Silver and indium’s shine is rubbing off on Iltani, which is drilling ‘one of Australia’s best exploration targets’

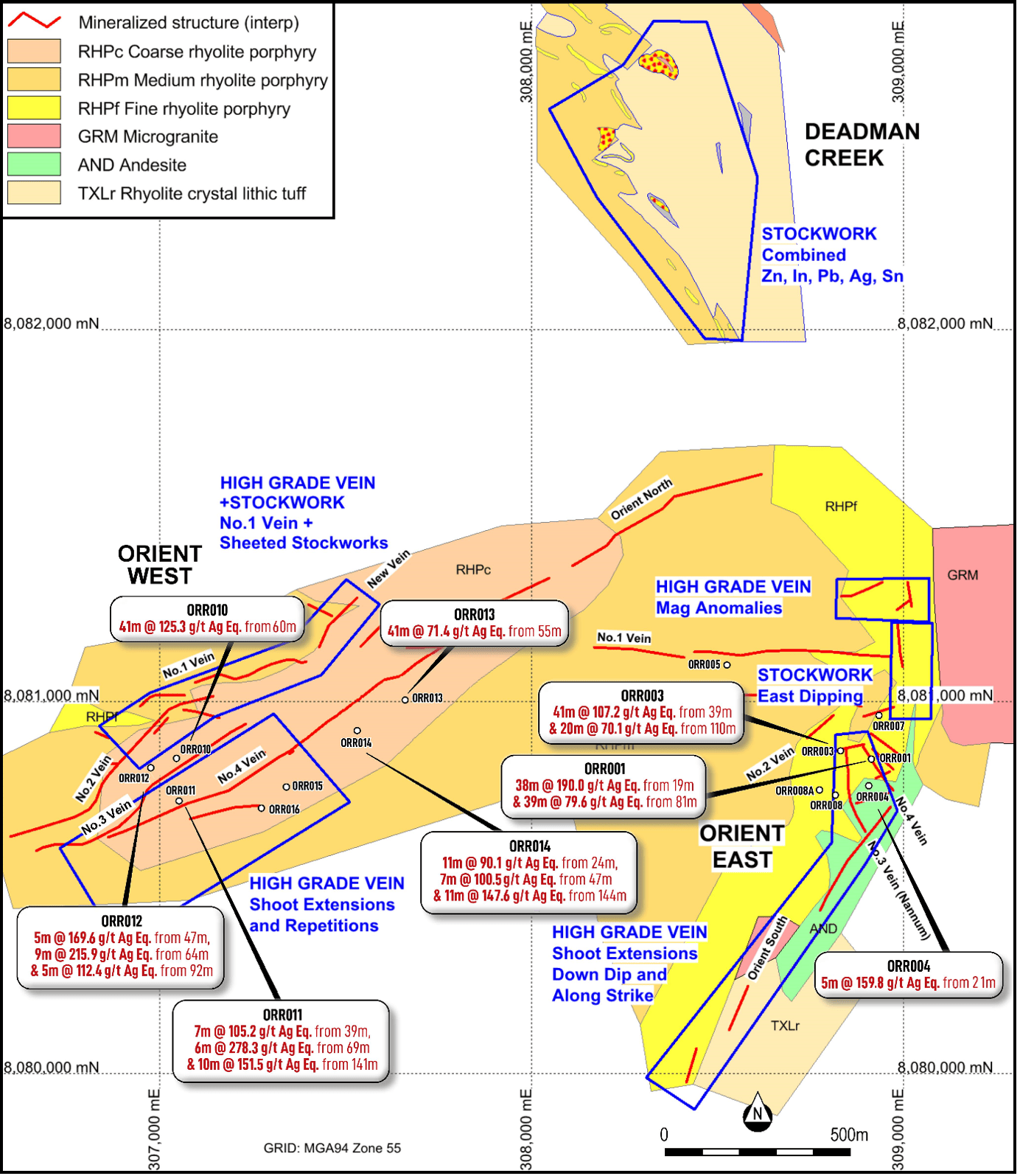

Iltani Resources is targeting Australia’s largest silver and indium deposit at its Orient project in Queensland. Pic Iltani Resources

- Iltani has kicked off a Stage 2 RC drilling program at the Orient project in QLD following up on recently completed Stage 1 RC drilling program

- 8 RC holes completed (for 1,276m drilled) early December, assay results expected shortly

- Stage 1 drilling confirms Orient has the potential to host large scale open pittable silver-indium deposit

- Historical metallurgical test work at Orient confirms potential to produce high quality lead-silver and a zinc-indium-silver concentrates

- Silver price on the rise due to its role as safe haven investment; long term industrial demand for silver and indium also strong

Special Report: With the investment case for silver building, alongside the emerging role of critical minerals like indium, Iltani Resources is out with the drill bit hoping to make the next big discovery in northern Queensland.

Iltani’s Orient Project, ~100km inland from Cairns in the historical mining area of Herberton in northern Queensland, was mined from 1886 to 1924, producing an estimated 6,600 tonnes of high-grade ore averaging 46oz of silver and 40% lead per tonne.

Orient is a large-scale system of outcropping veins and stockwork silver-lead-zinc-indium mineralisation hosted in a rhyolite porphyry complex over an area of at least 4km2.

Drilling to date has intersected multiple high grade vein systems surrounded by halos of up to 30 to 40m of lower grade mineralisation.

The vein systems are surrounded by extensive alteration zones and have distinctive epithermal textures, indicating that the outcropping mineralisation is the surface expression of a deeper porphyry system.

Iltani is currently drilling the shallow outcropping mineralisation and building a 3D model of the system which ,when complete, will help the company to better understand the potential for a large scale open pittable silver-lead-zinc-indium resource.

Iltani has also completed reprocessing of historical geophysical data, allowing it to target the deeper porphyry system in 2024.

Stage 1 Drilling

Iltani completed the Stage 1 RC program in August 2023, targeting Orient West and East. The company called the program an outstanding success, with multiple drill holes intersection high grade veins surrounded by extensive lower grade mineralisation.

Notable results included 41m @ 125.3 g/t Ag Eq (34.8 g/t Ag, 0.69% Pb, 0.99% Zn & 35 g/t In) from 60m including 8m @ 350.9 g/t Ag Eq from Orient West, and 38m @ 190g/t Ag Eq. (68.6 g/t Ag, 1.29% Pb, 1.44% Zn & 7 g/t In) from 19m including 7m @ 454.4 g/t Ag Eq. from Orient East.

All mineralisation intersected in the Stage 1 drilling is open down dip and along strike (in both directions) confirming the potential for Orient to host a large, potentially open pittable deposit at both Orient West and East.

Iltani commenced the Stage 2 RC program at Orient in early December, following up on the positive results received from the Stage 1 RC program, seeking to extend mineralisation down dip and along strike plus target areas of extensive mapped stockwork mineralisation.

8 holes were completed before the drill rig was demobilised for the wet season. The samples were submitted for assay, and results are expected shortly. The rig will return in early 2024 to complete the remaining 15 planned holes.

Historical metallurgical test work for the Orient project has already confirmed its potential to produce high quality lead-silver and a zinc-indium-silver concentrates, with the lead-silver concentrate potentially grading 48% Pb and 2,250g/t Ag, and the zinc-indium concentrate potentially grading 47-48% Zn, 2,000 g/t In and 200 g/t Ag.

This production potential positions Orient as one of Australia’s largest silver-indium projects and a strategically located supplier of lead-silver and zinc-indium concentrates going forward.

Initial conversations with concentrate traders have confirmed that the concentrates produced would be highly sought after, the company says.

Sitting down with Stockhead, ILT managing director Donald Garner says while Orient hasn’t got a JORC resource on it yet, the historical test work shows the company can produce a concentrate of up to 2,000g per tonne of indium.

“If you look at the bigger picture of what we’re doing and where we want to go, this production potential positions the Orient project as one of Australia’s largest silver-indium projects,” he says.

“We consider our ability to produce indium as key, given the fact that it is on the critical mineral lists of multiple countries around the world.

“As we continue to advance the project, it will enable us to access funding available for critical raw materials and move Orient further along the development pathway.”

ILT has built on previous work since acquiring the project in December 2022 with various mapping and Stage 1 drilling programs, which confirmed an extensive silver-rich epithermal system with strong similarities to the world-class Bolivian silver-zinc-lead-indium-tin systems.

“The system we are drilling outcrops at the surface, and we think that as we continue to drill it out, investors will start to see how the Orient project as competitive and comparable to other projects on the ASX,” Garner says.

“For example, Silver Mines is sitting at a market cap of around $230m and their Bowdens project has an ore reserve of 30Mt at about 100g silver equivalent. We hit grades equivalent to Bowdens in our first pass drilling.”

“Orient holds the potential for value creation through exploration success, seeing as our market cap is currently sitting around $5 to 6m,” he says.

“With prices rising, we think it’s a great time to be exploring for silver – there’s an ounce of silver in every solar photovoltaic panel and as the world moves towards a net zero emission future, there will be only continue to be greater investment in that area.”

Silver in demand

Silver plays a dual role – it is both an investment vehicle (like gold) and an important industrial metal.

While investment demand is expected to push prices higher, it is also going to post another sizeable 140Moz deficit this year as industrial demand hits a new all-time high.

A big reason for this silver boom is a surge in photovoltaic (PV) developments, where it plays a crucial role, as well as rising investment in 5G networks and growing electrification of vehicles.

There aren’t many ways for investors to play the silver thematic on the ASX, which puts advanced explorers like Queensland focused Iltani Resources (ASX:ILT) in a strong position.

Not just a one trick pony

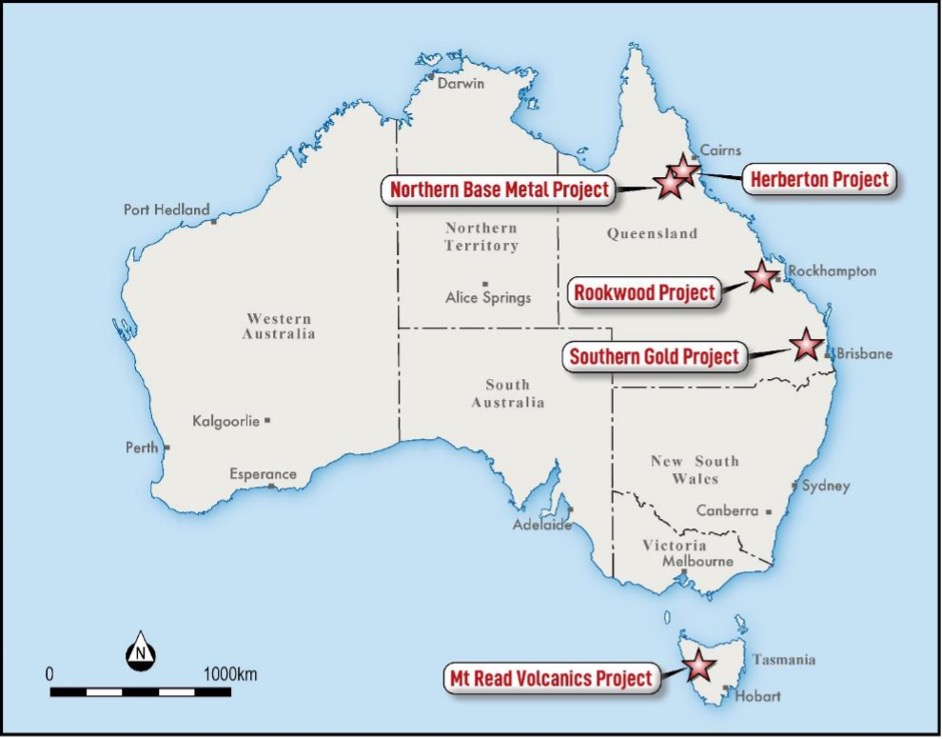

While much of ILT’s focus is on the Orient project, the company’s portfolio contains other advanced base metal and critical raw materials projects, including Isabel.

Like Orient, Isabel is part of Iltani’s Herberton project. It is Australia’s highest grade indium deposit with a high-grade non JORC compliant resource of 85,000 to 90,000t at 113 g/t silver, 370 g/t indium, 15.3% zinc and 2.8% lead.

Iltani’s key focus in 2024 will be on advancing Orient in two key areas – to seek to deliver a material open pittable resource based on the shallow outcropping mineralisation, and to drill some deeper holes to target the porphyry system at depth.

Iltani will also continue to work on its other exciting projects, in particular, the other projects (Isabel, Isabel Extended, Antimony Reward and Boonmoo) at Herberton.

“Continuing to advance Orient, and delivering on its potential to become Australia’s largest silver-indium project plus adding in the potential value uplift from the additional projects in the portfolio will unlock material value for Iltani shareholders,” Garner says.

“Not bad for a company that only listed in June 2023!”

This article was developed in collaboration with Iltani Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.