You might be interested in

Tech

Harvest Technology soars 23pc on additional orders with key Five-Eyes defence customer

Tech

ASX tech November winners: Indian ATMs pay out a handsome 67% for Findi, as sector stretches lead over benchmark

Tech

Tech

Well, what do you know? Far from being in a crash-landing recession after the near-death experience in the banking sector, the markets are instead flying sky high.

The Nasdaq 100 index, a bellwether for global tech stocks, quietly entered into a technical bull market last week.

(Generally, a bull market is defined as a rise of 20% or more over at least a two-month period.)

At Monday’s New York close of 13,051 points, the Nasdaq 100 index is up 20.15% so far in 2023, and 25% higher than its one-year low of 10,440 back in January.

It’s at the highest level since August 2022 when tech stocks surged to heights driven by the pandemic-fuelled rally.

The last quarter was also the second best-performing quarter for the Nasdaq 100 index in the previous 10 years, trailing only the stunning 30% rise in Q2 of 2020.

Here’s some encouraging facts for tech focused investors.

Since 1990, there have been four bull markets for the Nasdaq 100 index, and according to Bezinga, a bull market rally during that period could last for as long as eight years.

The first bull market was from October 1990 to July 1998, an eight-year long bull market, with the Nasdaq 100 delivering a total return of 962.4%.

From October 2002 to October 2007, the Nasdaq was also in a bull market when it delivered a total return of 153.4%.

From March 2009 to February 2020, the index delivered an astonishing total return of 1,156.1%.

And from April 2020 to February 2022 Covid period, the index was also in a bull market, delivering a total return of 134.2%.

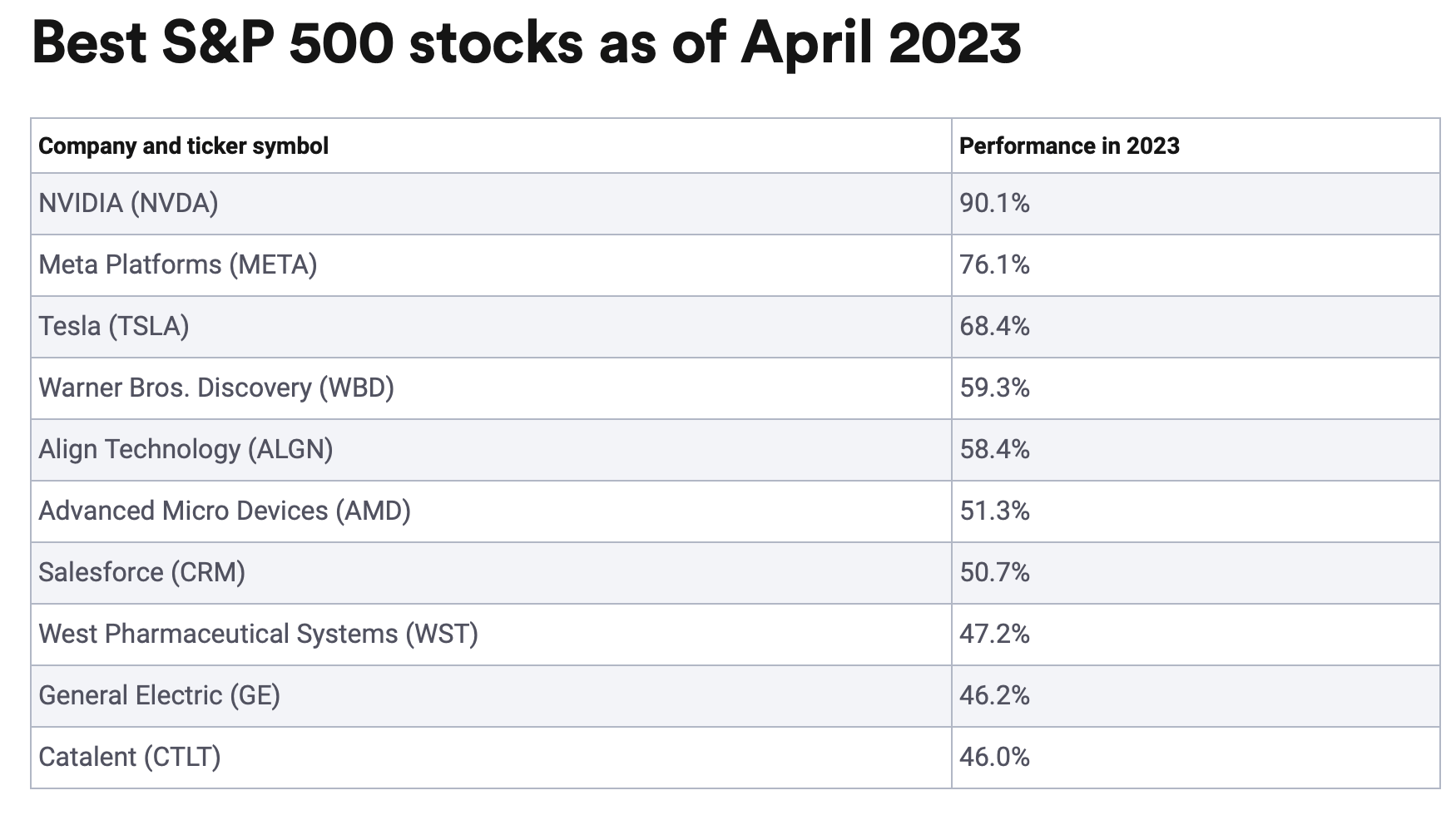

And in 2023, almost 90% of the S&P 500 index’s gains this year is accounted for by just 20 stocks, most of which are traded on the Nasdaq including Nvidia, Apple, and Meta.

The decline in ASX small caps of more than 20% on average in 2022 has raised the question on whether the tide could also be turning soon for local tech stocks, presenting buying opportunities for investors.

Emanuel Datt, chief investment officer, Datt Capital believes there is ample buying opportunities in the small caps sector right now, with a wide range of sector opportunities to pick from.

“And the tech sector is no different. Today Artificial Intelligence or AI adoption is on the front burner for many small cap tech focused companies. We view this environment becoming more crowded and highly competitive,” Datt said.

Datt says he likes the look of AI stocks like pure AI play Appen (ASX:APX) at current levels.

“Appen has experienced significant downward pressure on the share price at the same time as AI has catapulted into mainstream consciousness via the launch of OpenAI’s ChatGPT.”

“ChatGPT has transformed AI from a vague and remote concept to a readily accessible real-world experience in a matter of months,” says Datt.

Datt however advises investors to be cautious at this point in time, saying that ASX tech companies have to cope with higher cost inputs due to inflation.

“Tech stocks have been always particularly vulnerable to rising interest rates, which drive up the present-day cost of investing in future earnings,” he explained.

He noted a few companies that may struggle in this rising rates and inflation environment.

Bravura Solutions (ASX:BVS), which specialises in a range of administration and management applications in the wealth management industry, has lost more than 50% of its market value in calendar 2022 and could struggle further.

IntelliHR (ASX:IHR) is another AI focused small cap whose share price has struggled and is now the subject of a takeover offer from Humanforce after experiencing a share price slide of around 75% last year.

“High cash burn business models that have questionable sustainability, in our view, also includes call recording company Dubber Corporation (ASX:DUB) and cloud based communications provider Whispir (ASX:WSP),” Datt said.

“However, despite these trends, as an unconstrained or benchmark unaware manager who is active in the small cap space, we will continue to monitor risk reward propositions, and note that valuations are beginning to look attractive within certain parts of this market,” Datt said.

RBC Capital Markets meanwhile expect some of the the loss-making ASX tech stocks to finally deliver profits over the next couple of years.

RBC believes the current market levels could be a great entry point to get into these ASX stocks before they swing into profit for the first time.

Novonix has mapped out its growth strategy for 2023 and beyond of maintaining its competitive edge throughout the EV battery and energy storage supply chain.

The company has a long term strategy of developing its synthetic graphite production capacity with plans to expand to 150,000 tonnes per annum by 2030.

It will also focus on the commercialisation of its proprietary pipeline of advanced battery technologies.

Novonix’s broader battery technology pipeline contains a number of innovative materials and processes in advanced anodes, cathodes and electrolytes, as well as advanced capabilities for energy storage through its partnership with Emera Technologies.

EVS provides ESG solutions across aviation, mining and industrial, waste and water.

The company is expected to gain momentum on heightened concern for the environment, as well as tightening industry regulations.

The company has an advanced technology for water treatment powered by machine learning and deterministic modelling.

The company’s ANOMS flight tracking platform provides the capability to effectively measure, analyse, and communicate ground and airborne operational performance of four major national airports.

EVS Omnis meanwhile allows the customer to monitor odour, and review past incidents and determine whether its facility was at fault or not.

Family Zone is an emerging leader in the fast growing cyber safety industry.

The company’s main asset is its patented cyber safety ecosystem, a platform enabling collaboration between schools, parents and cyber safety educators.

A number of tailwinds are present in the industry.

For example, the UK’s Department of Education’s Keeping Children Safe in Education legislation has been in place since 2014, however recently has been amended to include what schools must do to comply with the legislation.

In the the US meanwhile, over US$125 billion of residual funding will be apportioned over time with a portion likely to be relevant to Family Zone’s online safety product offering in US schools.

Frontier is an owner and operator of online marketplace businesses in fast growing emerging markets.

Currently, FDV’s portfolio consists of 16 market leading companies, operating in 20 markets in Latin America, Asia, and MENA across property, automotive and general classifieds.

Assets include Zameen, a Pakistan-based property marketplace that achieved record revenue of $24.6m in FY22.

In Latam, the company has a strong management team with proven track record of building classifieds marketplaces.

The real-time remote control and monitoring tech specialist enables customers to stay connected with their operations anywhere in the world while utilising a fraction of the bandwidth.

HTG’s technology can livestream multiple channels of HD video, audio, and data securely to a monitoring system.

The company says it continues to see momentum in demand for its Infinity suite of products which has led to rapid growth in pipeline and new customers.

RBC Capital Markets also believes these profit-making ASX tech stocks could grow their profits over the next couple of years:

Since listing on the ASX in 2011, Alcidion has been providing the healthcare market with technology solutions based on its flagship product, the Miya Precision.

The Miya technology collects information to centralised dashboards in clinical settings to support clinical decisions.

In the first half, revenue rose 48% on pcp to $19m for an underlying EBITDA loss of $1.1m.

Alcedion believes it can withstand economic headwinds and will remain on track to be EBITDA and cashflow positive for FY23.

Bigtincan is helping the world’s leading brands facilitate the buying experience with its sales enablement software.

The company has recently launched GenieAI, an artificial intelligence technology that enables sales, partners, customer-facing teams, and all employees to dramatically increase their productivity.

The new features are driven by the latest technology known as “large language model tools”.

“GenieAI is truly magical, providing users with a powerful, AI-driven platform to unlock their organisation’s smarts,” said David Keane, CEO and co-founder of Bigtincan.

Bigtincan says it remains on track for its guidance for FY23, being: Revenue in the range of $123m-128m, and Adjusted EBITDA to exceed $5m.

Damstra provides workplace management solutions to multiple industry segments across the globe.

The company’s flagship is the Damstra Enterprise Protection Platform (EPP), a system that links together all existing technologies related to vendor management, security, training, and safety.

With the EPP, clients can connect and protect valuable resources like people, places, assets, and information.

In the last half, the company reported an 18% increase in revenue to $14.9m and a bottom line EBITDA of $2m.

The company has guided the market to a revenue guidance of $32m-$34m for the full year.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.