Brains in motion: Propell does just what the name says with latest SME product launch

The Aussie finance platform Propell Holdings (ASX:PHL), says it’s launching a new, in-house lending product - Business Loans. Image: Getty

The Aussie finance platform Propell Holdings (ASX:PHL), says it’s launching a new, in-house lending product – Business Loans – on the back of stirring customer demand and some strong early results following its trial deployment.

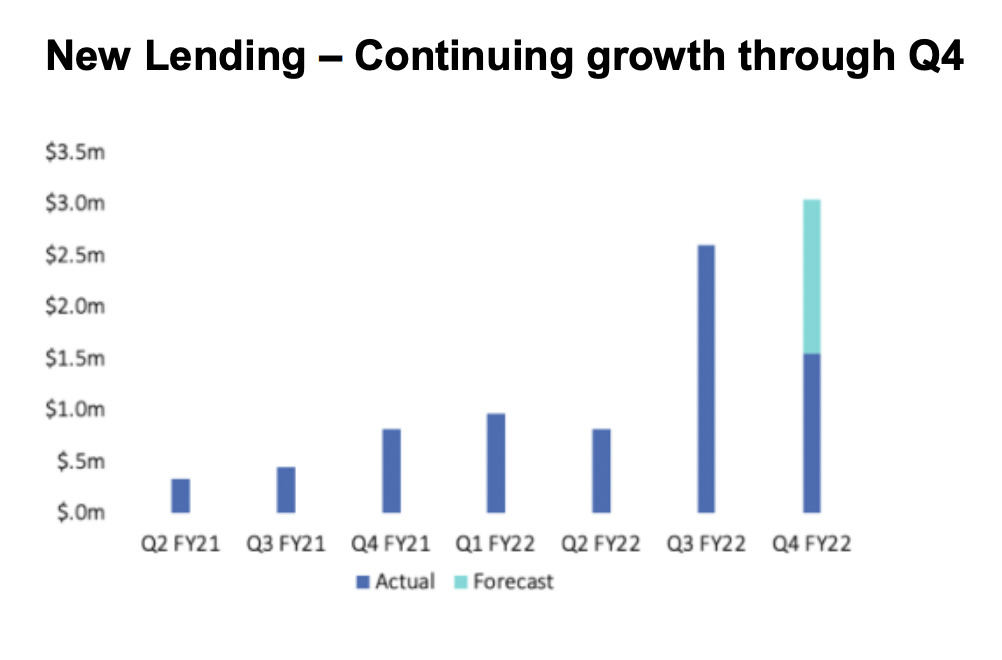

The move comes off the back of the SME-focused alt-lender’s incredible run during the uncertain markets of 2022, with January and March seeing the largest ever lending book growth on record.

CEO Michael Davidson says the whole point of Business Loans is to give PHL customers more choice and more access to capital.

“It’s simple. We want our SME’s to operate and grow in the way they want,” Davidson told Stockhead.

He said Business Loans will provide a fixed dollar amount, over a fixed term that can be used for specific business purposes like buying assets or equipment.

Flexibility and support for SME customers

The move follows Propell’s ongoing success with its Line of Credit products (both six month and 12 month) and the effort of Davidson’s team throughout a trial deployment is the result, he says, of consistent feedback from PHL customers.

He says Propell’s family of SME’s now have an even richer suite of options to work with their existing Line of Credit facilities, or with PHL’s highly competitive fixed term loans via the Business Loan product.

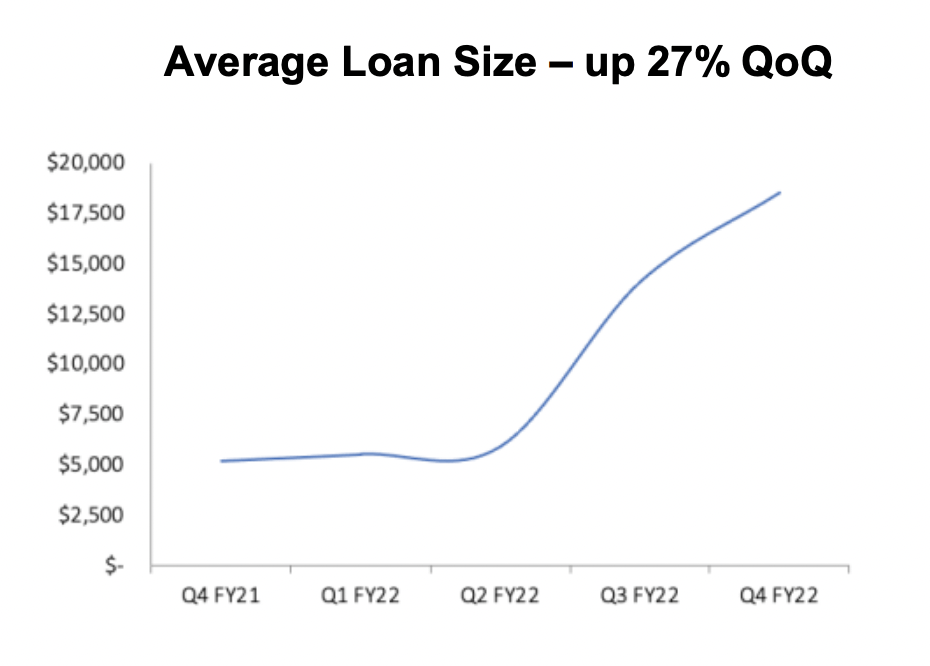

Given its characteristics – larger average loan size and target segment demand – this represents a new revenue line that is expected to contribute materially to the business.

In a statement to the stock exchange, PHL said that initially the Business Loan will be offered as an unsecured product, however over time, it will be added as a secured Business Loan product.

The Business Loan provides further leverage on the lender’s existing credit decisioning engine and broader loan management system, key components of its proprietary financial services Platform.

Another landmark moment

The launch is another key milestone for Davidson’s team as it continues to build on Propell’s core proposition, further enabling fast and simple access for SMEs to the finance products needed to operate and grow.

Davidson said his team, encouraged by the massive growth in PHL’s lending book (it’s up well over 200% in Q3), are pleased to keep building flexibility into the business mission.

“This product has been developed over the last few months to support our core proposition: the operation and growth of Australian small businesses.”

“Business Loans is a response to overwhelmingly positive feedback from customers on our existing suite of products.

“We’re excited to be able to provide even more financial flexibility for businesses, with the ability to access loans of up to $250,000 quickly and easily,” he added.

Reason to be optimistic

With average loan sizes spiking this year, work is underway to secure an additional larger wholesale facility to support Propell’s continued growth whilst driving down wholesale funding costs, in turn improving margins.

Davidson says work is underway to secure an additional larger wholesale facility to support Propell’s continued growth whilst driving down wholesale funding costs, in turn improving margins.

The new product provides new revenue opportunities that will contribute materially to the ongoing growth of the business.

“And we are optimistic about the uptake and flexibility it will provide for our customers.”

Earlier this month Propell opened an entitlement offer to raise $2.22m – with the funds set to support the company’s lending facility and drive organic growth.

The company says the 1:2.5 non-renounceable entitlement offer at $0.058 per share will give shareholders the opportunity to participate at the same issue price as under the recently completed $1.36m placement.

The idea is to ramp up the lending book, which is already up 211% for Q3 to $2.53m, with January and March representing PHL’s largest months on record.

Join a briefing

Propell CEO Michael Davidson will be holding an investor webinar on Thursday, 26th May at 12pm (AEST). Register for the investor briefing here.

This article was developed in collaboration with Propell Holdings, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.