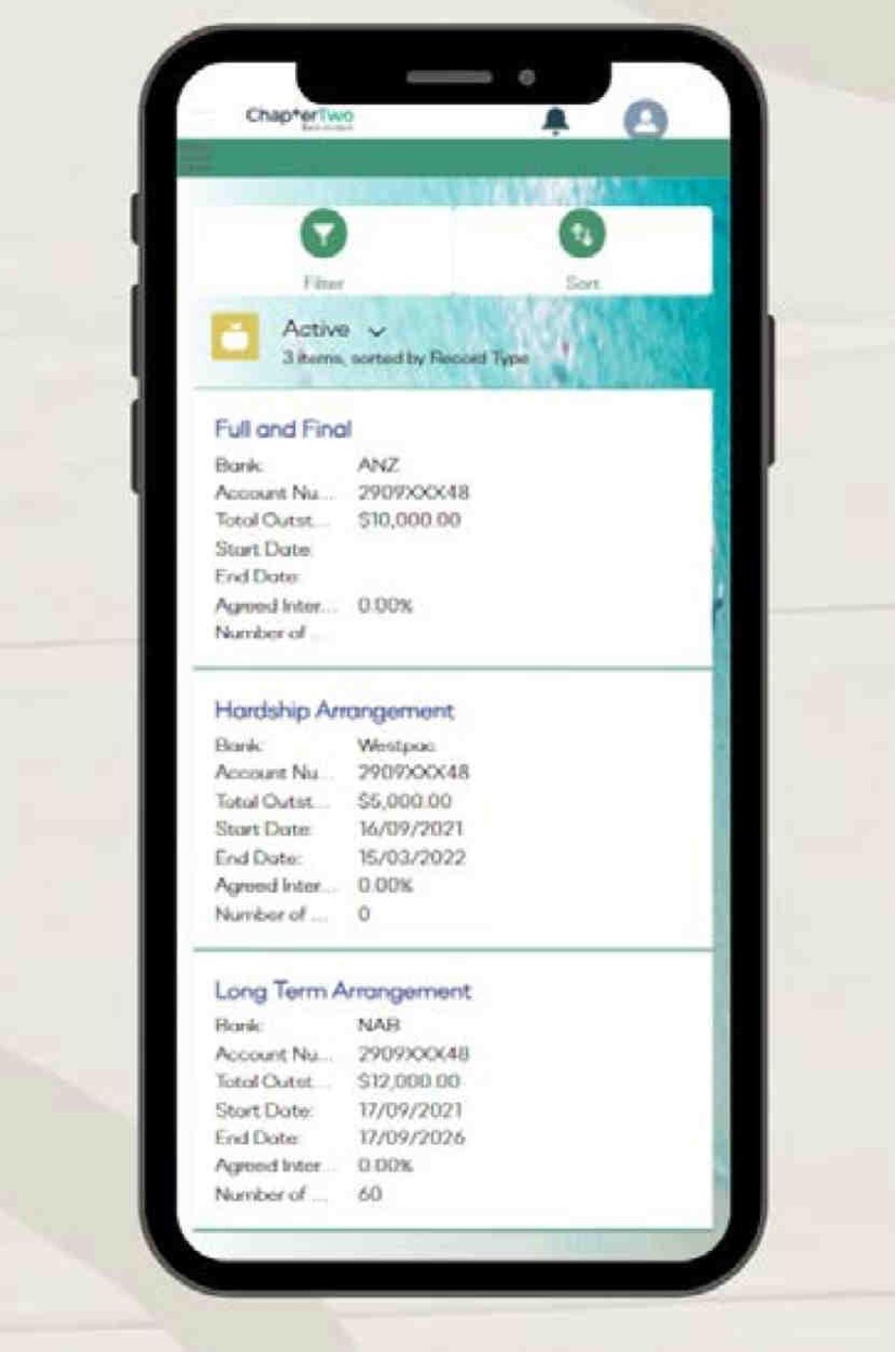

The app is the first of its kind in Australia, in that it has the ability to list all of the clients’ debts in one place, removing the need for multiple internet banking accounts and direct debits.

Here’s how it works – once debt arrangements are negotiated the clients could make monthly payments to ChapterTwo which will then manage their debt repayments.

As repayments are made, the client’s debt balances will subsequently be updated on the app, which enables them to check both balances and repayment history on the one platform.

Users can also download all repayment records, which will be useful in any future lending applications.

“This innovative debt management app will organise, with ChapterTwo’s help, clients’ indebtedness in one place on their mobile phone where they can manage and instantly see their financial well-being,” says CI1 CEO, Jimmie Wong.

What is ChapterTwo?

Founded in 2015, ChapterTwo is a fast growing, Sydney-based debt restructuring firm that provides informal debt negotiation and mortgage broking services to individuals experiencing financial hardship in Australia.

CI1 has a 60% stake in the business.

ChapterTwo’s debt solution services are especially relevant during the pandemic, as they provide an alternative way for people to avoid bankruptcy.

While most other debt restructuring companies typically focus on consumer insolvency, which forces people to file bankruptcy, ChapterTwo does things differently and focuses on what’s called ‘informal debt arrangements’.

The company could put the debtor into a hardship arrangement with the bank for six months to work out a repayment solution, or an informal agreement where it helps negotiate a repayment plan with the banks for five years.

Importantly, both options allow debtors to manage their debts without filing for bankruptcy, or impact their credit files.

“We have invested considerable time into exploring what our clients need and what is lacking in the market,” says ChapterTwo managing director, Chris Mushan.

“There are no fintech solutions available to Australian consumers which couple debt management services and technology and we see an increasing need for this solution.”

“Consumers are being offered BNBL, credit cards and loans across the board and are finding it harder to manage the proliferation of credit available to them, and at the end of each month finding the payments overwhelming,” Mushan added.

Many of ChapterTwo’s clients have poor credit histories, but once debt is negotiated by ChapterTwo, these clients would be able to see their credit scores improve gradually on the App.

According to recent data, Australian household per capita debt contributes to some of the biggest in the world.

As a result, many Aussies are turning to Insolvency agreements to fix their financial problems.

Customers who manage to work out their debt with ChapterTwo will be able to achieve certain milestones that weren’t previously obtainable, like the purchase of their first property.

CI1 says the app will be built out and expanded to encompass additional services in the future.

“After the initial rollout in Australia’s sophisticated fintech environment I will work with Chris to assist in migrating this unique app and service over Ci1’s Hong Kong and Singapore and other countries personal debt businesses,” Wong said.

Source: Credit Intelligence

Source: Credit Intelligence

This article was developed in collaboration with Credit Intelligence, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.