Resources Top 5: Miramar wants its slice of yellowcake, thanks very much. Copper, too

Pic via Getty Images

- Miramar Resources leads ressie pack with a 40% gain on the back of uranium and copper acquisitions

- SIPA continues its golden form this week, while MPK, ICG and LRS also make the gainz grade

Here are some of the biggest resources winners in early trade, Friday December 8.

Miramar Resources (ASX:M2R)

This microcap ($3.57m) WA minerals explorer has some yellowcake-and-eat-it news today – announcing its intention to acquire uranium and copper prospects in the resources-rich northern Gascoyne region of Western Australia.

The company notes it’s submitted an Exploration Licence Application to target part of an outcropping “Durlacher Supersuite” granite area – the same unit that hosts the Yangibana (Hastings Technology Metals (ASX:HAS) ) and YIN (Dreadnought Resources (ASX:DRE)) REE deposits.

Adds Miramar: “The tenement application also covers numerous N-S trending Mundine Well dolerite dykes, along strike from Dreadnought’s Mangaroon Ni-Cu-PGE prospect, and contains the ‘Chain Pool’ uranium occurrence and the historic ‘Joy Helen’ copper-lead-silver mine.”

And, yep, yellowcake fans, the tenements are also prospective for uranium mineralisation.

The company is already on the hunt for iron oxide copper gold (IOCG) deposits at its prospective Whaleshark project in the Northern Carnarvon Basin, but this new direction will add more multi-commodity potential to the company’s portfolio.

Read more about this on Stockhead > here.

M2R share price

SIPA Resources (ASX:SRI)

(Up on no news)

This junior Aussie gold, base metals and REE explorer continues its good week on not much news – other than perhaps its new MD Andrew Muir putting the word out here and there (actually mostly there right now) regarding the company’s portfolio and exploration targets.

SRI is now up 28% for the week and 52% for the month and has now pretty much wiped its YTD trading-price percentage deficit.

The company’s most recent AGM presso on the back of a quarterly activities and cashflow report, contains much of the most relevant info you might need. And from that, we can tell you:

• The Paterson North copper-gold Project saw a diamond drill program completed and core assaying was underway.

• The Skeleton Rocks project in WA’s Goldfields had aircore drilling of Ni-Cu and pegmatite targets completed with assays confirming and extending existing nickel anomalism.

• The Murchison project (Goldfields) was sold to Ora Gold (ASX:OAU) for $1.4m with 50% of the shares voluntarily escrowed for 12 months.

• At the end of the September quarter, SRI had $2.9m in its coffers.

SRI share price

Many Peaks Minerals (ASX:MPK)

(Up on no news)

Freshly name changed (from Many Peaks Gold) Many Peaks, now with a new ticker, too – MPK – is up and to the right on nothing in particular we’re noticing today. Nothing yet, at least.

It’s recent name change very likely can be attributed to the fact it’s not exactly a pure gold play any more – it’s on the hunt for lithium at the Aska project in Canada, for instance. And recently, it hit some head-turning TREO results at its Odyssey REE project, also in Canada, in the Red Wine rare earth element district in Labrador province.

As we noted early last month:

Exploration at the Mann 2 prospect at Many Peaks’ Odyssey REE project have shown up to 6.3% TREO in recent sampling, and combined with previous work hosts multiple >5% TREO results over a >800m strike length within a 2.2km long mineralised (>1% TREO) corridor.

You can read more on that here and here.

MPK share price

Inca Minerals (ASX:ICG)

(Up on no news)

Well, we say no news, we mean nothing fresh today. But midweek this Australian base metals explorer, which is on the hunt in Peru, hence its name, as well as the NT and Queensland, delivered an Alpaca Hill drilling update that caught some attention.

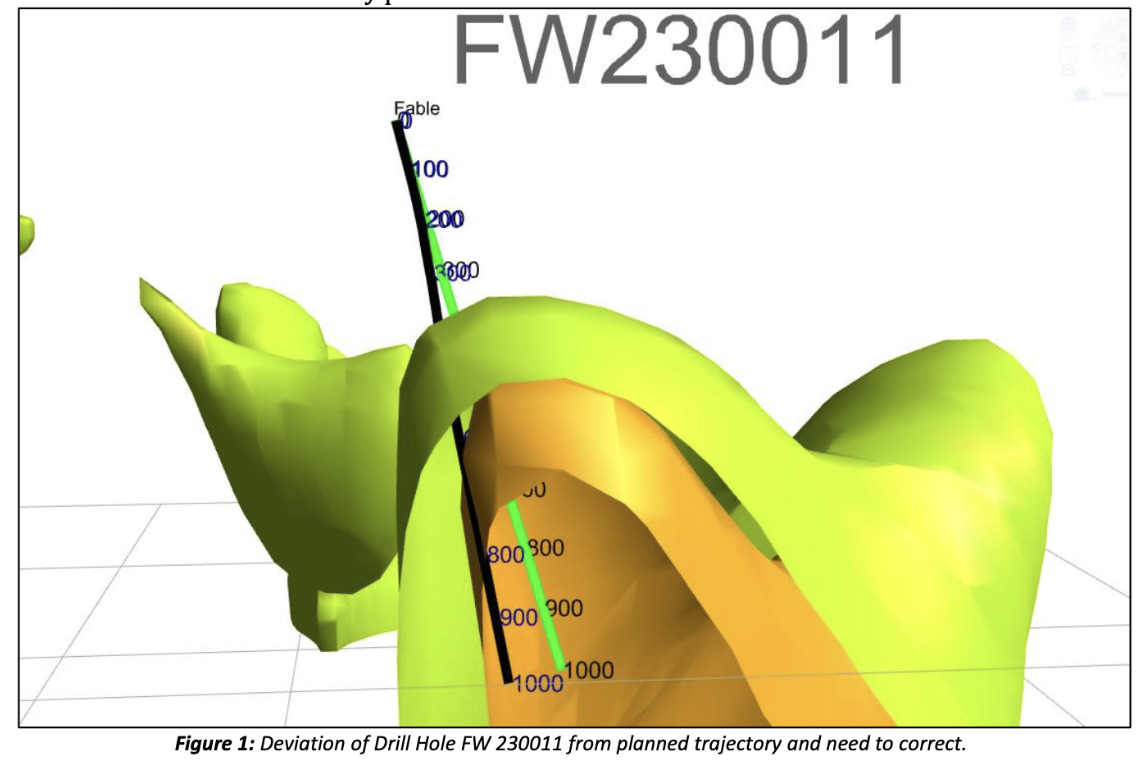

The IOCG (iron ore, copper, gold) Alpaca Hill site is not actually in Peru, it’s in the NT and is part of the company’s Frewena Fable project in the East Tennant province.

Some key progress has been made during its maiden diamond drill program at the prospect, with drilling was initially slower than expected. Inca notes the following highlights:

• Disseminated sulphides (pyrite and chalcopyrite) have been intercepted between 395 and 410m.

• Geology transitions revealed from sedimentary to altered granite igneous rocks around 368m.

• Drillhole deviated from modelled trajectory and is being corrected.

The company considers Frewena highly prospective for Tier-1 IOCG mineralisation.

This pic looks like an AI interpretation of someone peeling a Granny Smith apple with a deconstructed tape measure. Either that or a really bad NFT. But it actually represents the corrected drillhole deviation mentioned above. The green line is the correct path, apparently, which will set the program back on its intended target.

ICG share price

Latin Resources (ASX:LRS)

Right, what about lithium, we hear you ask? Okay, okay, here’s something.

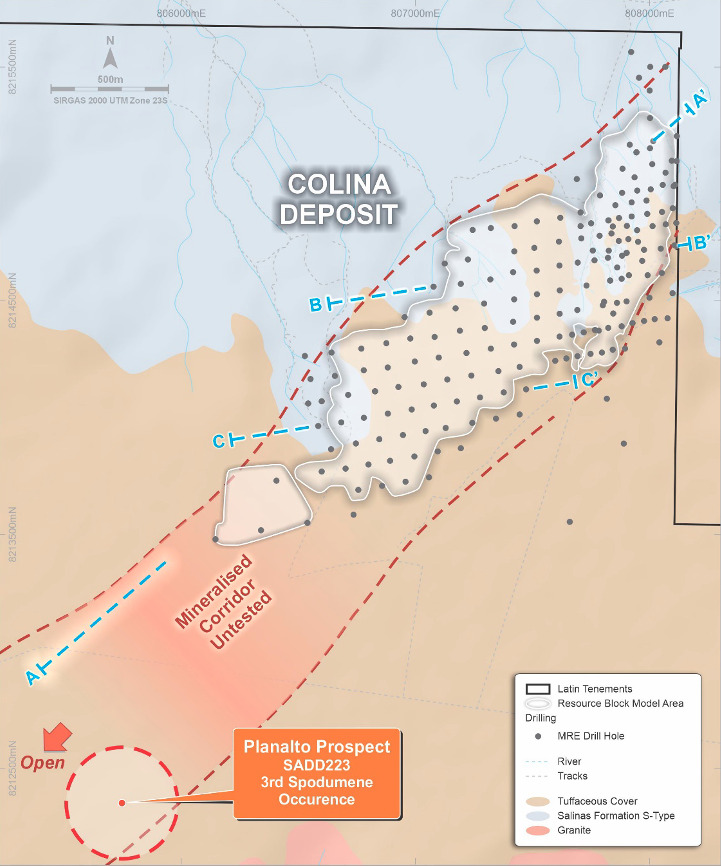

White-gold-hunter Latin Resources, an Aussie mineral exploration company with several projects on the go in Latin America and Australia, yesterday reported a whopping 56% increase in the global resource at its Salinas lithium project in Brazil to 70.3Mt at 1.27% Li2O.

Per our deep-diving report on it on Thursday, the project’s Colina deposit resource has increased by 41% and a maiden resource has been announced for Fog’s Block – reported at 6.8Mt at 0.9% Li2O inferred for a combined global mineral resource of now 70.3Mt at 1.27% of Li2O.

Smack bang in the lithium-rich Bananal Valley region of the pro mining state of Minas Gerais, Colina is a direct neighbour to Sigma Lithium’s (TSXV:SGML) 766,000tpa Grota do Cirilo project, which entered production earlier this year.

LRS recently defined a Preliminary Economic Assessment (PEA) for the project, which proposes a 3.6Mtpa standalone mining and processing operation over two phases.

The PEA highlighted an after-tax NPV of $3.6 billion (US$2.5 billion) and combined after-tax IRR of 132%.

The company is now planning for a Phase 3 extension in its DFS (Definitive Feasibility Study).

LRS share price

At Stockhead we tell it like it is. While Miramar Resources, Many Peaks Minerals and Latin Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.