Australia just installed its 500,000th smart meter and these ASX stocks could benefit

Pic: Morsa Images / DigitalVision via Getty Images

Australians have rushed to sign up for smart meters since rule changes in December made the energy technology free for consumers across Australia.

In fact Australia has just installed its 500,000th smart meter, the Australian Energy Market Commission announced on Thursday. That’s opening up opportunities for a handful of ASX-listed companies that focus on energy monitoring (see below).

In South Australia, 10 per cent of all households now have the devices installed.

The rollout hasn’t been without its glitches, but it does make the State a petri dish for another technology that is in its early stages of roll-out: energy monitoring.

Energy management software is a technology that has been on the cusp of success for well over a decade.

But unless a household has a smart meter, a fully connected home, or a high-tech solar panel or battery system, they’re unlikely to be able to properly use software that can tell you when it’s best to use the dryer.

A spokesperson for the Australian Energy Market Commission (AEMC) says smart meters will create opportunities for these kinds of technologies, which can make smart meters truly useful.

If you want smart appliances, you’ve really got to have a smart meter, she said.

Who’s who

Stockhead monitors six small caps that have are wholly or substantially focused on providing energy management services to businesses and consumers.

Almost all are growing strongly, although few are yet to post a profit:

| ASX code | Company | Price change (12 months) | Price Aug 9 (intraday) | Market Cap |

|---|---|---|---|---|

| BID | BIDENERGY | 3.81481481481 | 0.13 | 103.69M |

| EOL | ENERGY ONE | 1 | 0.86 | 17.09M |

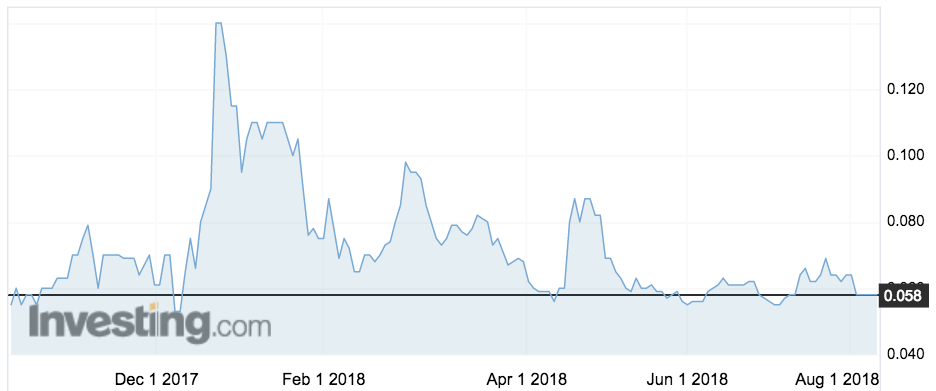

| BIQ | BUILDINGIQ | 0.260869565217 | 0.058 | 13.66M |

| EPW | ERM POWER | 0.111111111111 | 1.4 | 376.75M |

| SIS | SIMBLE SOLUTIONS (listed Feb 2018) | -0.125 | 0.175 | 15.74M |

| EAX | ENERGY ACTION | -0.141176470588 | 0.73 | 19.21M |

| BUD | BUDDY PLATFORM | -0.541666666667 | 0.11 | 106.14M |

It can be a tough market. Energy Action put itself up for sale this week.

Some have struggled to turn big promises about customer acquisition into revenue.

BidEnergy watched as 7 per cent was wiped from its share price on Thursday — but that came after a steep climb that started in July after it said it was launching a consumer product this month.

Others like BuildingIQ’s share price has repeatedly been the victim of one-day pumps.

They are also up against the big guns.

Unlisted Redback Technologies is one of the forerunners of the sector in Australia, and is backed by Energy Australia, while Origin Energy has a Californian startup working on the issue for it.

Big opportunity

Yet the opportunity is high, particularly in the consumer market.

This segment is expected by researcher Bloomberg New Energy Finance to provide almost half of the country’s energy needs by 2050 from solar panels.

Energy Consumers Australia says only 5 per cent of Australia households have bought monitoring software, but that another 20 per cent say they are looking into it.

Research from the Melbourne Sustainable Society Institute at the University of Melbourne indicates that while smart meters are being rolled out apace, many households don’t have access to the kind of technology that will allow them to fully use them.

BidEnergy has made baby steps into the consumer space — albeit not by using smart meters.

It plans to roll out out a bill analysis service that can match a household’s bill against all of the retail energy deals available on the market.

And as generators cotton on to concepts like ‘virtual power plants’, as AGL did in 2016 with a network of remotely monitored households with solar panels that can buy and sell energy as the system needs, Australia’s increasingly-informed population is likely to start demanding more control over how they spend their energy.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.