ASX Tech Stocks: AI has a terrifying human eye now; Enviro Group green-lit to build secret plant

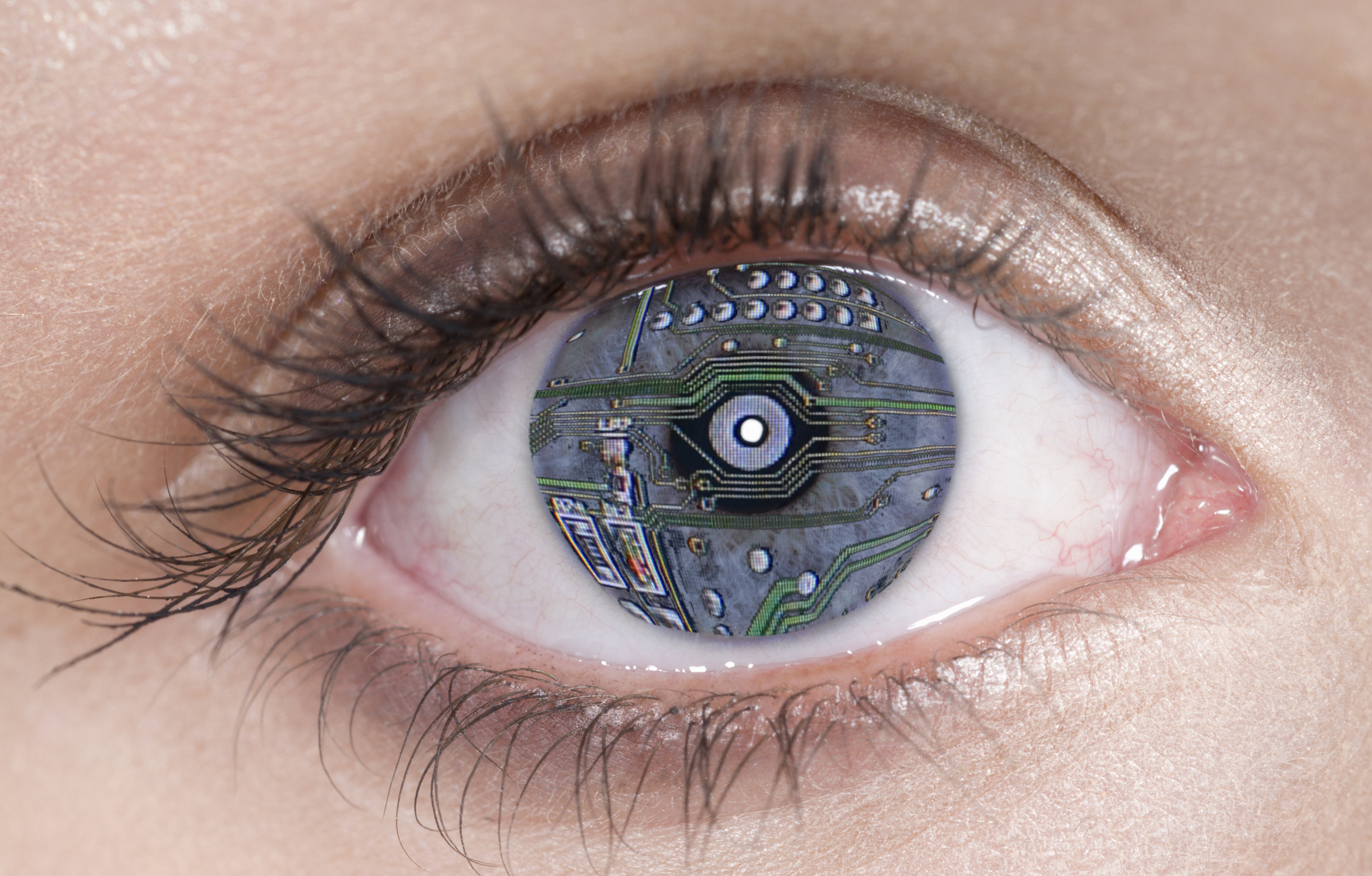

Pic: Bernhard Lang / Stone via Getty Images

- A new device could give artificial intelligence a human-like retina

- The Environmental Group nabs Australian national Patent application acceptance for its PFAS soil and water remediation treatment

- Cybersecurity player Mobilicom expects its NASDAQ listing in Q3 FY22

Researchers of the University of Central Florida (UCF) have obviously never seen the Terminator movies because they’ve built a device for artificial intelligence (AI) that replicates the retina of a human eye.

The researchers say the technology could become available for use in the next five to 10 years and could result in AI that could instantaneously understand what it sees such as automated descriptions of photos captured with a camera or a phone.

It could also be used in robots and self-driving vehicles and tbfh that’s a little terrifying.

This tech also performs better than the eye in terms of the range of wavelengths it can perceive, from ultraviolet to visible light and on to the infrared spectrum.

“It will change the way artificial intelligence is realised today,” UCFs Department of Materials Science and Engineering and NanoScience Technology Center assistant professor Tania Roy said.

“We had devices, which behaved like the synapses of the human brain, but still, we were not feeding them the image directly.

“Now, by adding image sensing ability to them, we have synapse-like devices that act like ‘smart pixels’ in a camera by sensing, processing, and recognising images simultaneously.”

Who’s got tech news out today?

THE ENVIRONMENTAL GROUP (ASX:EGL)

The company has nabbed Australian national Patent application acceptance for its PFAS soil and water remediation and commenced fabrication of the first PFAS separation unit for sale.

Following the successful commercial PFAS separation trials in November 2021, EGL committed resources from its in-house design, drafting and engineering services to fabricate its first commercially available plant, to ensure protection of its Intellectual Property and to progress into the commercial phase.

All process design has been completed, engineering 3D modelling and 2D drafting of the plant has been completed – and subsidiary Ignite Services has commenced the fabrication process of the first plant.

“We are very pleased to have been able to develop a low-cost solution for our clients that will enable a great environmental outcome, and we look forward to supplying our first plant,” CEO Jason Dixon said.

The plant is expected to be completed by mid-September this year.

The cyber security provider says its planned NASDAQ listing is at an advanced stage, and that it will play a key role in the company’s longer-term growth strategy.

The idea is the listing will enhance Mobilicom’s access to, and credibility with, prospective US customers, increase access to strategic partnerships and M&A opportunities.

It would also improve liquidity and the company says the listing would seek to underpin a higher market valuation in line with its US-listed peers.

The NASDAQ listing is anticipated in Q3 FY22.

Retail data and grocery app Frugl has launched its inaugural Grocery Price Index (GPI) which tracks grocery price changes over time at general, category and household level.

“Released quarterly, the Frugl GPI reports on grocery inflationary changes at a topline level, whilst also revealing inflationary trends for a range of grocery categories and different shopper household types,” the company said.

“It is anticipated that the Frugl GPI report will be launched each quarter a week prior to the official CPI and inflation announcement, giving shoppers, retailers and financial analysts an early indicator of likely inflationary movements and the impacts of grocery price changes to the Cost of Living for Australian Households.”

Recruitment platform LiveHire says its permanent hiring Software-as-a-Service (SaaS) solution has delivered a record June quarter and $5.7m in annual recurring revenue – which is up 10% on Q3 22 and up 31% year-on-year.

The company said financial indicators are tracking to plan and enabling investment in North America, with cash receipts of $1.7m for the quarter.

Plus, LVH has a closing cash balance of $7.3m.

EGL, MOB, FGL and LVH share prices today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.