Propell ramps up lending book, opens $2.22m entitlement offer

The company’s digital multi-product finance platform is focused on the small business segment in Australia. Pic: PM Images (DigitalVision) via Getty Images.

Fintech player Propell Holdings has opened an entitlement offer to raise $2.22m – with the funds set to support the company’s lending facility and drive organic growth.

The company says the 1:2.5 non-renounceable entitlement offer at $0.058 per share will give shareholders the opportunity to participate at the same issue price as under the recently completed $1.36m placement.

The idea is to ramp up the lending book, which is already up 211% for Q3 to $2.53m, with January and March representing the largest months on record.

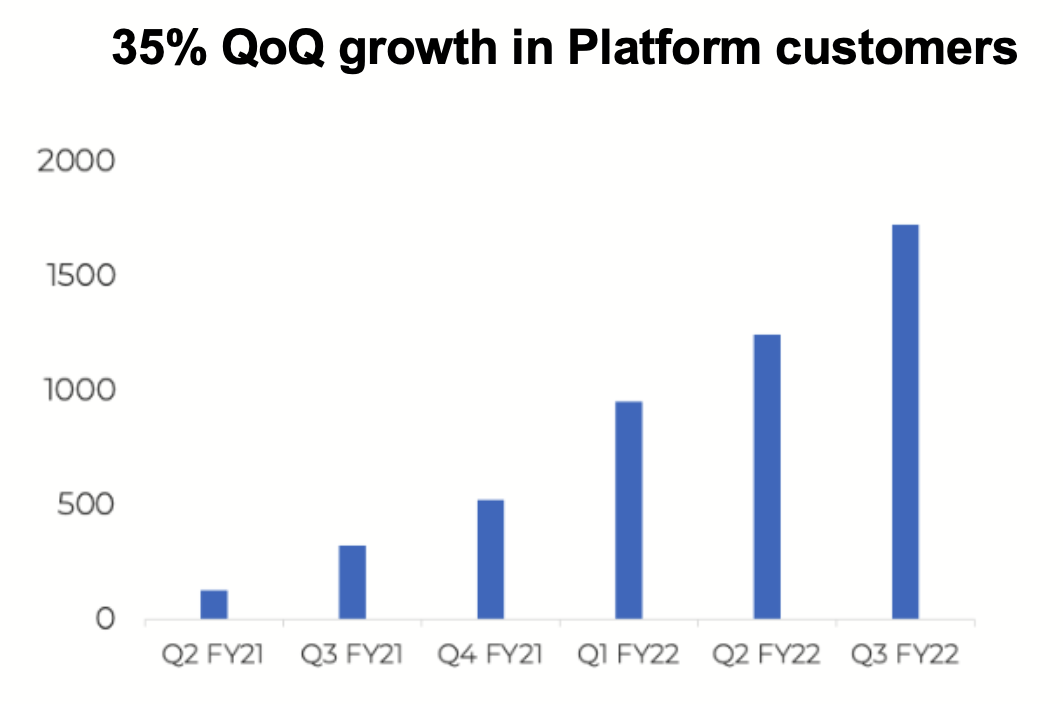

Customer growth up 35% for Q3

Propell Holdings (ASX:PHL) puts this growth down to the launch of its new Line of Credit product, along with improvements in platform customer financials and sentiment.

Apart from rising borrower numbers, lending volumes were also driven by a 138% increase in average loan size, a key indicator of customer quality, which the company says represents a critical measure in scaling the business.

Plus, platform customers were up 35% on Q2 FY22 to more than 1,700. That’s an increase of 420%+ since the company IPO’d in April last year.

New lending product is a goer

PHL has seen “significant immediate take up” from its new lending product, which has seen an increase in total approved facilities of $3.9m to +$9m, and an increase in average loan size by 138% QoQ.

This is an important milestone for the company as it builds on Propell’s core proposition, further enabling fast and simple access for small businesses to the finance products they need to run and grow.

Key features of the new product include:

- Unsecured, Line of Credit Facility;

- Loans from $5,000 to $250,000;

- Simple pricing with a flat rate monthly fee and no application or account charges; and

- Up to 12 months duration, however flexibility to repay the loan at any time.

Given its characteristics, larger average loan size and target segment demand, the product represents a new important revenue line that is expected to contribute materially to the future income growth.

Customers and revenue growth the focus

The company is confident that it is positioned well for the coming period having delivered platform development ahead of schedule, through to end of Q3 FY22.

Propell will now shift its dual focus on development and growth to placing the emphasis primarily on customer, product, and revenue growth.

The company anticipates Q4 will start to see the impact of the significantly increased lending activity.

Join an investor briefing with CEO of Propell Holdings, Michael Davidson, where he will discuss the company’s strong quarterly performance in more detail. Click here to register.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.