Zinc explorer Inca slides 25pc as it considers a move to battery metals

Pic: Schroptschop / E+ via Getty Images

Zinc explorer Inca Minerals sank 25 per cent on Tuesday after telling investors it’s changing tack and looking at other commodities including vanadium, cobalt, nickel and phosphate.

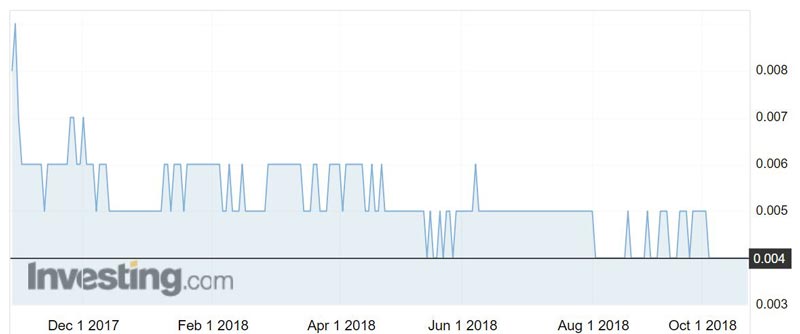

The shares dropped to 0.3c before closing at 0.4c. Inca (ASX:ICG) has traded between 1c and 0.3c over the past year.

The company is in the process of bringing in partners for its base metals projects to free it up to consider other project buys.

“The board has been particularly interested in commodities with an attractive supply-demand equation, and global regions with acceptable sovereign risk,” Inca said.

“As a consequence, and being mindful of the global appetite for resources, the board has recently refined its strategy to consider new and additional projects with commodities such as vanadium, cobalt, nickel and phosphate.”

Inca has been focused on its Greater Riqueza and Cerro Rayas projects in Peru, but is now negotiating a partnership with $19.3 billion South32 (ASX:S32).

A South32-funded geophysics survey was completed at Riqueza this year, which Inca said resulted in the discovery of a considerable number of large targets.

This led to the negotiation of an earn-in agreement that will see South32 majority fund exploration at the Riqueza project.

Inca said it believes its Cerro Rayas project could follow a “similar if not more rapid trajectory than Riqueza”.

Battery metals like vanadium and cobalt have garnered a lot of interest over the past few years as the demand for electric vehicles and stationary storage ramps up.

Vanadium prices are at their highest point since 2005, with the Europe price now at $US27.45 per pound and the China price hitting $US30.70 per pound.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.