Simble Solutions leads the race for growth in energy data

Tech

Tech

The energy management sector of the ASX is heating up as specialist companies compete to give consumers more control over their electricity consumption.

The trend is driven by ever-increasing power prices and changes to regulations.

Companies like Simble Solutions (ASX:SIS) are capitalising on these trends, with software that allows small-to-medium enterprises to manage exactly how and where they use their electricity.

It’s that kind of SaaS (software-as-a-service) that has made Simble the fastest-growing energy management company on the ASX.

The sector is booming

The market for energy management systems is forecast to grow significantly over the next few years.

Orbis Research suggests it could be worth $US55.8 billion ($73.6 billion) by the end of 2022, with a compound annual growth rate of 22.5 per cent between 2017 and 2022.

Smart meters are beginning to drive interest in energy management, as collected data is decommoditising the energy industry.

What that means is other energy suppliers — be it a telco or a supermarket chain — can enter the market and supply energy alongside their other services, potentially causing prices to fall.

Another push factor is power prices, a major political issue in Australia and pain-point for many consumers.

Power prices rose 63 per cent over the last 10 years, according to competition regulator ACCC.

Almost half of that is due to over-investment in the national energy network, the poles and the wires that transport electricity.

Between 2005 and 2016 the total value of the National Electricity Market distribution network increased from $42 billion to $72 billion. Yet the number of customers using it — and paying for it — barely changed.

Consumers have no power over these fees, particularly when they have no visibility to their energy use.

As governments around the world begin to mandate smart energy infrastructure, there is potential for companies to offer a way to take control over power costs, and to capture energy data.

It’s companies like Simble which — via their software and hardware solutions — provide the right data and the ability to use it, bringing about real benefits to consumers.

A competitive landscape

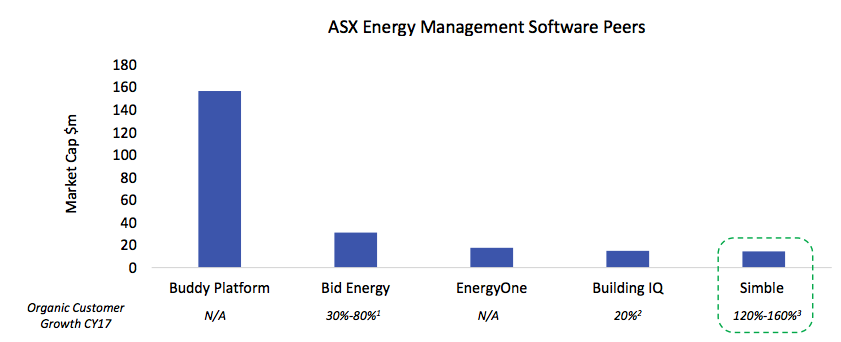

There are a handful of players on the ASX in energy management.

They include Simble, BidEnergy (ASX:BID), BuildingIQ (ASX:BIQ), Buddy platform (ASX:BUD) and EnergyOne (ASX:EOL).

All target a slightly different segment of the market.

Simble, with a market cap of $15 million, is among the smallest — and during calendar 2017 it achieved meter-under-management growth of 120 per cent and customer growth of 160 per cent

The smallest of the group, Building IQ, recorded 20 per cent growth in buildings-under-management in 2017.

BidEnergy, the second largest with a market cap of $31 million, announced customer growth of 30 per cent and 80 per cent meter-under-management growth.

Neither Buddy, the largest of the group with a market cap of $140 million, nor EnergyOne have disclosed their number of customers.

Simble Solutions didn’t become the fastest growing player in the ASX’s energy management sector by accident.

The company (ASX:SIS) achieved this by executing on the business plan they outlined when they listed in February.

Simble came to market with a handful of customers, but promised to use the IPO cash to sign up major channel partners through whom it would sell its new Energy Platform, a software suite allowing businesses to better manage their energy use.

“When we listed on the ASX we outlined how our strategy is tied around channel and distribution partnerships,” said chief Fadi Geha.

“So far we have signed Optus, Powercor in the UK, and the latest announcement was a partnership with Synnex in Australia.”

This special report is brought to you by Simble Solutions.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.