Additive manufacturing is expected to grow in the years ahead but these stocks are already capitalising

Only a couple of Additive manufacturing stocks have made substantial gains of late

Additive manufacturing has been tipped for big growth in the years ahead but has a mixed bag as an ASX sector of late.

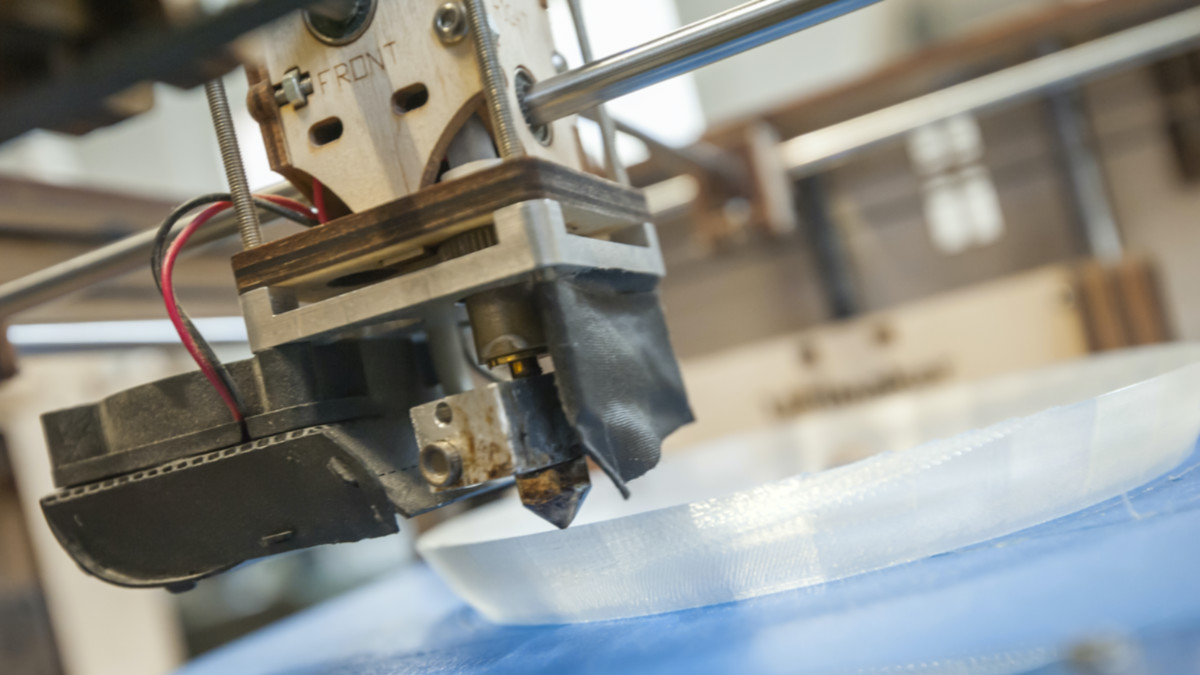

Additive manufacturing in a general sense (also known as 3D printing or additive layer manufacturing) alludes to a method of industrial manufacturing driven by computers and created 3D objects by depositing minerals layer by layers.

It serves several industries such as defence manufacturing, oil and gas exploration, medical implants and consumer goods and promises clientele a greater bang for their buck. However there are several different methods of additive manufacturing and many industries are highly capital intensive.

There are various estimates of the industry’s future but the vast majority tip heavy growth. One estimate this year was made by Lux Research which tips 15 per cent compound annual growth rate (CAGR) from $12 billion last year to $51 billion by 2030.

This would indicate a bright future for the cohort of ASX additive manufacturing stocks although the raw list paints a mixed picture.

Here’s a list of all ASX additive manufacturing stocks…

| Code | Company | Price | %Yr | MktCap |

|---|---|---|---|---|

| 3DA | Amaero International | 0.58 | 346 | $69.8M |

| KTG | K-Tig Limited | 0.43 | 126 | $56.3M |

| A3D | Aurora Labs Limited | 0.068 | 24 | $10.9M |

| OEC | Orbital Corp Limited | 0.86 | 17 | $68.3M |

| FBR | FBR Ltd | 0.038 | 9 | $82.8M |

| AL3 | Aml3D | 0.17 | 6 | $17.9M |

| 3MF | 3D Metalforge | 0.155 | -23 | $14.9M |

| TTT | Titomic Limited | 0.405 | -37 | $65.9M |

Two additive manufacturing stocks have notched up triple digit gains. One is Amaero Ltd (ASX:3DA), with a 346 per cent gain in 12 months.

The company began its life as a spin-off from Monash University’s Additive Manufacturing Centre and has facilities in Melbourne, Adelaide and Los Angeles.

It focuses on the defence and aerospace sectors and has excited investors with its collaborated with big names including with Boeing (which made a purchase order for additively manufactured metal evaluation parts) and Rio Tinto (ASX:RIO) to form a supply chain for a new super strength aluminium product to use in 3D printing.

Next with a 126 per cent gain is K-Tig (ASX:KTG) which specialises in precision welding which is essentially joining metals by heating them to the point of melting and cooling them.

And it claims it can weld up to 100 times faster than a traditional welder which makes the process more economical.

Although the company is yet to make a profit it has developed welding procedures for carbon steel which is critical for the petroleum, chemical and nuclear energy industries.

Behind them are advanced engine manufacturer Orbital Corp (ASX:OEC), AML3D (ASX:AL3) which specialises in Wire Additive Manufacturing – a form of 3D printing which involves making a solid object from a digital file – and.

Sitting on 12 month losses are Titomic (ASX:TTT) which manufacturers large scale industrial parts and produces anti-corrosion and ballistic protection equipment for defence out of titanium and recent listee 3D Metal Forge (ASX:3MF) which has in-house services focused on the energy, maritime, defence and manufacturing sectors.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.