Zenith leaving no stone unturned as it lines up lithium drill program in WA

Pic: DirkKotze1/iStock via Getty Images.

Explorer Zenith Minerals is leaving no stone unturned – or pegmatite undrilled – as it lines up a new drilling program on its Waratah Well lithium-cesium-tantalum project in WA.

While the project falls outside Zenith’s (ASX:ZNC) core base metals and precious metals strategy, it presents a potential battery metals opportunity that warrants drill testing as lithium prices continue to push record highs.

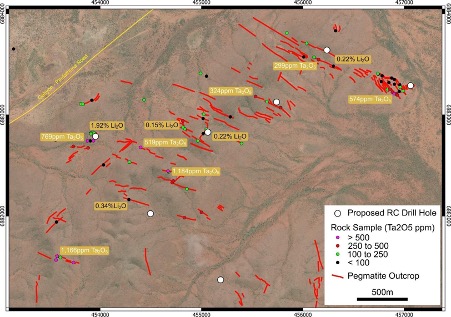

According to Zenith, the project hosts extensive outcropping highly fractionated LCT pegmatite dykes with very high-grade tantalum of up to 1,221 ppm Ta2O5 and high-grade lithium of up to 2.09% Li2O.

The pegmatite extends over a large surface area of 3km by 2km.

Seven 1km spaced, 200m deep reverse circulation drill holes will be punched from early December, targeting conceptual deep spodumene bearing pegmatites below the surface pegmatite dyke swarm, a phenomenon observed in other lithium deposits in Western Australia.

“Notwithstanding that the Waratah Well Lithium-Tantalum project is not a core component of our base and precious metals development strategy, to appropriately understand its value and potential, a small low-cost drill program is being undertaken,” Zenith CEO Mick Clifford said.

“If the conceptual target is confirmed, we can then decide on the most appropriate way forward for the project.”

Zenith has a 25% stake in the exciting Earaheedy zinc-lead discovery with Rumble Resources in WA as well as significant exploration success in its own right at the Split Rocks gold project and Develin Creek copper project in Queensland.

The latter gives Zenith exposure already to the battery metals thematic emerging in the Australian resources sector.

“Like copper, lithium continues to develop as a core piece of a greener electrical energy future,” Clifford said.

“Tantalum has many everyday applications and remains in high demand. The project has many strategic positives with our 100% ownership giving us ultimate flexibility as to its future.”

Tantalising targets

Waratah Well is perfectly located in WA’s mid-west, just 190km from the Port of Geraldton and 20km northwest of the historic mining town of Yalgoo.

Making the project an interesting proposition is the fact conceptual comparisons can be drawn to significant lithium deposits already around in WA.

The key lithium target for Zenith is to drill for blind lithium spodumene mineralisation beneath tantalum-bearing dykes, a similar geological architecture to the Bald Hill lithium and tantalum mine near Kambalda.

A similar picture has been uncovered at Kathleen Valley in the Goldfields by Liontown Resources.

That discovery has turned Liontown from a penny stock into a mine developer with a market cap of $3.7 billion as lithium concentrate prices have gone on a bull run to all time highs in 2021.

Field work at the project looks promising.

As many as 14 closely spaced stacked dykes occur at the northeastern end of the pegmatite outcrop, where surface composite rock chip sampling has returned tantalum grades including 262, 299, 360, 366, 421 and 573ppm.

This zone is open ended to the north, northeast and southeast where it runs under surface soil cover.

A second area of dykes returned results of 207, 250, 323, 518, 616, 1184 ppm Ta2O5, while a third zone of narrower dykes returned higher grade results of 708, 995, 1007, 1166 and 1221ppm.

This article was developed in collaboration with Zenith Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.