ASX November Tech Winners: NoviqTech leads as AI boom lifts ASX technology stocks

AI boom lifts ASX tech stocks. Picture via Getty Images

- AI boom lifts ASX tech stocks, XIJ index up 10% in November

- Appen and Life360 have surged this year, benefiting from global AI hype

- NoviqTech and Harvest Tech were best performers this month

The artificial intelligence (AI) theme has been dominating the tech space, and it’s not just US stocks benefiting from the surge.

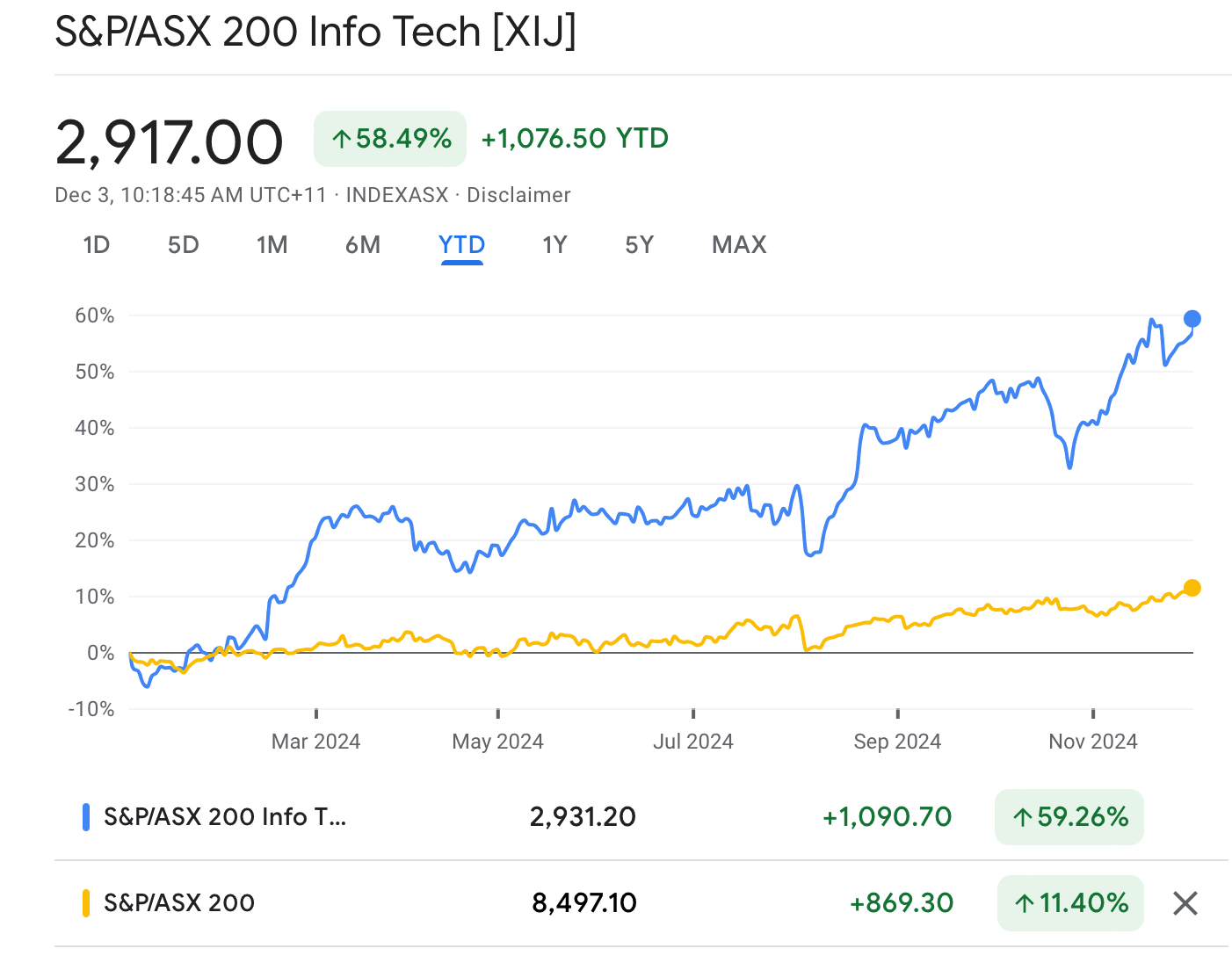

Aussie tech stocks in the Info Tech (XIJ) index (which tracks ASX-listed 200 tech companies) are also riding the coattails of the AI boom with strong investor sentiment lifting local companies.

In November, the index rose by another 10%, beating the benchmark S&P/ASX 200 index return of 3% easily.

This has pushed the XIJ to become the best-performing ASX sector this year, beating the benchmark by a long shot (59% vs 11%).

But how exactly is the US AI frenzy impacting Aussie tech stocks?

Well, the massive growth in US tech giants like Nvidia, Microsoft, Alphabet and Meta have generated huge investor enthusiasm for AI, pushing some of them to record highs.

As the US market gets excited about AI’s potential, the optimism has a knock-on effect on the ASX tech sector. Investors see what’s happening globally and look for similar growth potential locally.

As a result, Aussie companies involved in AI, machine learning, or semiconductors are benefiting from the global AI frenzy.

The high multiples assigned to US AI companies have encouraged investors to apply similar valuations to Aussie tech stocks with AI exposure.

For example, Appen (ASX:APX), which helps train AI models with human-annotated data, is the best tech performer this year, and is up almost 300%.

Another stock, Life360 (ASX:360), an AI-powered family safety app company, has seen its stock price skyrocket by a massive 240% in 2024.

Semiconductor stocks are also riding the wave, with companies like BrainChip Holdings (ASX:BRN), Weebit Nano (ASX:WBT) and Adisyn (ASX:AI1) benefiting from the global AI surge.

Looking ahead, investors will continue to closely monitor developments in AI stocks.

“One uncertainty is whether AI can deliver on its promises of efficiency and productivity,” said Catherine Brock, a tech analyst.

“But, many experts believe AI will prove itself, fuelling higher earnings expectations and, in turn, higher stock prices.”

Top 50 ASX tech winners in November

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| NVQ | Noviqtech Limited | 0.115 | 423% | $26,932,481 |

| HTG | Harvest Tech Grp Ltd | 0.029 | 107% | $23,489,016 |

| IFG | Infocus Group | 0.031 | 107% | $5,648,737 |

| 1TT | Thrive Tribe Tech | 0.002 | 100% | $1,406,723 |

| PHX | Pharmx Technologies | 0.071 | 69% | $41,895,475 |

| OPL | Opyl Limited | 0.027 | 59% | $4,609,295 |

| QHL | Quickstep Holdings | 0.395 | 58% | $28,690,486 |

| EML | EML Payments Ltd | 1.01 | 54% | $372,640,758 |

| CAT | Catapult Grp Int Ltd | 3.68 | 50% | $960,841,406 |

| GTIDD | Gratifii | 0.11 | 47% | $30,037,304 |

| GTK | Gentrack Group Ltd | 13.01 | 46% | $1,292,861,336 |

| OLL | Openlearning | 0.019 | 46% | $8,038,306 |

| SPZ | Smart Parking Ltd | 0.9 | 45% | $312,603,099 |

| DTI | DTI Group Ltd | 0.013 | 44% | $5,831,168 |

| AXE | Archer Materials | 0.315 | 43% | $77,728,339 |

| DCC | Digitalx Limited | 0.054 | 42% | $45,919,414 |

| FCL | Fineos Corp Hold PLC | 1.96 | 42% | $669,872,937 |

| WBT | Weebit Nano Ltd | 2.76 | 41% | $553,604,175 |

| CF1 | Complii Fintech Ltd | 0.026 | 37% | $13,753,435 |

| VR1 | Vection Technologies | 0.026 | 37% | $37,144,491 |

| ID8 | Identitii Limited | 0.015 | 36% | $12,209,721 |

| LVH | Livehire Limited | 0.045 | 36% | $20,709,720 |

| SKO | Serko | 3.3 | 34% | $406,317,011 |

| ADA | Adacel Technologies | 0.4 | 27% | $30,148,371 |

| OEC | Orbital Corp Limited | 0.11 | 24% | $16,066,261 |

| SQ2 | Block | 138.31 | 24% | $6,702,987,304 |

| EPX | Ept Global Limited | 0.021 | 24% | $12,730,368 |

| BEO | Beonic Ltd | 0.032 | 23% | $22,296,418 |

| TNE | Technology One | 30.21 | 23% | $10,020,751,040 |

| CPU | Computershare Ltd | 31.89 | 21% | $18,603,775,140 |

| EIQ | Echoiq Ltd | 0.275 | 20% | $161,843,287 |

| TYR | Tyro Payments | 0.9 | 17% | $471,653,724 |

| HSN | Hansen Technologies | 5.81 | 16% | $1,187,564,319 |

| JAN | Janison Edu Group | 0.215 | 16% | $61,073,739 |

| 360 | Life360 Inc. | 25.3 | 16% | $4,534,349,429 |

| QOR | Qoria Limited | 0.485 | 15% | $594,129,227 |

| XPN | Xpon Technologies | 0.015 | 15% | $5,074,181 |

| XRO | Xero Ltd | 173.85 | 15% | $26,870,322,378 |

| TAL | Talius Group Limited | 0.008 | 14% | $20,595,492 |

| OCL | Objective Corp | 17.48 | 14% | $1,666,689,280 |

| OCL | Objective Corp | 17.48 | 14% | $1,666,689,280 |

| WTC | Wisetech Global Ltd | 128.1 | 13% | $42,092,999,160 |

| WTC | Wisetech Global Ltd | 128.1 | 13% | $42,092,999,160 |

| SLX | Silex Systems | 5.61 | 12% | $1,307,200,797 |

| DTZ | Dotz Nano Ltd | 0.089 | 11% | $44,646,711 |

| BLG | Bluglass Limited | 0.026 | 11% | $45,981,809 |

| YOJ | Yojee Limited | 0.095 | 10% | $28,883,940 |

| MP1 | Megaport Limited | 7.89 | 10% | $1,218,512,553 |

| CCR | Credit Clear | 0.3475 | 10% | $148,236,994 |

| SOR | Strategic Elements | 0.054 | 10% | $26,253,272 |

| Code | Name | Price | Month % Change | Market Cap |

| NVQ | Noviqtech Limited | 0.115 | 423% | $26,932,481 |

| HTG | Harvest Tech Grp Ltd | 0.029 | 107% | $23,489,016 |

| IFG | Infocus Group | 0.031 | 107% | $5,648,737 |

| 1TT | Thrive Tribe Tech | 0.002 | 100% | $1,406,723 |

| PHX | Pharmx Technologies | 0.071 | 69% | $41,895,475 |

| OPL | Opyl Limited | 0.027 | 59% | $4,609,295 |

| QHL | Quickstep Holdings | 0.395 | 58% | $28,690,486 |

| EML | EML Payments Ltd | 1.01 | 54% | $372,640,758 |

| CAT | Catapult Grp Int Ltd | 3.68 | 50% | $960,841,406 |

| GTIDD | Gratifii | 0.11 | 47% | $30,037,304 |

| GTK | Gentrack Group Ltd | 13.01 | 46% | $1,292,861,336 |

| OLL | Openlearning | 0.019 | 46% | $8,038,306 |

| SPZ | Smart Parking Ltd | 0.9 | 45% | $312,603,099 |

| DTI | DTI Group Ltd | 0.013 | 44% | $5,831,168 |

| AXE | Archer Materials | 0.315 | 43% | $77,728,339 |

| DCC | Digitalx Limited | 0.054 | 42% | $45,919,414 |

| FCL | Fineos Corp Hold PLC | 1.96 | 42% | $669,872,937 |

| WBT | Weebit Nano Ltd | 2.76 | 41% | $553,604,175 |

| CF1 | Complii Fintech Ltd | 0.026 | 37% | $13,753,435 |

| VR1 | Vection Technologies | 0.026 | 37% | $37,144,491 |

| ID8 | Identitii Limited | 0.015 | 36% | $12,209,721 |

| LVH | Livehire Limited | 0.045 | 36% | $20,709,720 |

| SKO | Serko | 3.3 | 34% | $406,317,011 |

| ADA | Adacel Technologies | 0.4 | 27% | $30,148,371 |

| OEC | Orbital Corp Limited | 0.11 | 24% | $16,066,261 |

| SQ2 | Block | 138.31 | 24% | $6,702,987,304 |

| EPX | Ept Global Limited | 0.021 | 24% | $12,730,368 |

| BEO | Beonic Ltd | 0.032 | 23% | $22,296,418 |

| TNE | Technology One | 30.21 | 23% | $10,020,751,040 |

| CPU | Computershare Ltd | 31.89 | 21% | $18,603,775,140 |

| EIQ | Echoiq Ltd | 0.275 | 20% | $161,843,287 |

| TYR | Tyro Payments | 0.9 | 17% | $471,653,724 |

| HSN | Hansen Technologies | 5.81 | 16% | $1,187,564,319 |

| JAN | Janison Edu Group | 0.215 | 16% | $61,073,739 |

| 360 | Life360 Inc. | 25.3 | 16% | $4,534,349,429 |

| QOR | Qoria Limited | 0.485 | 15% | $594,129,227 |

| XPN | Xpon Technologies | 0.015 | 15% | $5,074,181 |

| XRO | Xero Ltd | 173.85 | 15% | $26,870,322,378 |

| TAL | Talius Group Limited | 0.008 | 14% | $20,595,492 |

| OCL | Objective Corp | 17.48 | 14% | $1,666,689,280 |

| OCL | Objective Corp | 17.48 | 14% | $1,666,689,280 |

| WTC | Wisetech Global Ltd | 128.1 | 13% | $42,092,999,160 |

| SLX | Silex Systems | 5.61 | 12% | $1,307,200,797 |

| DTZ | Dotz Nano Ltd | 0.089 | 11% | $44,646,711 |

| BLG | Bluglass Limited | 0.026 | 11% | $45,981,809 |

| YOJ | Yojee Limited | 0.095 | 10% | $28,883,940 |

| MP1 | Megaport Limited | 7.89 | 10% | $1,218,512,553 |

| CCR | Credit Clear | 0.3475 | 10% | $148,236,994 |

| SOR | Strategic Elements | 0.054 | 10% | $26,253,272 |

Supply chain tech company NoviqTech surged following a strategic placement to raise $1.05 million to fast-track its blockchain-powered solutions.

A key factor has been the backing from Tony G (Antanas Guoga), a well-known investor and chairman of Solana Strategies Inc.

Investors believe his endorsement brings valuable expertise and a strong network, particularly in disruptive technologies. This support is seen as a major validation of NoviqTech’s mission to integrate blockchain into sustainability.

With this fresh capital, NoviqTech will work to accelerate the development of scalable blockchain solutions that promise to reshape transparency and accountability in the global supply chains.

Harvest Technology Group (ASX:HTG)

Data tech company Harvest Tech made a strong move after announcing the launch of Harvest Technology Europe (HTE) in Ireland, which aims to expand its Nodestream product range across the UK and European markets.

Nodestream is a cutting-edge technology designed to overcome challenges in remote video streaming, such as high latency and limited bandwidth, ensuring high-quality communication even in low-connectivity areas.

Harvest also secured a $1m in additional funding, with another $1m expected soon. These funds came from a major investor who previously invested in its convertible notes.

The company also received a $1.59m R&D rebate for FY24, further boosting its cash position. In addition, Harvest said it has significantly reduced its burn rate to $225k per month.

Infocus Group Holdings (ASX:IFG)

Retail intel tech company Infocus rose after securing a US$2.5 million multi-phase service agreement with GBO Assets to develop a new digital and social gaming product called VigoBet Tech.

The contract, which will span over the next 24 months, will see Infocus apply its expertise in data analytics and software engineering to build the platform. The first phase alone is expected to generate AU$1.1 million in revenue within three months.

The contract is Infocus’ largest to date and opens doors to new markets beyond retail data analytics, positioning the company to expand into the digital gaming space.

As a follow up to that deal, the company announced this week that a US$75,000 deposit has been received from GBO Assets for the first phase of the development.

Opyl, a tech company providing services in the healthcare space, rose after signing a deal with Southern Clinical Development Consulting to license its AI-powered TrialKey platform.

The platform will help optimise clinical trials, offering predictive modelling, patient recruitment insights, and site feasibility.

Opyl will earn fees for each report generated.

The company also announced that it has allocated $1.7 million in its budget for growth, focusing on staffing, compliance and business development.

Shares in defence tech company Quickstep jumped following the finalisation of key contracts with major defence customers.

The company secured volume and price increases for its C-130 Program with Lockheed Martin, F-35 Vertical Tail Program with Marand, and additional contracts with Northrop Grumman.

These agreements will run through to 2029.

The company’s shares rose further following the announcement of a takeover bid by ADSAM Operations, but no offer price has been disclosed to the public.

And finally, a discussion of ASX tech stocks wouldn’t be complete without mentioning WiseTech.

The company’s shares rose slightly in November despite a scandal involving its founder and CEO, Richard White.

White resigned after allegations of bullying, inappropriate conduct, and financial misconduct.

An investigation revealed that he had a relationship with an employee and paid for her multi-million-dollar house. He also faced accusations of poor governance and intimidation from a former director.

White will remain with the company in a consulting role, while the board reviews its governance practices.

Despite the controversy, analysts remain divided on whether his departure will affect the company’s future growth.

ASX tech losers in November

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| BCC | Beam Comms | 0.075 | -50% | $7,173,019 |

| SBW | Shekel Brainweigh | 0.022 | -50% | $4,789,286 |

| FL1 | First Lithium Ltd | 0.088 | -48% | $7,009,517 |

| SMN | Structural Monitoring | 0.435 | -33% | $66,873,369 |

| ICE | Icetana Limited | 0.014 | -30% | $4,234,055 |

| LIS | Li-S Energy | 0.135 | -27% | $102,432,037 |

| CAG | Caperangeltd | 0.13 | -26% | $12,338,079 |

| ELS | Elsight Ltd | 0.385 | -25% | $56,099,845 |

| EVS | Envirosuite Ltd | 0.056 | -24% | $80,678,416 |

| CYB | Aucyber Limited | 0.2 | -23% | $31,077,038 |

| SPX | Spenda Limited | 0.01 | -23% | $50,639,555 |

| DXN | DXN Limited | 0.059 | -22% | $13,548,183 |

| RCL | Readcloud | 0.082 | -22% | $12,105,912 |

| PRO | Prophecy Internation | 0.51 | -22% | $39,389,875 |

| MX1 | Micro-X Limited | 0.055 | -21% | $33,151,414 |

| SPADD | Spacetalk Ltd | 0.175 | -20% | $11,798,462 |

| IRI | Integrated Research | 0.535 | -20% | $93,110,172 |

| BDT | Birddog | 0.064 | -20% | $10,173,619 |

| NVU | Nanoveu Limited | 0.042 | -19% | $21,825,297 |

| DRO | Droneshield Limited | 0.78 | -19% | $645,365,218 |

| ROC | Rocketboots | 0.089 | -19% | $9,807,222 |

| SNS | Sensen Networks Ltd | 0.043 | -19% | $34,100,611 |

| RKT | Rocketdna Ltd. | 0.013 | -19% | $11,869,960 |

| PPK | PPK Group Limited | 0.385 | -18% | $37,687,187 |

| TZL | TZ Limited | 0.07 | -18% | $18,590,654 |

| AT1 | Atomo Diagnostics | 0.019 | -17% | $12,144,844 |

| EOS | Electro Optic Systems | 1.225 | -17% | $232,507,279 |

| 3DP | Pointerra Limited | 0.042 | -16% | $35,423,379 |

| AI1 | Adisyn Ltd | 0.059 | -16% | $17,071,303 |

| 1CG | One Click Group Ltd | 0.011 | -15% | $10,437,543 |

| AJX | Alexium Int Group | 0.011 | -15% | $15,738,787 |

| AVA | AVA Risk Group Ltd | 0.125 | -14% | $36,267,337 |

| IOD | Iodm Limited | 0.16 | -14% | $94,629,577 |

| KNO | Knosys Limited | 0.039 | -13% | $8,429,409 |

| FCT | Firstwave Cloud Tech | 0.021 | -13% | $37,686,426 |

| W2V | Way2Vatltd | 0.007 | -13% | $7,315,870 |

| ODA | Orcoda Limited | 0.145 | -12% | $23,038,704 |

| DUG | DUG Tech | 1.67 | -12% | $229,591,210 |

| IXU | Ixup Limited | 0.011 | -12% | $18,380,845 |

| ATA | Atturralimited | 1.045 | -11% | $362,680,080 |

| SMP | Smartpay Holdings | 0.555 | -9% | $120,971,732 |

| FND | Findi Limited | 5.91 | -8% | $379,953,213 |

| NVX | Novonix Limited | 0.74 | -8% | $340,697,379 |

| IRE | IRESS Limited | 9.29 | -7% | $1,753,953,161 |

| IFM | Infomedia Ltd | 1.38 | -7% | $516,707,125 |

| AMO | Ambertech Limited | 0.155 | -6% | $15,264,765 |

| NOV | Novatti Group Ltd | 0.032 | -6% | $15,891,167 |

| 4DS | 4Ds Memory Limited | 0.084 | -6% | $142,838,228 |

| SP3 | Specturltd | 0.017 | -6% | $5,082,263 |

| ATV | Activeportgroupltd | 0.018 | -5% | $10,022,839 |

At Stockhead we tell it like it is. While Harvest Technology is a Stockhead advertiser at the time of writing, it did not sponsor this article.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.