Parkway’s acquisition of Tankweld Group to supercharge growth

PWN is accelerating its project execution related capabilities. Pic via Getty Images.

- Parkway Corporate has acquired engineering solutions provider Tankweld Group

- Acquisition accelerates its technology project execution capabilities

- Enlarged business represents step-change in revenue towards near-term profitability

Special Report: Leading industrial water treatment technology company Parkway Corporate says its acquisition of established engineering solutions provider Tankweld Group is a “great strategic fit” which will accelerate its technology delivery plans.

Shortly after the release of an ambitious “master plan” by Parkway Corporate (ASX:PWN) in June 2023, an analyst from Independent Investment Research (IIR) released a report indicating the company has the potential to be a 50-bagger.

The technology platform underpinning the master plan continues to be scaled-up following a series of technology breakthroughs, and is being further supported by the establishment of the Parkway Centre for Brine Technologies.

These developments, including news that PWN has been awarded a pre-FEED study by a major global energy company, provide encouragement the company is on to something with its brine treatment technologies.

PWN believes its acquisition of Tankweld is pivotal to its vision of delivering these technologies at a commercial scale.

Tankweld is an established engineering solutions provider based in Melbourne, with decades of experience in design, fabricating and installing industrial scale equipment, including in the water sector.

Tankweld provides industrial engineering solutions, including for the water treatment sector. Pic: Supplied

PWN is typically focused on earlier project phases, from concept development through to an engineered design.

The company says its acquisition of Tankweld will enable it to fast-track and execute complete projects, as a result of the expanded capabilities.

Here’s how the growth profile looks following the Tankweld acquisition:

As an established industrial solutions provider, Tankweld is highly experienced in delivering large and complex projects, predominantly with a mechanical engineering focus.

The process engineering capabilities of PWN will also assist Tankweld to provide a broader range of value-added scope, supporting the execution of larger and more complex projects, as outlined below.

“The Tankweld acquisition provides PWN with advanced fabrication and project execution capabilities, these capabilities are increasingly being recognised to be of national strategic importance,” PWN group managing director Bahay Ozcakmak says.

“We are already speaking to key industry stakeholders including government, about how we can further expand these strategically important capabilities. Whether it is water, infrastructure or defence, as a nation, we need to ensure we support and expand our advanced manufacturing capabilities.”

A ‘highly accretive’ acquisition

PWN believes the Tankweld acquisition is highly accretive and provides the company with a range of attractive near-term growth opportunities.

Tankweld has a significant project backlog in excess of $10 million with a strong pipeline of near-term project opportunities estimated to be well in excess of $20 million.

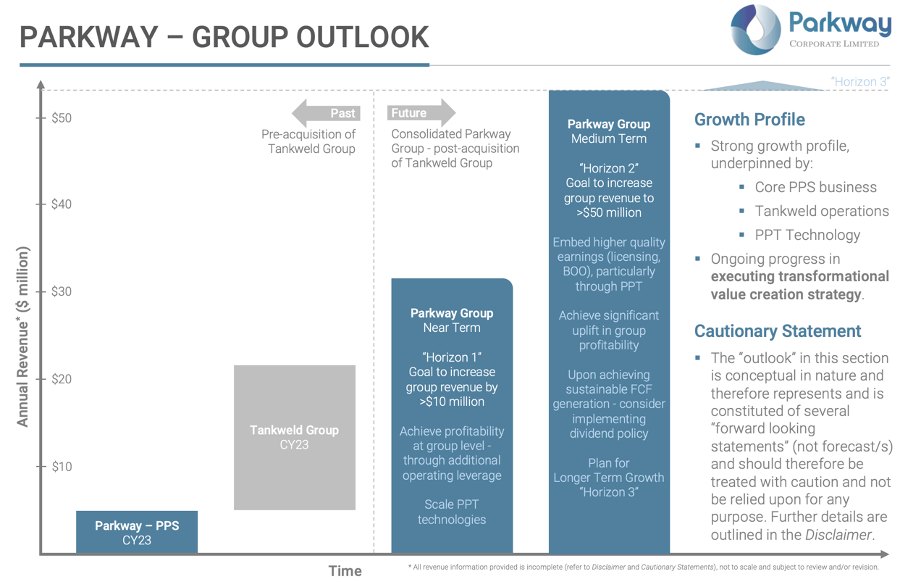

PWN says, on a proforma basis, the acquisition of Tankweld is expected to result in consolidated annual revenues in excess of $20 million, providing increased critical mass for operations and significant operating leverage.

The company also has a roadmap to grow revenues beyond $50 million over the medium term.

Parkway’s growth outlook. Pic: Supplied

Terms of the deal

PWN has already paid $650,000 for Tankweld Group with a $1.75 million loan settlement (provisional amount, subject to working capital movements) to be paid imminently from existing cash resources.

The acquisition consideration also consists of a deferred component of $200,000 cash, payable from cash flow generated by Tankweld at a rate of 50% of free cash flow, until this deferred component is paid.

Tankweld vendor and longstanding managing director Jeff Harley will transition to a general manager role for an initial four-year term.

Ozcakmak declared Tankweld a “transformational transaction” for PWN.

“The strategic value of Tankweld is obviously a lot higher than the relatively modest consideration we’ve paid,” he says.

“We’ve structured the transaction in such a way, that should, as we expect, Tankweld continue to grow both revenue and profitability, then significant additional performance consideration is payable.

“For instance, on the fourth-year anniversary of the acquisition, if Tankweld sales reach $25 million with an agreed EBITDA margin (12%), then Parkway is required to pay in the order of $1 million in performance consideration.

“Under these circumstances, the business will have generated $3 million in operating profit for the year, therefore, I think we have really good alignment in terms of incentives, which points to the confidence we all have in the success of this transaction.”

Given Tankweld has managed to grow revenue in the order of 31% year-on-year compound growth, perhaps the performance incentives are reasonably achievable.

Handing over to ‘a great custodian’

Tankweld’s history dates back to the 1940s, but more recently it expanded its offering from fabrication into project execution, particularly project installations.

Harley says he’s had the privilege of working with a dedicated team and partners to build Tankweld into the leading engineering solutions provider it is today.

“We see abundant opportunities to provide greater value-added solutions for our existing clients and look forward to working with Parkway’s process technology team to capture and deliver on these emerging high-value opportunities,” he says.

“I am confident Parkway will be a great custodian of Tankweld and as a member of the Parkway management team, I look forward to contributing to the continued success of Tankweld, as part of the broader Parkway group.”

This article was developed in collaboration with Parkway Corporate, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.