ASX Tech Stocks: Sparc nabs $1.1 million funding increase for hydrogen water splitting tech

Pic: via Getty Images.

- Sparc Hydrogen nabs 50% increase in water splitting tech development funding

- IntelliHR receives competing takeover offer at $0.14 per share

Green hydrogen tech developer Sparc Hydrogen (ASX:SPN) has secured a A$1.1 million increase in funding increase for Stage 1 of its Joint Venture with the University of Adelaide, Fortescue Future Industries (FFI) and Sparc Technologies to develop its photocatalytic water splitting technology – with the aim of producing low-cost green hydrogen on a commercial scale.

Approval has also been given for the appointment of an experienced Project Manager, an increase in resources at the University of Adelaide, design and construction of an on-sun prototype reactor as a precursor to pilot scale design, and for additional working capital.

“The significant increase in funding for the project is another strong endorsement of Sparc Hydrogen’s green production process and demonstrates the increasing maturity of the technology,” executive chairman Stephen Hunt said.

“We are excited about the acceleration of on-sun testing and with the appointment of an experienced project manager to lead development of this work as we move towards piloting.”

The company says the acceleration of on-sun prototyping is part of testing the efficacy of the technology in real world conditions.

The prototyping is expected to be undertaken at an existing concentrated solar field and would be the first demonstration of the technology outside of the laboratory and is targeted to be conducted in mid-2023.

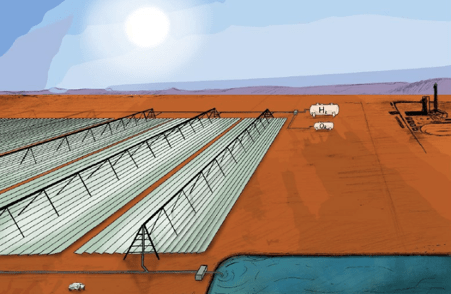

Here’s a cute mock-up of the process:

The funding bump is around a 50% increase in committed funding and budgeted to be fully funded by R&D tax rebates – so no increase in investment is required from the JV partners.

SPN share price today:

Back in Jan, the HR software player entered a Scheme Implementation Deed (SID) with Humanforce Holdings for Humanforce to acquire all the issued shares in IHR for $0.11 cash per share.

But the company has now received an unsolicited counterproposal from The Access Group for $0.14 per share.

That’s a tidy 122% premium to the closing price of IHR shares on 30 January 2023.

The board is considering whether it constitutes a ‘Superior Proposal’ under the terms of the Humanforce SID, and Humanforce now has a five business day matching right.

In the meantime, IHR directors maintain their existing recommendation in favour of the Humanforce proposal.

IHR share price:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.