ASX chip makers in sweet spot as semiconductor shortage hits big car-makers, smartphones

Tech

Tech

A worldwide shortage of key semiconductor components has curtailed production of EVs, smartphones and laptops but could be advantageous to ASX semiconductor companies.

Taiwan Semiconductor Manufacturing is one of the largest manufacturers of semiconductors and it is accelerating the construction of new factories to keep up with demand.

The Taiwan-based company has a roll-call of blue chip customers that include Apple, Google and Qualcomm that use semiconductors in their products such as phones and computers.

The company has a full order book and is increasing its capacity in order to produce a new type of microchip suitable for 5G mobile phones.

It is also reported to be paying its workers bonuses to carry on working over the traditional Lunar New Year holiday in mid-February to fulfil customer orders.

Taiwan Semiconductor Manufacturing is Taiwan’s largest company by market value, and accounts for one-third of the local stock market’s capitalisation.

A number of car makers including General Motors have come out and declared that the worsening shortage of semiconductor components is affecting their production.

“Despite our mitigation efforts, the semiconductor shortage will impact GM production in 2021,” said the company in a statement.

“Our supply chain organisation is working closely with our supply base to find solutions for our suppliers’ semiconductor requirements and to mitigate impacts on GM,” it added.

Another carmaker, Nissan, said this week it will halt some US production due to a lack of microchips.

The semiconductor components shortage was triggered by the COVID-19 pandemic, which caused abrupt changes to supply chains and factory shutdowns, disrupting product flows.

The effects of the pandemic on international supply chains has been compounded by the WFH movement which has increased demand for electronic products.

“The virus pandemic, social distancing in factories, and soaring competition from tablets, laptops and electric cars are causing some of the toughest conditions for smartphone component supply in many years,” Neil Mawston, an analyst with Strategy Analysts told Zero Hedge.

Prices for electronic components used in smartphones and EVs have risen by 15 per cent in the past six months, according to Mawston.

Another reported factor behind the shortage of semiconductor components is some stockpiling by Chinese mobile phone companies because of US trade sanctions.

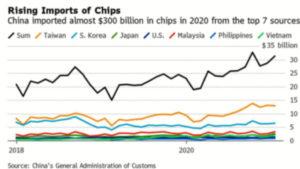

As a result, China’s imports of micro-processor chips surged to $US380bn last year, accounting for 20 per cent of the country’s total imports bill.

Some US electronics companies reacted to the growing market shortage of electronics components by increasing their buying, thereby worsening the market shortage.

“A lot of it can be traced back to the second quarter of last year, when the whole world basically shut down,” IDC market analyst, Mario Morales, told Zero Hedge.

Around one dozen semiconductor-related companies trade on the ASX market, including BluGlass (ASX:BLU) and Weebit Nano (ASX:WBT).

The largest by market value at $880m is software company Brainchip Holdings (ASX:BRN) which is well known for its artificial intelligence software.

Brainchip’s neurotrophic processor is a high performance, low power use microchip that has a range of applications and mimics the way the human brain processes information.

K2 Energy (ASX:KTE) is an oil and gas company that has a stake in US semiconductor company, Atomera, that is developing proprietary technology for the tech sector.

Atomera’s leading technology is its Mears silicon technology, a thin film of re-engineered silicon that can be used to automate machines.

Pivotal Systems (ASX:PVS) provides gas flow control systems to the semiconductor manufacturers such as Brooks Instruments, Fujikin and Hitachi Metals.

The company has production partnership in South Korea and China, and research partnerships in the US and Japan.

Pivotal said in a company presentation that it forecasts the market for supplying equipment to the semiconductor sector will grow by 11.6 per cent in 2021, despite COVID-19.

Revasum (ASX:RVS) makes equipment used in the manufacturing process for semiconductors and the company is currently going through a capital raise for $8m.

Its flagship products are a silicon carbide polishing machine and silicon carbide grinding machine used to produce silicon carbide wafers from which microchips are made.

Silicon carbide wafers are estimated to deliver a 20 per increase in battery range for EVs compared with silicon-only chips, and a higher energy efficiency for EV chargers.

| Code | Company | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| BRN | Brainchip Ltd | 0.54 | 2.8571 | -13.6 | 938.4615 | $847.4M |

| KTE | K2 Energy Ltd | 0.056 | 3.7037 | 5.6604 | 700 | $17.7M |

| WBT | Weebit Nano Ltd | 2.55 | -8.9286 | -15.8416 | 571.0526 | $300.3M |

| SE1 | Sensera Ltd | 0.078 | -4.878 | -14.2857 | 550 | $23.0M |

| DTZ | Dotz Nano Ltd | 0.24 | 0 | 0 | 300 | $90.3M |

| SLX | Silex Systems | 1.2 | -11.7647 | -9.434 | 228.7671 | $201.3M |

| 4DS | 4Ds Memory Limited | 0.18 | -11.25 | 22.4138 | 186.2903 | $230.7M |

| AKP | Audio Pixels Ltd | 27.41 | 1.5185 | 13.2645 | 93.7102 | $846.3M |

| BLG | Bluglass Limited | 0.081 | -5.814 | -6.8966 | 40.872 | $58.5M |

| RVS | Revasum | 0.45 | 4.6512 | 58.5951 | -31.8711 | $48.7M |

| PVS | Pivotal Systems | 1.09 | 9.596 | 15.4255 | -34.2424 | $121.4M |