Analyst reckons Parkway has potential to be a 50-bagger

PWN’s solution to coal seam gas problem could make it a billion dollar company. Pic via Getty Images.

Independent Investment Research (IIR) has flagged that Parkway’s innovative tech for treatment of coal seam gas (CSG) brine could become best available technology (BAT) with a solid financial uptick for shareholders.

IIR has a risked base case valuation of $0.083 per share, a 10-fold increase on the current Parkway Corporate (ASX:PWN) price of $0.008/share, making it a potential 10-bagger, with further upside in an unrisked scenario.

IIR performed a detailed evaluation, and based on its own analysis of PWN found the company had disruptive, flexible, and low-cost tech, no competition at this stage and with strongly leverage earnings potential, in a growing market. Together with key personnel with skin in the game, the analyst noted great alignment between the company and shareholders.

IIR’s valuation is predominantly based on PWN’s game-changing tech, designed to solve a pressing problem for the coal seam gas sector in Queensland.

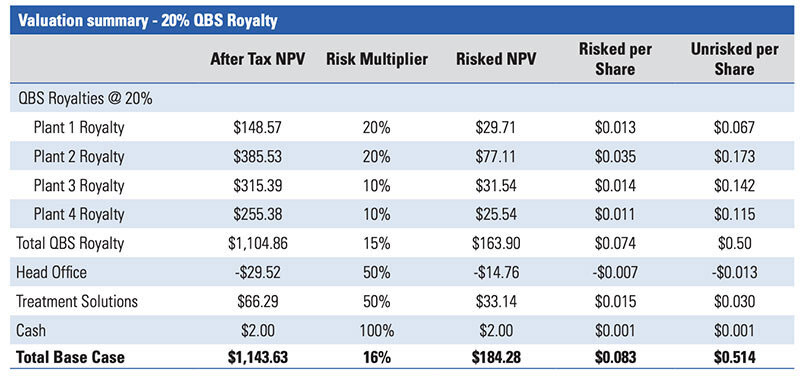

“The base case, with a 20% royalty, results in a risked valuation of A$0.083/share,” IIR said in its report.

“We note that this is at a discount to the 20% royalty on cost savings and a 30% share of product sales as presented by the company, however we have erred on the side of caution here.”

In the event PWN nails all its defined targets and based on standard industry metrics, IIR reckons the company could be worth in the order of 50 cents/share.

Based Case Valuation Summary. Pic: Supplied (IIR analysis)

Furthermore, based on indicative earnings and multiples (as outlined by IRR in the table below) PWN could be north of a $1 billion plus company by as early as 2028 or 2029.

Indicative earnings and multiples table. Pic: Supplied (IIR analysis)

Cracking CSG treatment code

PWN which has a strategy to build an advanced water treatment technology company, with two main streams.

The first stream Parkway Process Technologies (PPT) is building a portfolio of tech for a range of complex wastewater and process streams considered difficult to treat. This includes the development of a transformational brine-processing solution for the coal seam gas (CSG) industry, with an initial focus on Queensland.

Consisting primarily of methane, CSG is absorbed into coal and held in place by underground water pressure. To extract it, wells are drilled through the coal seams, which reduces pressure and releases natural gas from the coal.

The process produces vast volumes of highly saline water, otherwise known as brine, an unavoidable by-product of the CSG extraction process.

Big bucks have been spent to evaluate solutions to solve this problem with the only viable alternative identified to date, waste salt disposal, found to be both deeply unpopular and expensive.

PWN’s iBC technology solution

PWN’s solution to the saline brine problem is based predominantly on its proprietary tech called iBC, which takes toxic waste brines, recovers fresh water and turns the waste salts into three industrial chemical products for use in the Queensland market.

PWN has developed its Integrated Brine Causticisation (iBC) technology which produces pure water and saleable end products including sodium hydroxide, lime, and industrial salt with less than 2% of the treated material having to be disposed of.

Under Queensland Government legislation treatment solutions are required to be put in place by the operators, with an emphasis on processes that convert waste to usable products and therefore minimising disposal requirements.

Furthermore, PWN has just released an ambitious master plan for the Queensland opportunity, which engagement with stakeholders, as part of developing an optimal commercialisation strategy.

PWN established a subsidiary Queensland Brine Solutions Pty Ltd (QBS) as a dedicated commercialisation entity to advance the aims of its master plan.

Tech potential beyond sunshine state

But while there has been much talk about PWN’s iBC tech addressing problems in Queensland its potential as IIR noted is much larger.

The tech’s applications include treating mine and energy wastewater, municipal wastewater, and desalination RO rejects amongst others – which collectively represent significant global markets.

This is where PWN’s second stream Parkway Process Solutions (PPS) comes into play. PPS is a conventional water treatment business, providing equipment, services, and integrated solutions which is also on a growth trajectory.

Significant royalty income and no capex

IIR noted one potential commercialisation strategy includes licensing its tech, and being paid a royalty for use, which provides highly leveraged returns on development costs, and no requirement to raise the significant funds to develop facilities.

IIR said the upside for royalties is a potential increase to 20%.

“We have then included potential upside, including amounts due on additional royalties of 10% (taking total royalties to 20%),” IRR said.

Then there’s the cash generated by the sale of the high purity products.

“Our modelling estimating sales of these totalling A$325/tonne of salt treated, or ~A$2 billion (unescalated), or ~A$3 billion escalated at 2.5% p.a for the life of the project,” IIR said.

There is also a Queensland government $175/tonne (indexed to inflation) waste disposal levy on regulated waste facilities – this, on 6 million tonnes of salt, adds an additional ~$1 billion impost on industry.

With no viable alternatives to date and CSG companies required by legislation to treat the waste and produce usable products, PWN is strongly positioned to provide an solution the industry desperately needs.

“Our modelling indicates a >$17 billion advantage to Parkway in this market – this figure is in line with Parkway releases,” IIR noted.

Upside lies in commercialisation

The main opportunity IIR sees for PWN is commercialisation of its tech, including (amongst others), straight out licensing of the tech, with the receipt of a royalty, possibly around 10% to 20% of the total benefit in using iBC over the planned salt encapsulation option.

PWN might also fund and build plants, possibly in partnership with a major waste treatment or industrial chemicals group, and then toll treat the brines, and licence and collect royalties from third party operators, who would build and operate the plants.

The overarching plan is to be involved in the treatment of the brines currently in storage dams, as well as all brine produced in the future.

“The overall valuation needs to be considered as indicative only, due to inherent uncertainties in particularly the proposed QBS business (including whether it will be accepted or not), but despite this comment, we see considerable upside in PWN in the medium term,” IIR said.

You can read the report in full on PWN’s Investor Hub.

This article was developed in collaboration with Parkway Corporate Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.