archTIS announces 358pc revenue pop as cybersecurity gains momentum

Pic: Yuichiro Chino / Moment via Getty Images

Cybersecurity stock archTIS (ASX:AR9) has announced some solid H1 FY21 results this morning.

The company reported a 358% increase in revenue for H1 FY21 on previous corresponding period, to $1.11 million.

Of that, $0.45 million is recurring revenues – up 355%.

The company said the strong result was highlighted by two key transformational events for the company – a $4.2 million landmark contract from the Australian Department of Defence (DoD) and the merger with US-based Nucleus Cyber.

Major highlights for the half

The $4.2 million landmark DOD contract was signed in September last year. The contract provided the DOD with three licenses for the Kojensi enterprise platform aimed at securing information shared between different warfighters and Allied partners.

The Nucleus Cyber acquisition in October 2020, on the other hand, was a $9.75 million scrip-for-scrip merger deal which provided the company with immediate presence in the North American markets that includes access to the Microsoft Teams platform. Microsoft Teams has more than 100 million daily users.

Strong growth trend

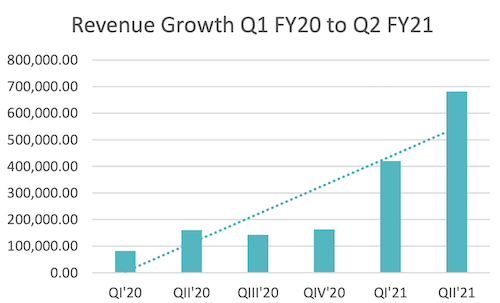

archTIs is undergoing strong growth, with revenue growing every quarter since Q3 FY20.

Its balance sheet is strong, with a cash balance of $12.1 million at 31 December 2020, following an $8.4 million capital raising during the period.

Strong outlook ahead

archTIS operates in a very large addressable market – one that is being supported by a $15 billion commitment from the Australian government over the next decade.

In July 2020, the federal government released the “2020 Force Structure Plan”, focusing on Australia’s commitment to cyber and information warfare capabilities.

Beyond Defence, a report from AusCyber notes the Australian cybersecurity industry in 2020 was worth $5.6 billion, and is expected to grow to $7.6bn by 2024.

Globally, the cybersecurity market is currently worth $173 billion in 2020, growing to $270 billion by 2026 – according to the finding. archTIS is well-placed to tap into the global market after its merger with Nucleus Cyber.

The company said two of its goals to 30 June 2021 are to pursue high margin licences to drive recurring revenues, and explore global market expansion opportunities.

Stockhead has also outlined why the industry will be big in 2021.

The archTIS share price has risen by more than 200% in the last twelve months.

archTIS share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.